US GDP Preview: Three reasons to expect dollar-boosting figures

- There is room for an upside surprise in GDP figures, similar to most pandemic-era releases.

- Inflation components are set to remind investors of the Fed's aggressive rate rise path.

- The publication may unleash further dollar strength, extending the trend.

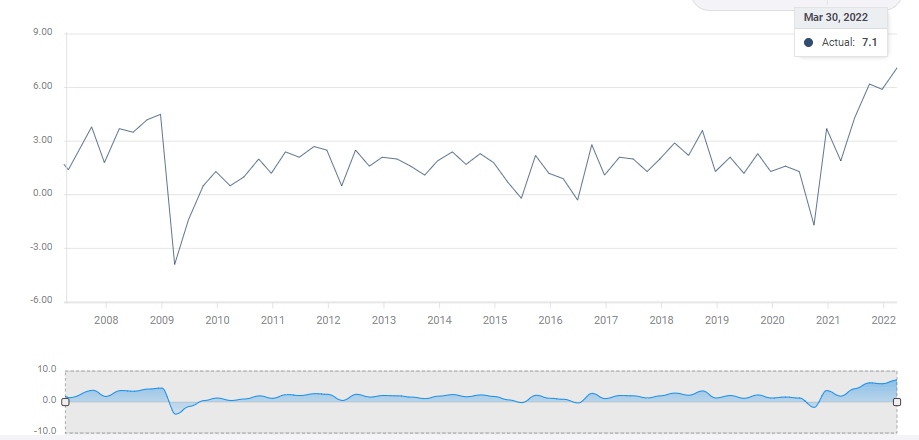

Has US growth peaked? That is what economists are expecting first-quarter Gross Domestic Product figures to show – a marked slowdown from 6.9% annualized expansion to a mere 1%. Rising energy prices have eroded consumers' willingness to spend, and rising wages are insufficient to keep the momentum, as these are chasing rising wages.

Slower growth means a weaker dollar, but there are three reasons to expect a positive outcome for the greenback.

1) Expectations are too low

The world's No. 1 economy is still growing at a rapid clip, as figures from early 2022 have shown. Fast job growth is incompatible with a snail pace growth. Even if the reasons mentioned above are enough for a significant deceleration, perhaps the gloom has gone too far.

Source: FXStreet

Overall, experience shows that economists were too bearish on growth prospects in recent years. If that repeats itself, the dollar could gain ground in response.

2) The Deflator

Source: FXStreet

The consensus stands at 7.2% annualized price rises, up from 7.1% in the fourth quarter. Even if this is a relative deceleration, a level above 7% still implies high inflation. In turn, this publication serves as a reminder for investors that the Federal Reserve is set to raise interest rates at a rapid pace.

GDP data is due out less than a week before the Fed meets – and while the central bank is in its blackout period, staying silent. Even if the data does not impact officials, markets will not know that. Uncertainty could further push funds into the safe-haven dollar.

3) Make the trend your friend

The dollar is already benefiting from worries about the Fed, China's zero covid policy and Russia's ongoing war in Ukraine – now with bans on gas imports to some countries. However, markets may take a step back in rushing toward the greenback ahead of the GDP releae, a major one.

The mere release of the figure could unleash further strength, basically resuming the broader trend. Such a phenomenon happens with significant events, that cause a pre-publicaiton freeze and furious action afterward.

Final thoughts

A refocus on the US economy and the Fed could remind investors that the US dollar has room to rise with or without its role as a safe-haven currency.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.