US GDP surprise called

S&P 500 sprang to life on the first dovish Fed speaker‘s remark it could, yet the full array of speakers dialed the message back ultimately – and correctly so, for the bond market is getting ahead in rate cut expectations, with corporate bonds flying, financial conditions easing, and risk-on turn continuing. It can be seen pretty well in the run up to GDP today – and core PCE tomorrow.

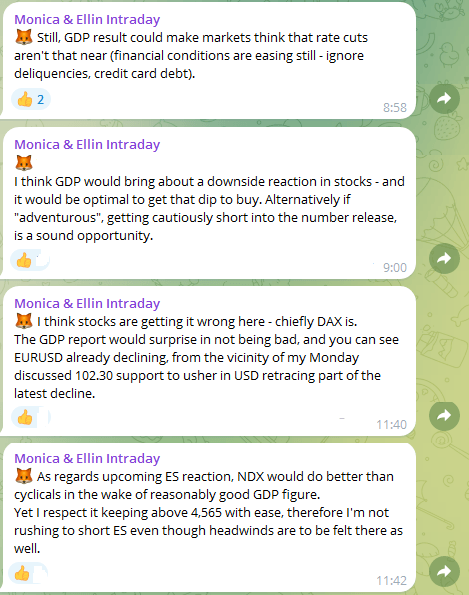

But one at a time. GDP is likely to be accompanied by the following (macro commentary taken from our intraday stock market channel, and the Trading Signals Telegram channel together with both Trading and Stock Signals clients, had my thoughts already as well):

Please note how this ties in with the 102.30 USD Index support. Given the figure indeed coming above expectations, the buyers will get on strategic defensive later today.

Let‘s move right into the charts (all courtesy of www.stockcharts.com) – today‘s full scale article contains 4 of them, featuring S&P 500, yields, precious metals and oil.

S&P 500 and Nasdaq outlook

4,565 served as support, which is a premarket fly in the ointment for those who look for a brief correction before stocks continue higher. Expect the GDP figure to decide the sentiment of the day – corrective or grind higher continuing.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.