US higher than expected inflation – FOMC Minutes in focus

Previous week’s events (week 12-16.02.2024)

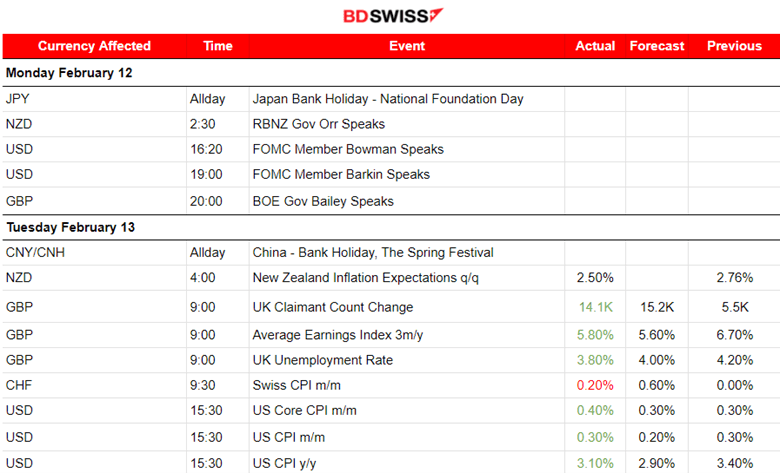

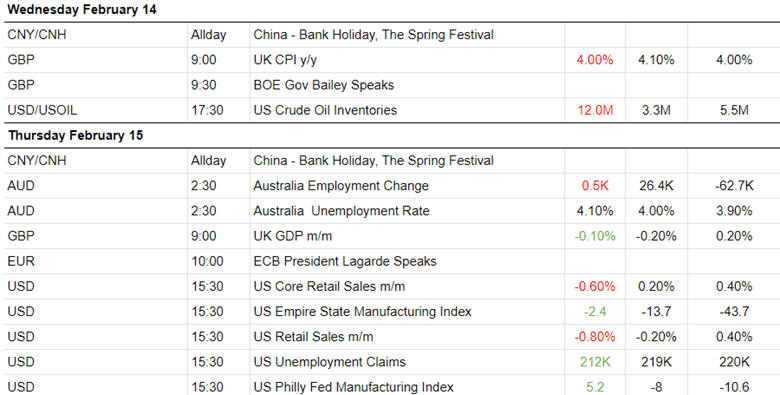

Announcements

US economy

Retail sales in the U.S. tumbled 0.8% last month, the biggest drop since March 2023, suggesting slowing momentum in consumer spending. This suggests that the economy looks strong but cooling.

However, jobs are added continuously and wage growth remains elevated. Consumer spending is far from collapsing. That should sustain the economic expansion. Economists expect that consumer spending will rise at a solid pace this year.

According to Friday’s PPI data releases the U.S. producer prices increased more than expected in January amid strong gains in the costs of services, spreading fear that inflation is picking up after all these months of cooling. The increase was the largest in five months.

Consumer prices in January shifted bets that the Federal Reserve would start cutting interest rates in June instead of May. The data are consistent, that January is causing trouble to inflation.

Services increased 0.6%, the largest rise since July 2023.

UK economy

The U.K. claimant count for January 2024 increased, higher than the previously reported figure. The early estimate of payrolled employees for January 2024 increased by 48,000 (0.2%). British pay grew by 6.2% in the last three months of 2023 compared with the same period a year earlier and the labour market remains tight as businesses struggle to find and retain staff.

The Bank of England (BoE) is probably against a labour market that has not cooled sufficiently to achieve a sustainable return to the 2% inflation target. The BoE is worried that pay might continue to rise too quickly for inflation to fall to its 2% target.

The GDP figures released for the U.K. suggest that the economy fell into a recession in the second half of 2023. Gross domestic product (GDP) contracted by 0.3% in the three months to December, having shrunk by 0.1% between July and September.

Recent data showed that inflation held at a lower-than-expected 4.0% in January, reviving talk among investors about a BoE rate cut as soon as June.

Australia economy

The labour market data for Australia showed very weak employment growth in January, while the jobless rate climbed to a two-year high, to 4.1%, topping forecasts of 4.0%.

