It was a reasonably quiet session for the US dollar on Monday, eking out a modest gain against major peers, according to the US Dollar Index.

For those who missed the research team’s latest technical report, here is a reminder of the USD’s current position on the daily timeframe:

If sellers can maintain position south of the 200-day SMA, this is likely to remain a sellers’ market, with swing (and short-term) traders perhaps selling into any rallies and targeting 102.36 support structure.

(TradingView—US Dollar Index Daily Timeframe)

Macro-Packed Week

We have a busy week ahead in the macro space, kicking off with US consumer price inflation for November (Consumer Prices Index [CPI]) on Tuesday, a day ahead of the FOMC meeting on Wednesday which is widely anticipated to see a 50 basis-point increase, bringing the Federal Funds target range to between 4.25% and 4.5%.

The target rate probabilities, according to the CME’s FedWatch Tool, shows a 72.3% probability of a 50 basis-point hike over a 27.7% chance for a 75 basis-point increase. A 50 basis-point move will represent a deceleration from the four successive 75 basis-point increases as the central bank attempts to rein in spiralling inflation. We will also see the FOMC’s Summary of Economic Projections, consisting of projections for inflation and economic growth over the next two years, as well as the FOMC member’s forecasts for the Fed Funds rate. It is expected that the terminal dot plot will be lifted to around 5.0%.

In addition to US data, the Bank of England (BoE), the European Central Bank (ECB) and the Swiss National Bank (SNB) are all set to raise their respective interest rates by 50 basis points on Thursday.

US Inflation CPI Eyed at 1:30 pm GMT

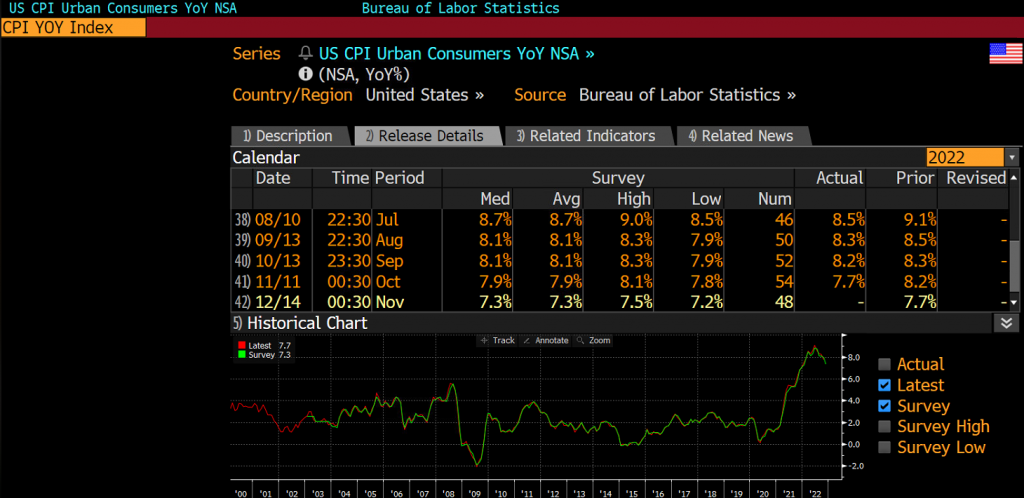

Annual US inflation has noticeably slowed to 7.7% in the four months since pencilling in what appears to be a peak at 9.1%. According to the Bloomberg median estimate, inflation is anticipated to slow once again to 7.3%, though do be aware that the survey range falls between 7.5% and 7.2%. Therefore, a miss or beat outside of this range could spark some strong dollar moves. Higher than the forecast range is likely to see the US dollar rally and equities take a hit, and vice versa for a miss below 7.2% could have the buck sell-off and equities catch a strong bid.

