US January Retail Sales Preview: Geopolitics, FOMC Minutes to impact dollar’s valuation

- Retail Sales in the US are forecast to rebound in January.

- Investors are likely to ignore the US data amid the Russia-Ukraine conflict.

- The US Dollar Index needs to clear 96.40 resistance to continue to push higher.

The dollar started the new week on a firm footing and outperformed its rivals as heightened fears over Russia invading Ukraine caused investors to seek refuge. The US Dollar Index (DXY) climbed to its highest level in nearly two weeks at 96.43 on Monday but reversed its direction on Tuesday, with markets turning optimistic on the de-escalation of the Russia-Ukraine conflict.

The US Census Bureau will release January Retail Sales data on Wednesday but this week’s market action suggests that the dollar’s valuation is driven by the risk perception. Additionally, investors are likely to stay on the sidelines while waiting for the US Federal Reserve to release the minutes of its January meeting.

Nevertheless, Retail Sales are expected to rise by 1.6% on a monthly basis in January following December’s disappointing decrease of 1.9%. In case the data points to an improvement in consumer activity as anticipated, this could be seen as a development that will allow the Fed to stay focused on policy normalization without worrying about the loss of growth momentum.

On the other hand, the dollar shouldn’t find it difficult to stay resilient against its peers even if the data falls short of the market consensus. When the December sales data was published on January 14, it missed analysts’ estimates by a wide margin but the DXY ended up closing the day in positive territory. Moreover, a weak print could also weigh on sentiment and help the dollar find demand.

Having said all of that, the market reaction is likely to remain short-lived and the DXY’s next decisive move should depend on headlines surrounding the Russia-Ukraine conflict and markets’ pricing of the Fed’s policy outlook.

DXY Technical Outlook

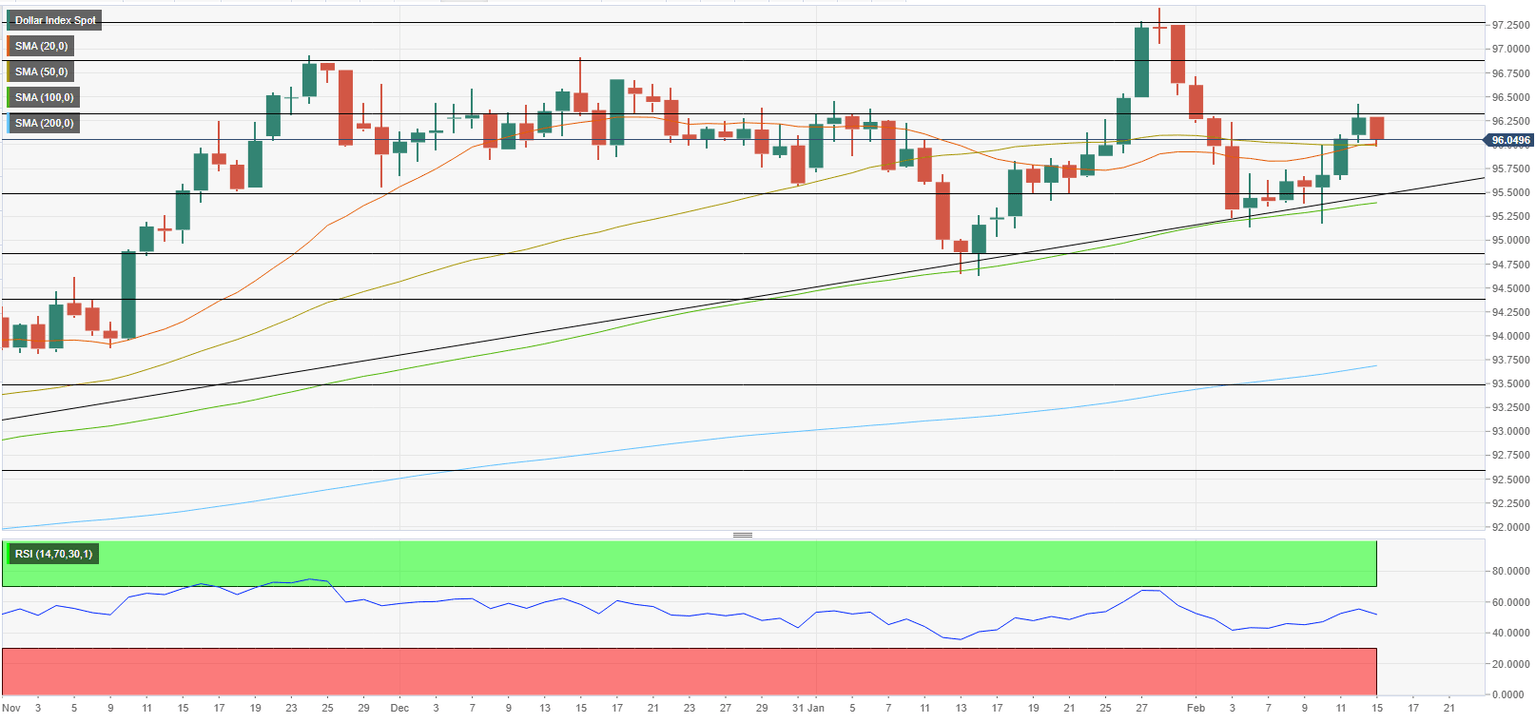

The DXY continues to trade above the ascending trend line coming from May, suggesting that the dollar’s bullish bias stays intact. Additionally, the index managed to hold above the 100-day SMA following the sharp decline witnessed in early February, supporting the view that sellers are struggling to retain control.

Key support seems to have formed at 95.50 (100-day SMA, Fibonacci 23.6% retracement of May-February uptrend, ascending trend line). As long as buyers continue to defend this level, the index could clear the 96.40 (static level) hurdle and target 97.00 (psychological level).

On the other hand, a daily close below 95.50 could attract bears and open the door to an extended slide toward 95.00/94.90 (psychological level, static level) and 94.40 (Fibonacci 38.2% retracement).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.