US Initial Jobless Claims Preview: What was old is new again

- ISM manufacturing employment index falls into contraction in November.

- November services employment forecast to add workers.

- Dollar keyed on claims and the labor market.

Jobless claims are again at the center of concerns about the US labor market and by extension the economic recovery. A increase of 67,000 in the last two reporting weeks is assumed to come from the new business restrictions in states with rising COVID-19 counts.

Even though claims have reversed course several times in the past eighth months, 127,000 in July and 133,000 in August are the largest, this is the first time with a coincident increase in government ordered business closures.

Initial filings for unemployment benefits are expected to dip to 775,000 in the week of November 27 after rising to 778,000 in the previous release. Continuing Claims are forecast to drop to 5.915 million in the November 20 week from 6.071 million.

Initial Jobless Claims

Manufacturing PMI

The Manufacturing Employment Index from the Institute for Supply Management (ISM) dropped to 48.4 in November, after rising above the 50 expansion-contraction mark for the first time in 15 months in October.

Overall the Purchasing Managers' Index fell to 57.5 last month from 59.3, its best level since September 2018. The 55.8 average over the last six months has been the highest in two years.

The New Orders Index slipped to 65.1 from 67.9, its best score in over 17 years, but it had been forecast to drop to 53.4.

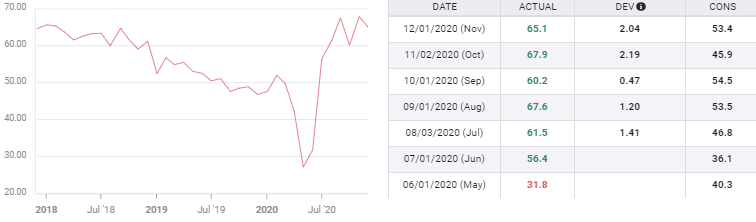

New Orders PMI

Since the recovery began in earnest in June economists have had difficulties judging the the amount of new business being generated. The New Orders Index has averaged 63.1 from June and has beaten its consensus estimate by an average of 14.8 points each month.

Factory managers are clearly wary about hiring. It took five months of expansion and the best new orders numbers in almost two decades before the the Employment Index reached 50 in October. Just two weeks of rising unemployment claims have dropped the index back into contraction.

Employment and GDP

Nonfarm Payrolls have seen about 55% of the 22.16 million workers laid off in March and April return to their jobs. The unemployment rate has fallen to 6.9% in October from 14.7% in April. Payrolls are forecast to add 520,000 workers in November and the unemployment rate is expected to drop to 6.8% when the Labor Department Employment Situation Report is released on December 4.

Economic growth has recovered at a faster pace in the third quarter, 33.1%, than it plunged in the second 31.4%. More importantly that pace appears to be continuing in the fourth quarter. The Atlanta Fed GDPNow model's latest estimate of December 1, which includes the November Manufacturing ISM report, is 11.1%.

Conclusion and the dollar

Conclusion and the dollar

Currency markets have been focused on the increasing count of COVID-19 diagnoses in the US and the attendant business closures and social measures. In this wave of the pandemic the states are several weeks behind Europe and the US rise is a newer factor in market calculations. The dollar has been taken lower as the risk to the US economy has appeared to increase.

Despite the increasing viral counts the US economy does not appear to be slowing. The gain in unemployment claims coinciding with the new public health measures is most likely centered on restaurants and similar businesses suffering from the new restrictions.

Even if the modest increase in jobless claims do not presage a more general rise in unemployment, until it is plain that the US recovery is proceeding in safety, the level of the dollar will be closely tied to the labor market indicators, initial claims and Nonfarm Payrolls.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.