(Bloomberg)

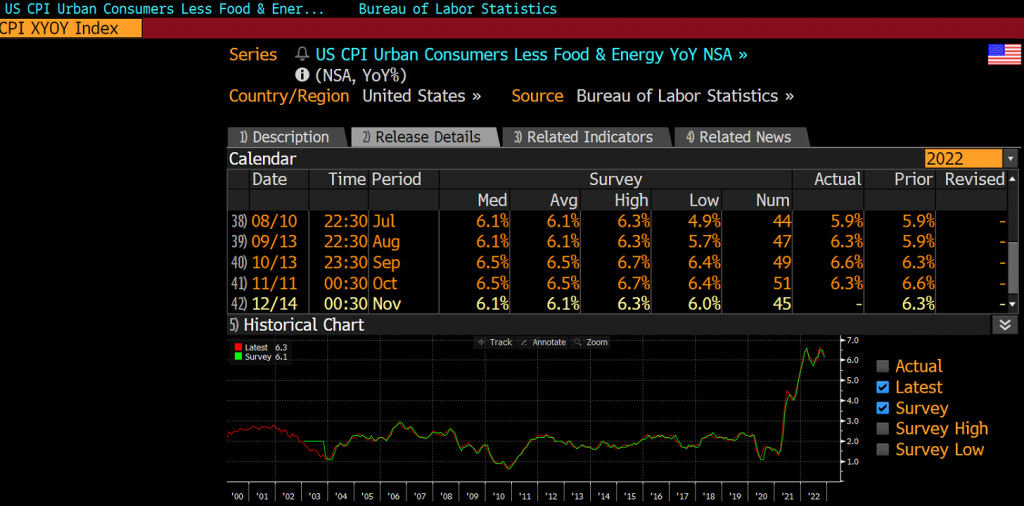

Core inflation, which excludes food and energy, is also anticipated to soften to 6.1% in November following October’s 6.3% reading, according to Bloomberg’s median estimate. The survey range resides between a high of 6.3% and a low of 6.0%. Again, much like the headline print noted above, the forecast range will be a key watch.

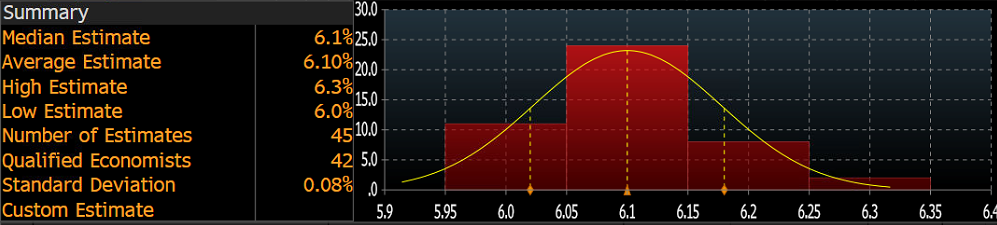

Distribution of economists’ forecasts:

(Bloomberg)

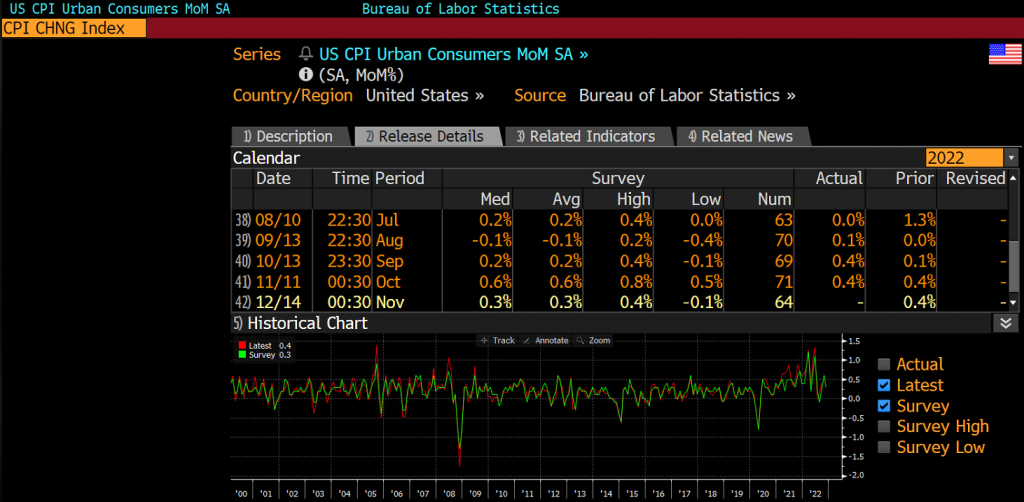

Month-over-month US inflation data is expected to slow to 0.3% in November, according to Bloomberg’s median estimate. This follows October’s 0.4% print. The survey forecast range is between a high of 0.4% and a low of -0.1%.

