- Economists expect the US to report a meager 0.4% annualized growth rate in Q2.

- A negative print would put the world's largest economy in a technical recession.

- The greenback is set to benefit from a return to growth or from fears.

Has America ducked a recession? That is what economists expect from the first release of the second quarter Gross Domestic Product (GDP) – a paltry 0.4% annualized growth rate. Un-annualized that is only 0.1%.

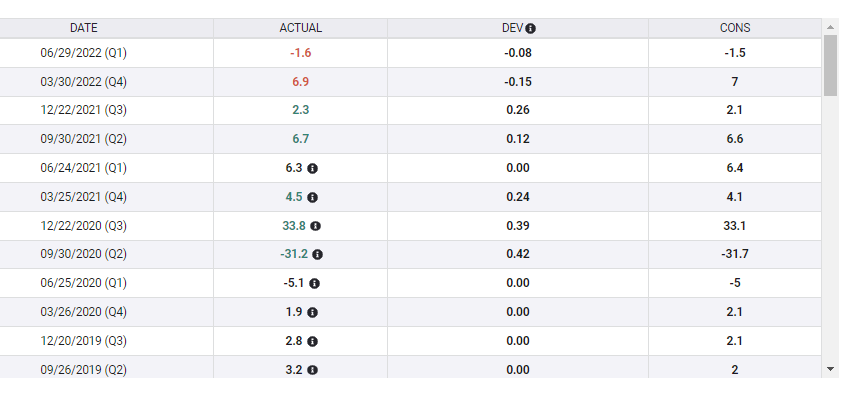

After shrinking by 1.6% annualized in the first three quarters of the year, a small miss would mean two consecutive quarters of contraction – one of the definitions of recession. I believe that the GDP outcome will have little impact on the dollar reaction – and that its chances are low.

Low chances for a recession

It is essential to note that only the National Bureau of Economic Research (NBER) officially defines recessions. Their broad criteria are

a significant decline in economic activity that is spread across the economy and lasts more than a few months

The NBER is unlikely to determine a recession while US job growth is at around a monthly pace of 400,000, and while retail sales look robust. An unemployment rate of 3.6% and ongoing shopping sprees are inconsistent with a recession.

Moreover, that 1.6% squeeze in the first quarter was a result of an unusually high trade deficit and inventory reduction – one-off quirks. When inventories are depleted in one quarter, they tend to replenished later on. If such a fill-up happened already in Q2, growth could be higher

Another reason to expect a stronger growth figure is the fact that economists missed estimates in the past two quarters – and that three consecutive disappointments last occurred in 2013.

Source: FXStreet

Why a win-win is likely for the dollar

In case growth exceeds expectations, there would be no headlines screaming recession, which would be positive for the US dollar. It would show that additional rate hikes would be needed to tame inflation.

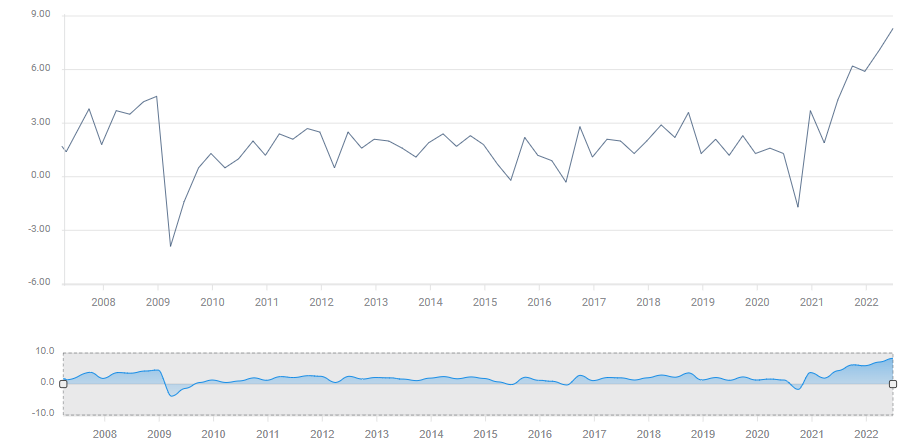

Such a reaction would be boosted if the GDP Price Index – sometimes called "deflator" remains at elevated levels. The figure represents the inflationary impact on growth, and stood at 8.3% in the first quarter – a rapid pace of price rises. The economic calendar points to an 8% increase now, which would still be high.

Source: FXStreet

In case my upbeat expansion expectations for a return to growth fail to materialize, headlines would scream recession. While pundits would be discussing the technicalities, markets would clearly see a deteriorating economic environment as a prelude to a drop in inflation.

Two quarters of negative growth would also imply employment is set to fall – and that is also critical for the Fed. The central bank has two mandates: price stability and full employment. If labor markets cool, Fed Chair Jerome Powell and his colleagues would need to take jobs into consideration when discussing how to fight inflation. That would mean lower rate hikes.

Will the dollar fall in case of negative numbers? Not so fast. The dollar reflects fear and not only the Fed's interest rates. If headlines indeed scream "US recession," other parts of the world are unlikely to thrive. "When America sneezes, the globe catches a cold" – goes the adage.

One currency pair that is likely to feel the difference between expansion and contraction outcomes is USD/JPY. A better than expected GDP figure will likely send the currency pair higher, while a weak outcome would push 10-year yields lower, dragging USD/JPY down.

When it comes to EUR/USD, GBP/USD, and commodity currencies, the dollar is more likely than not to come out on top – whether headlines scream recession or not.

Final thoughts

The first release of GDP has a greater impact than consequent ones, when a technical recession is in play, the stakes are even higher. Nevertheless, the greenback has room to rise.

Last note: I have written this preview before the Fed decision, which is set to have a substantial impact on the dollar and markets. If needed, an update will be provided.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD: Next upside target comes at 0.6550

AUD/USD managed well to shrug off the marked advance in the Greenback as well as geopolitical tensions, regaining the area above the 0.6500 hurdle ahead of preliminary PMIs in Australia.

EUR/USD: Further losses now look at 1.0450

Further strength in the US Dollar kept the price action in the risk-associated assets depressed, sending EUR/USD back to the 1.0460 region for the first time since early October 2023 prior to key releases in the real economy.

Gold faces extra upside near term

Gold extends its bullish momentum further above $2,660 on Thursday. XAU/USD rises for the fourth straight day, sponsored by geopolitical risks stemming from the worsening Russia-Ukraine war. Markets await comments from Fed policymakers.

Ethereum Price Forecast: ETH open interest surge to all-time high after recent price rally

Ethereum (ETH) is trading near $3,350, experiencing an 10% increase on Thursday. This price surge is attributed to strong bullish sentiment among derivatives traders, driving its open interest above $20 billion for the first time.

A new horizon: The economic outlook in a new leadership and policy era

The economic aftershocks of the COVID pandemic, which have dominated the economic landscape over the past few years, are steadily dissipating. These pandemic-induced economic effects are set to be largely supplanted by economic policy changes that are on the horizon in the United States.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.