US government ran big surplus in April but don't get excited

The U.S. government ran a rare surplus in April, but don’t get too excited. The Biden administration hasn’t slowed down the spending train, and more budget shortfalls loom on the horizon.

The Biden administration ran a $209.5 billion surplus in April thanks to an influx of revenue as people filed their tax returns.

Tax receipts came in at $776.2 billion in April, a 22 percent increase over last year, according to the April Monthly Treasury Statement.

The surge in revenue pushed the fiscal 2024 deficit back under $1 trillion ($855.2 billion), but the reprieve won’t last. Even with the tax receipt boot, the Biden administration is on track for a $1.5 trillion deficit.

Even with the drop in the 2024 deficit, NPR called it "remarkably large" given the (alleged) strength of the economy.

Analysts say the influx of tax receipts was due to the “strong labor market” and wage growth.

In reality, it was due to price inflation.

Inflation raises wages along with consumer prices. (After all, a wage is nothing more than the price of labor.) But rising wages have not kept pace with spiking prices, and higher prices have forced many people to take on second jobs, juicing the labor market.

In other words, the U.S. Treasury managed to turn price inflation into a windfall.

Meanwhile, the spending freight train continued to hurtle down the track and breakneck speed.

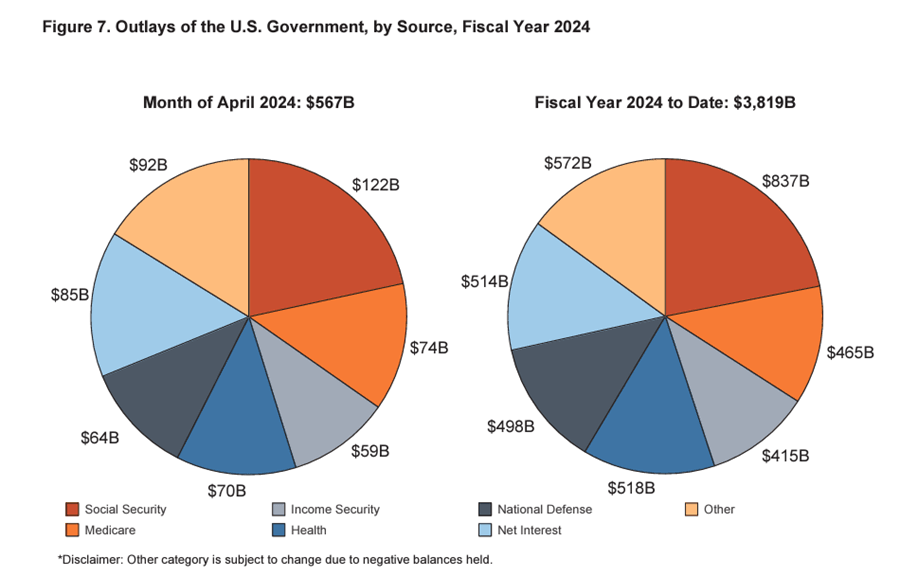

Government outlays were up by 23 percent over a year ago, as the Biden administration blew through $566.7 billion in April.

Through the first seven months of fiscal 2024, the federal government has spent a staggering $3.82 trillion.

Spending continues to increase despite the [pretend] spending cuts and promises from the Biden administration that it would save “hundreds of billions” with the debt ceiling deal (aka the [misnamed] Fiscal Responsibility Act.)

This reveals the ugly truth in Washington D.C. No matter what you hear about spending cuts, the federal government always finds new reasons to spend more and more money.

I should note that this problem isn't specific to Biden or Democrats in general. The Trump administration was running $1 trillion deficits before the pandemic. In other words, Trump was generating Obamaesque deficits despite having what he claimed was the strongest economy in history.

Borrowing and spending is a bipartisan sport.

These massive monthly budget shortfalls are pushing the national debt higher at a dizzying pace. On December 29, the national debt eclipsed $34 trillion for the first time. When Congress effectively eliminated the debt ceiling on June 5, the national debt stood at a "mere" $31.46 trillion. As of May 13, the national debt stood at over $34.5 trillion.

The debt to GDP ratio has risen to over 122 percent. And yet virtually nobody in either major political party shows any interest in reining in the spending. In fact, both parties keep pushing to spend more money to expand both the welfare and warfare state.

The elephant in the room

Meanwhile, a giant elephant is standing in the kitchen. The borrowing and spending are unsustainable in this higher interest rate environment.

With price inflation still running hot, the Federal Reserve has dampened expectations of rate cuts in the near future. But the ugly truth is the federal government is going to have a hard time maintaining the pace of borrowing with rates this high. (And from a historical perspective, they aren't even all that high.)

The U.S. government spent $102.4 billion on interest expenses alone in April. This was more than the amount spent on national defense ($64 billion) and more than Medicare ($74 billion). The only spending category higher than interest expense was Social Security.

The government has shelled out $624.5 billion on interest payments so far in fiscal 2024. That's a 35.7 percent increase over the same period in fiscal 2023. Again, the only category with higher spending was Social Security.

Net interest expense, excluding intragovernmental transfers to trust funds, was $514 billion through the six months of the fiscal year. Net interest expense for the year has now eclipsed the outlays for national defense ($415 billion) and Medicare ($465 billion).

To put this into a different perspective, the federal government is spending over 1/3 of its tax receipts on interest expense alone.

And interest expenses will only continue to climb.

Much of the debt currently on the books was financed at very low rates before the Federal Reserve started its hiking cycle. Every month, some of that super-low-yielding paper matures and has to be replaced by bonds yielding much higher rates.

The weighted average interest rate on the government’s outstanding Treasury securities rose to 3.3 percent as of the end of March. That compares with a weighted average rate of 2.7 percent in May 2023.

The only way out of this fiscal death spiral is significant spending cuts and/or major tax hikes. I wouldn't hold my breath.

To receive free commentary and analysis on the gold and silver markets, click here to be added to the Money Metals news service.

Author

Mike Maharrey

Money Metals Exchange

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.