US Gross Domestic Product Preview: Would the US avoid a technical recession?

- The US economy is expected to have grown a modest 0.4% in the second quarter.

- A second consecutive negative reading will indicate the US is in a recession.

- USD strength or weakness will be directly linked to the market sentiment.

The US will publish the preliminary estimate of the second quarter Gross Domestic Product on Thursday, July 28. The economy is expected to have grown at an annualized pace of 0.4%, improving from a 1.6% decline in Q1.

Macroeconomic data, however, points to heightened downward risks for the economy, particularly figures linked to the last half of the quarter, as spending retreated sharply. A negative figure will mean the US is in a technical recession, defined as two consecutive quarters with negative GDP readings.

Following the first year of the pandemic, global economies bloomed. The US expanded substantially throughout 2021 but lost momentum by the end of the year. Supply-chain issues and bottlenecks were initially blamed for the slowdown, alongside shocking spending that led to higher inflation. Central bankers were expecting the latter to be temporary, realizing too late that they missed big.

Nor did they foresee Russia’s decision to invade Ukraine and create a global energy and food crisis would go on to fuel price pressures. Central banks rushed into quantitative tightening, but things are getting no better. Inflation among developed economies keeps reaching multi-decade highs while business activity shrinks.

Short-lived hopes?

In this scenario, there is a small chance the US economy would expand modestly in the second quarter of the year. Maintaining growth in the third quarter of the year, however, seems unlikely.

Treasury Secretary Janet Yellen said the country is not in a recession but in “a period of transition in which growth is slowing.” “A recession is a broad-based contraction that affects many sectors of the economy. We just don’t have that,” she added. And indeed, some sectors of the economy are doing well. Job creation has been robust in the last two years, while business activity decelerated but remains in expansionary territory.

A figure signaling growth will indicate the US is skipping a recession, but any number below 1% will bring little relief to those concerned about the economic slowdown. Rather it will just buy a bit more time.

USD possible scenarios

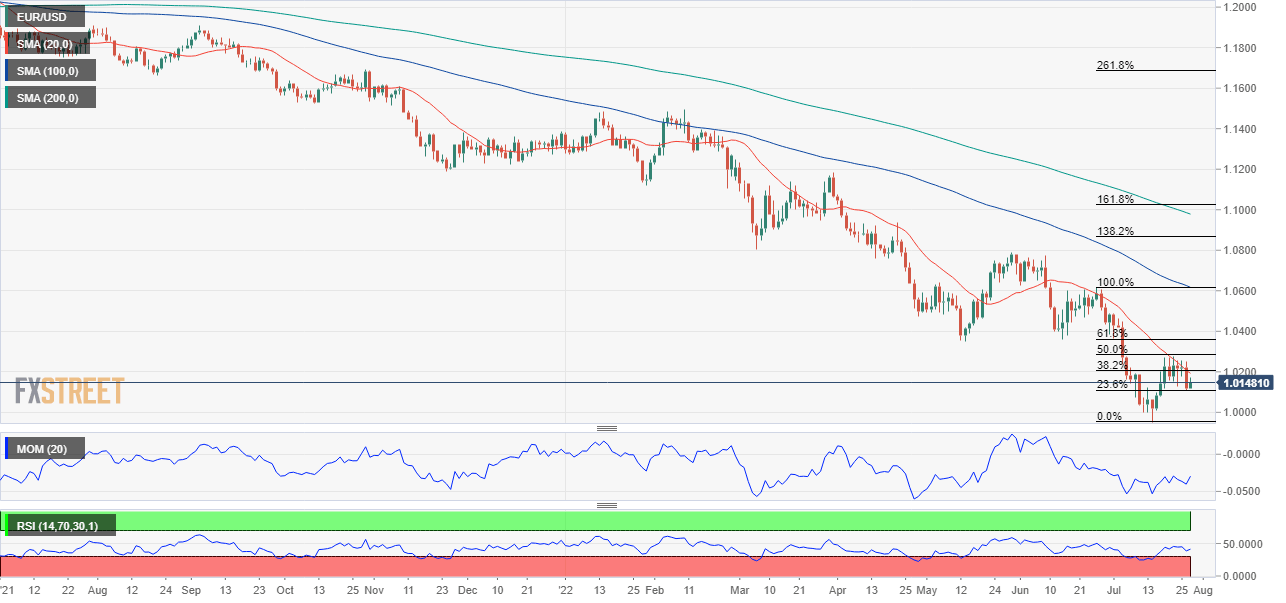

Generally speaking, the dollar has more chances of appreciating in a risk-averse environment than falling amid poor local data. The EUR is the greenback’s weakest rival as local turmoil caps demand. Should the dollar surge, selling EUR/USD seems the best choice.

The Swiss Franc, the British Pound and the Australian dollar are at the other end of the range. A falling dollar plus resurgent stocks will make AUD/USD the preferred choice, while, in the case stocks fall, eyes should turn to CHF and GBP.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.