(Bloomberg)

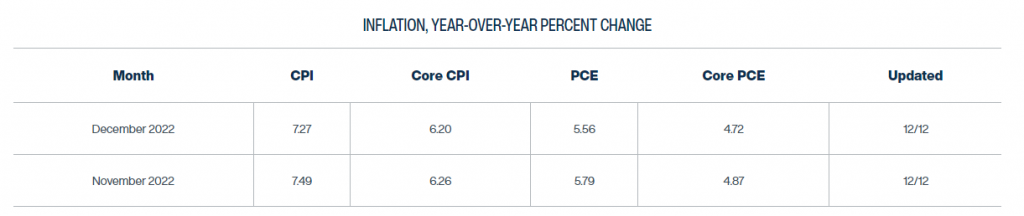

According to the Federal Reserve Bank of Cleveland’s Inflation Nowcast, they see November’s headline inflation print at 7.49% and 6.26% for the core reading.

This material on this website is intended for illustrative purposes and general information only. It does not constitute financial advice nor does it take into account your investment objectives, financial situation or particular needs. Commission, interest, platform fees, dividends, variation margin and other fees and charges may apply to financial products or services available from FP Markets. The information in this website has been prepared without taking into account your personal objectives, financial situation or needs. You should consider the information in light of your objectives, financial situation and needs before making any decision about whether to acquire or dispose of any financial product. Contracts for Difference (CFDs) are derivatives and can be risky; losses can exceed your initial payment and you must be able to meet all margin calls as soon as they are made. When trading CFDs you do not own or have any rights to the CFDs underlying assets.

FP Markets recommends that you seek independent advice from an appropriately qualified person before deciding to invest in or dispose of a derivative. A Product Disclosure Statement for each of the financial products is available from FP Markets can be obtained either from this website or on request from our offices and should be considered before entering into transactions with us. First Prudential Markets Pty Ltd (ABN 16 112 600 281, AFS Licence No. 286354).

Recommended Content

Editors’ Picks

USD/JPY stalls the bounce below 150.50 after BoJ Ueda's speech

USD/JPY is stalling the rebound below 150.50 in the Asian session on Friday. Japan's core CPI rose to a 19-month high in January, reaffirming bets that the BoJ will continue to raise interest rates, underpin the Japanese Yen alongside BoJ Ueda's hawkish comments.

AUD/USD eases from over a two-month top, back below 0.6400

AUD/USD is trading back under 0.6400 early Friday, having briefly reclaimed 0.6400 for the first time since December 12 on Friday. Broad US Dollar rebound offsets RBA Governor Bullock's cautious stance on further easing, weighing negatively on the pair.

Gold down but not out ahead of US PMI data

Gold price is on a corrective move lower from near record highs of $2,955 set on Thursday. Despite the pullback, Gold price remains on track to book the eighth consecutive weekly gain.

Bitcoin underperforms as Gold, S&P 500 reach record high

Bitcoin traded above $98,000 on Thursday, continuing its range-bound movement, while traditional assets, including Gold and the S&P 500, set new highs. Meanwhile, asset manager VanEck noted that Bitcoin could help reduce the US national debt.

Money market outlook 2025: Trends and dynamics in the Eurozone, US, and UK

We delve into the world of money market funds. Distinct dynamics are at play in the US, eurozone, and UK. In the US, repo rates are more attractive, and bills are expected to appreciate. It's also worth noting that the Fed might cut rates more than anticipated, similar to the UK. In the eurozone, unsecured rates remain elevated.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.