US inflation outlook not so easy

US Inflation has continued to move lower. However, the core CPI remained firm, with higher energy prices still to hit in coming month’s.

Markets initially leapt higher on the back of the better than expected drop in the headline data.

Monthly inflation fell from 0.4% to 0.1%, and to 5.0% for the year. The yearly drop was of course expected.

The real story though was in the detail of the report. Never judge a book by it’s cover. While it was good to see Shelter price pressures moderating, the fact that this data release only including the previous significant declines in gasoline and natural gas prices, is a major cause for concern over what may be coming next month.

We are all ware that global oil and gasoline prices are yet again on the move higher. Also, that Natural Gas looks to have bottomed and prices are rising. It is very likely much of the benefit to the lower CPI headline data just seen, will be sharply reversed next month.

This is the case, even if energy prices simply stay where they currently are. Should energy continue to move higher, as I expect will be the case, then we could well be looking at significant re-acceleration over the coming months.

Which would shatter all forecasts of Fed rate cuts within the next year. The forecast here remains a still higher than expected by the market, terminal rate. Plus, that rates will remain on hold for a following extended period. There will be no pivot. In fact, that unlike the IMF for instance, that rates are in fact returning to more normal historic levels permanently.

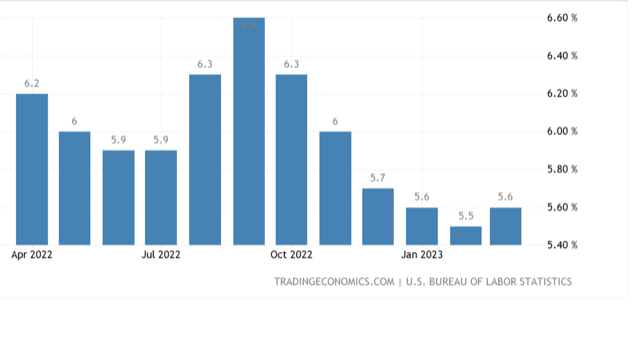

Building on the subtext concerns of yesterday’s headline data, is the fact that core CPI, the Federal Reserve’s preferred measure, remained firm at 0.4%. For the year, core CPI actually rose to 5.6%.

The real story though was in the detail of the report. Never judge a book by it’s cover. While it was good to see Shelter price pressures moderating, the fact that this data release only including the previous significant declines in gasoline and natural gas prices, is a major cause for concern over what may be coming next month.

We are all ware that global oil and gasoline prices are yet again on the move higher. Also, that Natural Gas looks to have bottomed and prices are rising. It is very likely much of the benefit to the lower CPI headline data just seen, will be sharply reversed next month.

This is the case, even if energy prices simply stay where they currently are. Should energy continue to move higher, as I expect will be the case, then we could well be looking at significant re-acceleration over the coming months.

Which would shatter all forecasts of Fed rate cuts within the next year. The forecast here remains a still higher than expected by the market, terminal rate. Plus, that rates will remain on hold for a following extended period. There will be no pivot. In fact, that unlike the IMF for instance, that rates are in fact returning to more normal historic levels permanently.

Building on the subtext concerns of yesterday’s headline data, is the fact that core CPI, the Federal Reserve’s preferred measure, remained firm at 0.4%. For the year, core CPI actually rose to 5.6%.

Author

Clifford Bennett

Independent Analyst

With over 35 years of economic and market trading experience, Clifford Bennett (aka Big Call Bennett) is an internationally renowned predictor of the global financial markets, earning titles such as the “World’s most a