US inflation

Inflation in the U.S. was reported higher than expected, at 3.1% versus 2.9%. The consumer price index increased 0.3% last month after gaining 0.2% in December. Global stock market indexes dropped, the 10-year U.S. Treasury yield hit a 2-1/2-month high and the dollar appreciated greatly against a basket of currencies.

All three major U.S. stock indexes fell more than 1% each, and the Dow Jones industrial average posted its biggest daily percentage drop in almost 11 months. The yield on the benchmark U.S. 10-year Treasury note rose 14 basis points to 4.31% after reaching 4.314%, its highest level since Dec. 1.

After the data, expectations rose that the Fed will likely not cut rates until its June 11-12 policy meeting.

Gold prices fell below the key $2,000 per ounce level to a two-month low following the CPI data. Spot gold was down 1.3% at $1,993.29 an ounce, its lowest since Dec. 13th.

UK inflation

The U.K.’s inflation report yesterday showed that it held steady at 4% in January. Unexpected and defied analyst forecasts of a rise. Investors formed expectations that cutting interest rates this year is more likely to take place, with many targeting June.

Services inflation rose slightly to 6.5% but was not as strong as the central bank expected.

Currency markets impact – Past releases (week 12-16.02.2024)

Server Time / Timezone EEST (UTC+02:00).

-

In New Zealand, the annual CPI inflation for the December 2023 quarter was measured at 4.7%, a decline from last quarter’s 5.6% annual inflation. The two-year-ahead, five-year-ahead and ten-year-ahead annual inflation expectations decreased from last quarter’s mean estimates and remained within the 1- 3% inflation target band. At the time of the release, the NZD started to depreciate significantly. NZDUSD dropped to near 30 pips during that time and retracement followed.

-

On the 13th it was reported that the early estimate of payrolled employees for January 2024 increased by 48,000 (0.2%) during the month and increased by 413,000 (1.4%) during the year. Wages & bonuses were reported stronger than expected, (5.8%) but cooler than last month (6.7%). The unemployment rate was reported down (3.8%) and claims also reported better, CC change at 14.1K. The market reacted with an initial GBP appreciation. The GBPUSD jumped near 20 pips at that time but it soon reversed after finding resistance.

-

The Swiss consumer price index (CPI) increased by 0.2% in January 2024 compared with the previous month.

-

During the CPI data / Inflation report for the U.S. at 15:30 on the 13th Feb, the USD strengthened greatly causing the markets to shake. The higher-than-expected inflation figure raised concerns of higher interest rates and, thus higher borrowing costs in the near future. USDJPY climbed to near 160 pips since the report release.

-

On the 14th Feb, the annual inflation for the U.K. was reported at 4%, thus no change. On a monthly basis, CPI fell by 0.6% in January 2024, the same rate as in January 2023. The market reacted heavily to the news with GBP depreciation. The dollar appreciated at 9:00 as well against other currencies. The GBPUSD dropped near 40 pips at that time.

-

Australia’s labour market data released on the 15th Feb showed that the unemployment rate jumped above 4% with January recording no significant increase in jobs. Quite weak data for labour. The market reacted with AUD depreciation, bringing down all AUD pairs (AUD as the base). The AUDUSD suffered a near 20 pips drop before retracing soon after during the Asian session.

-

In the U.K. real gross domestic product (GDP) is estimated to have fallen by 0.3% in the three months to December 2023, compared with the three months to September 2023. On a quarterly basis, this gives two consecutive falls in GDP, with a fall of 0.3% in Quarter 4 (Oct to Dec) 2023. The market reacted to this month’s decline with GBP depreciation. GBPUSD dropped more than 20 pips.

-

The U.S. retail sales reports were released along with the unemployment claims and Empire State and Philly manufacturing PMIs. The figures recorded a decline in retail sales for January beating expectations and casting an intraday shock for USD pairs. A weak start for consumer spending after a solid performance in the fourth quarter of 2024. Without any Fed intervention so far commenting on the recent data the market reacted with USD depreciation. Gold was up, over the 2K USD level, and U.S. indices remained high during that time.

-

In the U.K. strong retail sales were reported on the 16th Feb. This was the largest monthly rise since April 2021 and returned volumes to November 2023 levels. The market reacted with a moderate shock, GBP appreciating momentarily but the effect faded soon.

