US: How will coronavirus impact unemployment rate after causing a surge in jobless claims?

The weekly data published by the US Department of Labor (DOL) on March 26th revealed that the Initial Jobless Claims jumped to an all-time high of 3,283,000 in the week ending March 21st from 282,000. To put that number in perspective, the highest reading in 2009 was at 669,000 in early April when the 2008's global financial crisis was taking a heavy toll on the US economy and the labor market.

Confusing market reaction

"The increase in initial claims are due to the impacts of the COVID-19 virus. Nearly every state providing comments cited the COVID-19 virus impacts," the DOL noted in a disclaimer in its press release. However, Wall Street's main indexes stretched higher on the day of the release to suggest that this reading had little to no impact on the market sentiment.

Why did market participants shrug off this unprecedented surge in the number of applications for unemployment benefits? The short answer is that more people are now eligible to apply for unemployment insurance and this data doesn't necessarily mean that more than 3 million Americans have lost their jobs during that week.

According to CareerOneStop, the US' federal government is giving new options for states to amend their laws to provide unemployment insurance benefits related to the coronavirus outbreak.

Federal law allows states to pay benefits where:

- An employer temporarily ceases operations due to COVID-19, preventing employees from coming to work;

- An individual is quarantined with the expectation of returning to work after the quarantine is over; and

- An individual leaves employment due to a risk of exposure or infection or to care for a family member.

In addition, federal law does not require an employee to quit in order to receive benefits due to the impact of COVID-19.

How is the Unemployment Rate calculated?

No one can deny that the coronavirus outbreak will have a significant impact on the labor market. However, one needs to understand the difference between being eligible to apply for unemployment benefits and being unemployed in the eyes of the US Bureau of Labor Statistics (BLS).

While explaining its methodology, the BLS clearly states that it does not use the Jobless Claims figures when calculating the Unemployment Rate.

Because unemployment insurance records relate only to people who have applied for such benefits, and since it is impractical to count every unemployed person each month, the government conducts a monthly survey called the Current Population Survey (CPS) to measure the extent of unemployment in the country.

Within this survey, some of the questions that the BLS is asking include:

Last week, were you on layoff from a job?

What was the main reason you were absent from work last week?

Has your employer given you a date to return to work?

Have you been given any indication that you will be recalled to work within the next 6 months?

Have you been doing anything to find work during the last 4 weeks?

What are all of the things you have done to find work during the last 4 weeks?

According to some of the examples that the BLS is providing on its website, people who are expected to be called back to work are counted as 'unemployed'. However, the BLS also states that those who have no job and are not looking for one are counted as 'not in the labor force'. How will people respond to those questions? If you are neither working nor looking for a job because of the coronavirus but are expected to return to work once the crisis is over, are you unemployed or not in the labor force? Does anyone have any idea about how long the shutdowns will last?

The most likely scenario is that there will be a large drop in the Labor Force Participation Rate and a modest increase in the Unemployment Rate in the near term. The BLS could also opt out to explain how the coronavirus outbreak is causing discrepancies in its readings.

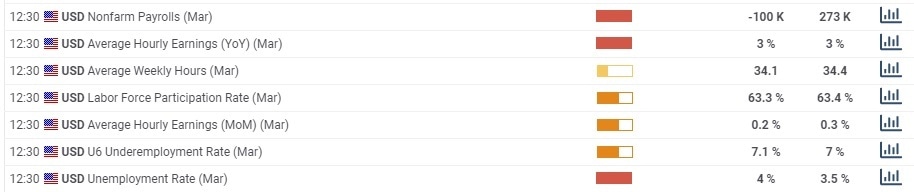

Since the Unemployment Rate is a lagging indicator, labor market data for April and May will paint a more accurate picture of the current situation. On Friday, the BLS will publish the Unemployment Rate alongside Nonfarm Payrolls (NFP) figures. The Unemployment Rate is expected to rise to 4% from 3.5% in March and the NFP is seen declining by 100,000 following February's reading of +273,000.

One thing we know for certain is that, once again, the first Friday of every month will be critical for traders.

Related articles

US Jobless Claims Analysis: Three million is only the beginning, three reasons why the dollar may rise.

Fed's Rosengren: US economy to suffer a 'significant shock' with higher unemployment.

Is a US recession inevitable? What does the history of consumer sentiment tell us?

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.