US interest rate expectations hinge on Minutes and CPI

Chinese stocks sold off sharply during the Asia session, as reports that Chinese consumers spent less during the recent Golden Week holiday knocked confidence. The government in Beijing have announced no fresh stimulus measures of note this week, which is also knocking sentiment, however, they will hold a press conference about fiscal policy on Saturday morning. The risk is that unless China engages in a more radical package of fiscal reforms to boost government handouts, the stimulus announced so far may not be enough to sustain a long-term pick up in economic growth and domestic demand. The decline in Chinese shares has heaped pressure on European markets, which have opened lower bar the FTSE 100, which is higher on Wednesday. S&P 500 futures are also pointing to a lower open in the US later today.

Patience is a virtue (that markets don’t have)

These fears have knocked more than 6% off the CSI 300 index on Wednesday, and there could be more volatility to come. There is a chance that nothing of note is announced this Saturday, and instead Beijing waits until next month’s National People’s Congress to announce new fiscal stimulus measures. China may also want to wait to see how the US election pans out and what the Fed does at its next meeting before pledging more government spending. This could weigh on sentiment towards Chinese shares in the short term. Patience is a virtue that the market does not have, hence the sharp selloff in European companies that are linked to China. LVMH dropped more than 2% on Tuesday, and Kerring, the owner of Gucci, is one of the weakest performers on the Cac 40 in the past week.

Commodity rally fades with Chinese shares

The sell off in Chinese shares has also weighed on commodities, especially industrial metals. Aluminum, copper and Iron ore are all sharply lower on Wednesday. The price of copper, a key ingredient for global growth and expansion, was lower by nearly 2%, as hopes fade for a strong rebound in China’s economy. It is worth noting that China’s economy faces multiple hurdles and structural issues, that will not magically fixed by the government throwing lots of money at the economy. One of the biggest problems facing China is an unwind of a massive property bust. These issues take many years to fix, hence a prudent approach by Beijing is probably the most sensible option and will save taxpayers money in the long run. However, this message doesn’t make life any easier for China stock market bulls on Wednesday.

Brent Crude stable for now

The oil price has stabilized after Tuesday’s sharp sell off. Brent crude is back at $77 per barrel, after briefly breaching the $80 per barrel mark on Monday. China stimulus fears and a lack of escalation in the direct attacks between Iran and Israel have calmed the oil markets for now, but they remain sensitive to headline risk.

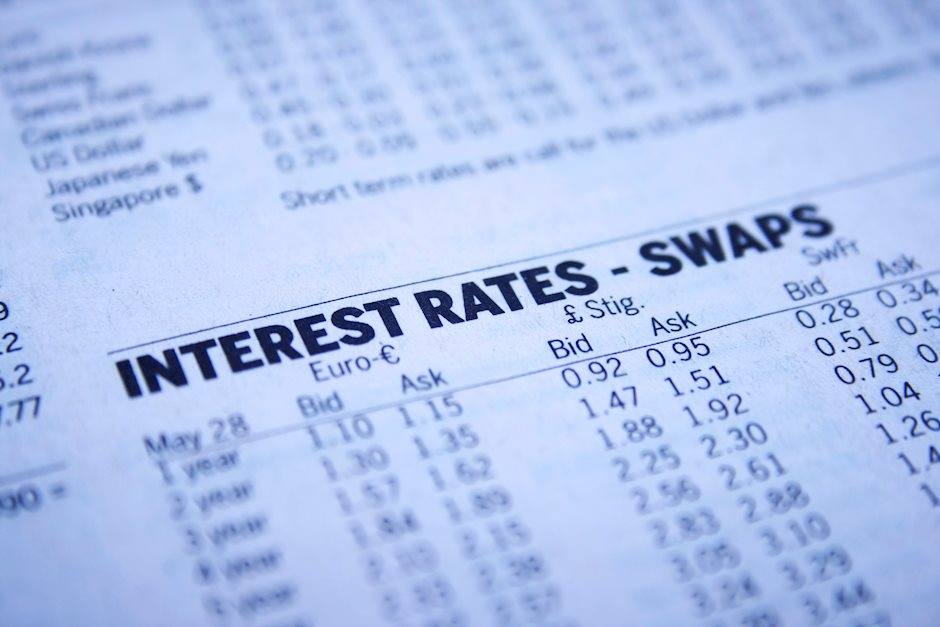

US interest rate expectations hinge on Minutes and CPI

The Fed Funds futures market is continuing to price in a growing chance that the Fed does not cut rates next month. There is now a 14% chance of no cut, according to the CME Fedwatch tool. A week ago, the market was betting on a second 50bp rate cut. FOMC minutes that are due later today and, crucially, tomorrow’s CPI report for September, will be the most important drivers of rate cut expectations in the short term. A hotter than expected inflation report for last month could trigger a surge in expectations of no rate cut from the Fed when it next meets in November.

Rio Tinto splurges on Lithium even though EV sales are plunging

The FTSE 100 is higher on Wednesday, after declining by the most in 2 months on Tuesday, even though M&A news has triggered mixed reactions. Miner Rio Tinto has acquired Arcadium Lithium, and its shares are the weakest performer on the FTSE 100, as investors weigh up the $6.7bn asking price, its biggest deal in 17 years. The market is not used to mega deals in the mining industry as there have been a dearth of them, so it may take the market a while to get used to this one. Rio has increased its share of the lithium market with this deal, however, there are concerns that this looks expensive, especially when electric vehicle sales have stalled around the world, lithium is a key metal used for EV batteries. Rio’s share price is down more than 5% in the past week and is down again on Wednesday. However, this has not impacted the rest of the materials sector in the FTSE 100, which is higher along with the overall index.

Author

Kathleen Brooks

XTB UK

Kathleen has nearly 15 years’ experience working with some of the leading retail trading and investment companies in the City of London.