-

The PPI data at 15:30 showed that the Producer Price Index for final demand increased 0.3% in January, beating expectations. The Corre PPI increased 0.5%, beating expectations as well for a just 0.1% increase. The market reacted with USD appreciation at the time of the release. The EURUSD dropped near 30 pips before reversing back to the mean.

Forex markets monitor

Dollar Index (US_DX)

The dollar index is moving to the downside steadily despite the higher-than-expected inflation figure released on the 13th Feb and PPI figures released on the 16th. During these events the USD experienced strong appreciation, however, the pressure for the dollar to weaken continued to be strong enough. The Fed’s Interest Rate Cuts will happen, it's just a matter of time.

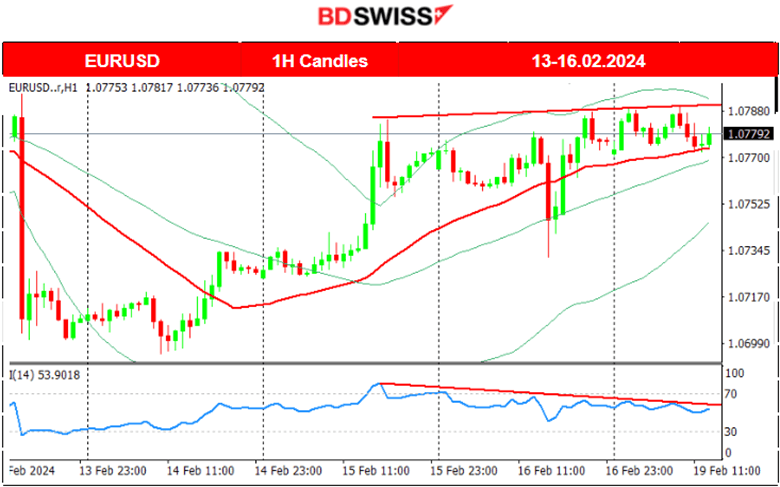

EUR/USD

The EURUSD reversed to the upside, correcting from the drop that occurred on the 13th due to dollar appreciation. The pair crossed the 30-period MA on its way up and remained on the upward path. The RSI is however showing signs of slowing down. It would be the case that the dollar might see some strengthening again as expectations have settled towards a more probable June cut.

Crypto markets monitor

BTC/USD

Early on the 14th Feb, Bitcoin climbed again aggressively reaching up to 52,600 USD on the 14th and even reached 52.800 USD on the 15th Feb before retracing. On the 17th Feb Bitcoin fell rapidly reaching the support near 50,550 USD before reversing fully back to the 30-period MA. Since the 17th Feb, it has been on an upward path that forms an upward wedge and is on the way to test more resistance. 52,600 USD seems to be a significant resistance level.

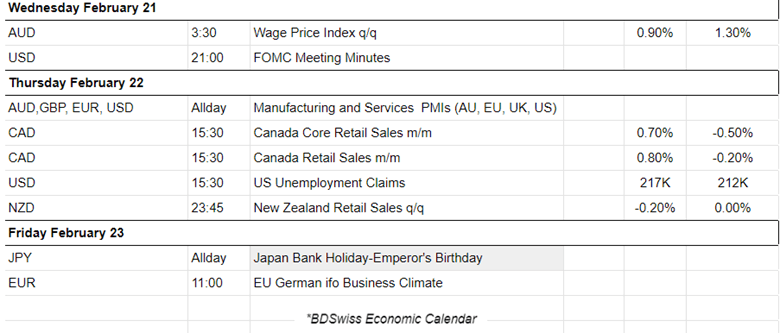

Next week’s events (19 - 23.02.2024)

Coming up: This week we have Canada’s Inflation data release and Retail Sales report.

In addition, on Wednesday the FOMC Meeting Minutes release will give more information to the market regarding the thoughts and intentions of the FOMC.

PMIs of the Manufacturing and Services sector will be reported on the same day.

Currency markets impact

-

On the 20th Feb, the CPI data for Canada will be reported at 15:30. On a monthly basis, analysts expect growth instead of a decline. Annual inflation is recorded below 3% and seems to have lowered significantly in the 4th quarter of 2023. For January it was reported 2.6%. A less-than-expected figure will probably cause more volatility for CAD but a decline instead will possibly cause the CAD to depreciate heavily.

-

The quarterly Wage price index released on the 21st Feb for Australia could cause more volatility than normal during the Asian session. The figure is expected to be reported lower coinciding with the expectations that elevated rates should have a negative impact on wages. A possible moderate impact on AUD during that time.

-

The Canada’s Retail Sales report release will take place on the 22nd Feb. The figures are expected to be reported higher. Growth instead of declines indicates that the market expects that in December there was more activity and more demand. The market could see more volatility during that time again affecting the CAD pairs.

-

Unemployment Claims for the U.S. will be released as well during that time. A possible impact on the USD and higher volatility. However, the effect is not expected to last as claims tend to remain just above 200K for now.

Commodities markets monitor

US Crude Oil

On the 14th Feb, the release of the Crude oil inventories report at 17:30 caused a price drop that extended until the end of the trading day, about an 18 USD drop. The reported figure was indeed a high number, 12M barrels, a huge Crude build. U.S. production is back at record highs. On the 15th Feb, correction took place, with the price to reverse almost fully. On the way up, Crude oil crossed the 30-period MA and reached a resistance near 78 USD/b. It soon retraced to the mean on the 16th Feb but bounced back to the upside eventually reaching the resistance at 78.50 USD/b.

Gold (XAU/USD)

On the 13th Feb, after 15:30, the more-than-expected inflation figure caused USD heavy appreciation and a sharp drop for Gold, passing the support at 2000 USD/oz, moving further downwards until the next support near 1990 USD/oz. Surprisingly, on the 14th Feb, Gold remained in consolidation. Retracement eventually took place yesterday back to the upside, supported by the weak sales report for the U.S. and causing the price to reach just above the 2K USD level. On the 16th Feb, the price dropped after the PPI news and USD appreciation, reaching the support at near 1995 USD/oz before reversing to the upside. The USD currently experiences weakness and is one major factor that pushes Gold’s price more to the upside. Currently Gold settled near 2020 USD/oz. No signals for any change in trend currently.

Equity markets monitor

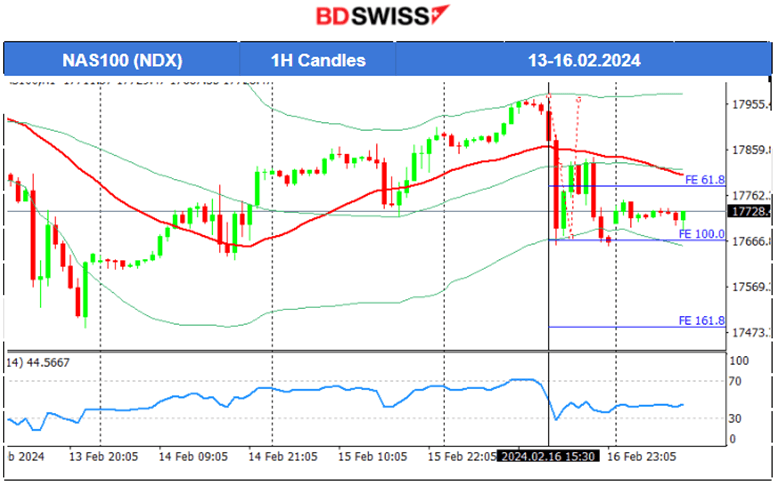

NAS100 (NDX)

Price movement

On the 14th Feb and 15th Feb, the index climbed further. All three U.S. benchmark indices experienced the same path. On the 16th the index found resistance at 17,970 USD and immediately dropped with the PPI data release for the U.S. The index found support at that time near 17,660 USD before retracing to the 61.8 Fibo level and later back to the 30-period MA. Another drop followed causing the index to close lower and remain close to 17.700 USD. This signals the end of the uptrend and possible sideways but volatile movement if no breakouts to the downside occur soon.

Author

BDSwiss Research Team

BDSwiss

BDSwiss is a leading financial institution, offering bespoke CFD trading and investment products to more than 1.7 million registered clients, in over 180 countries.