US GDP and PCE inflation up next before July FOMC

-

Fed to get final clues on growth and inflation before July meeting.

-

But with traders more preoccupied with politics, will the data move the dollar?

-

Preliminary GDP is due Thursday and PCE inflation on Friday, both at 12:30 GMT.

Fed still wants to see more progress

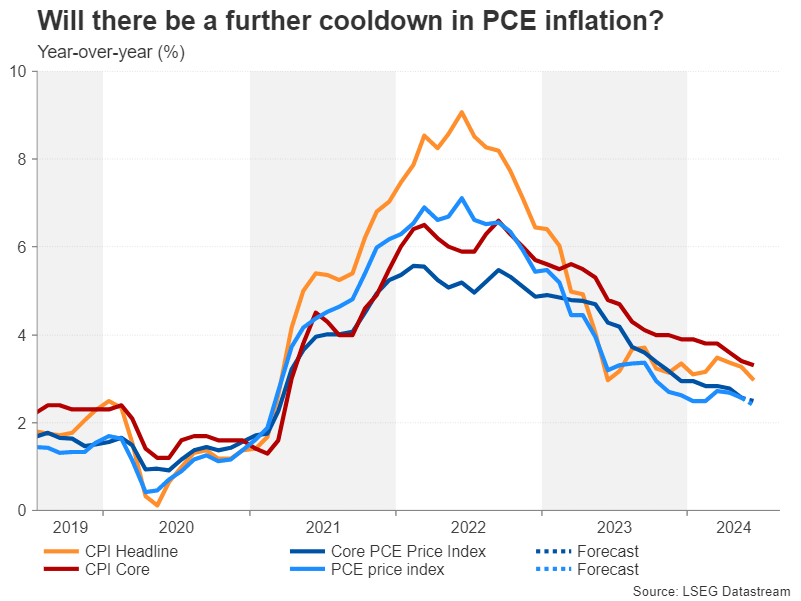

The recent inflation reports have brought some much needed relief for both policymakers and the markets, pointing to a resumption of the downward trend after several months of sideways movement. The Fed has even toned down its hawkish rhetoric somewhat, hinting that a rate cut may be nearing.

However, Chair Jerome Powell was also quite specific when he addressed lawmakers earlier this month that the Fed wants to see more good data to gain greater confidence of achieving its 2% price objective. Hence, Friday’s PCE inflation figures could be crucial in taking the Fed a step closer towards its target.

The personal consumption expenditures (PCE) price index is expected to have eased from 2.6% in May y/y to 2.4% to June, which would make it the lowest since February 2021. The more important core PCE price index that strips out food and energy prices is forecast to have edged down 0.1 percentage points to 2.5% y/y in June – also a more than three-year low.

Are American households spending less?

Included in the same report are the personal income and personal consumption numbers. The former is expected to have risen by 0.4% m/m in June, slowing from 0.5%, and the latter by 0.3% m/m, in a modest pick up from 0.2%.

Recent indicators suggest the US consumer is finally reining in spending and this may have contributed to the Fed’s slight dovish lean, as weaker consumption would reduce the upside risks to inflation. But if there’s an unexpected acceleration, the Fed will be more inclined to maintain a cautious stance when it meets next week.

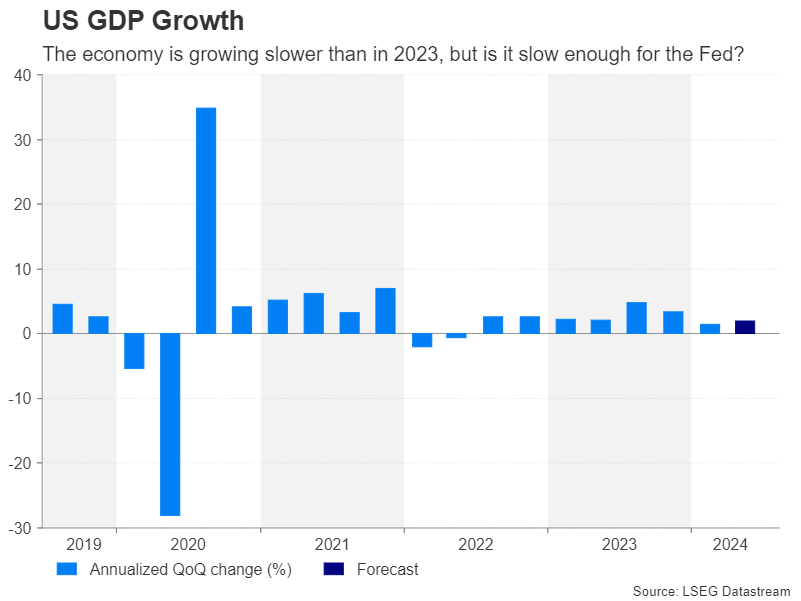

GDP growth probably quickened in Q2

Overall, though, it’s clear that the US economy has lost steam this year, with even the red-hot labour market cooling a bit lately. Yet, there have been some discrepancies between the different data sets and it’s not just inflation that policymakers have struggled to get a clear read on. Although it can only be a good thing that a soft landing seems achievable and is not simply an elusive goal, the Fed would probably prefer for growth to have slowed more sharply by now to aid its fight against inflation.

Thursday’s advance estimate of GDP growth for the second quarter is not expected to do much in clearing the fog. The US economy is projected to have expanded by an annualized rate of 2.0% in Q2 versus 1.4% in the prior three months.

Fed not in a rush to cut

A lower print would ease concerns about domestic demand remaining too strong, but the bigger question is would softer readings on either inflation or growth, or both, prompt some kind of a policy shift by the Fed at the July 30-31 meeting?

Judging by their language, policymakers seem quite comfortable to wait a while longer so unless there is anything in the incoming data that points to a sudden deterioration in the economy, the Fed will probably make only slight tweaks to its language to flag a possible rate cut in September without quite committing to it.

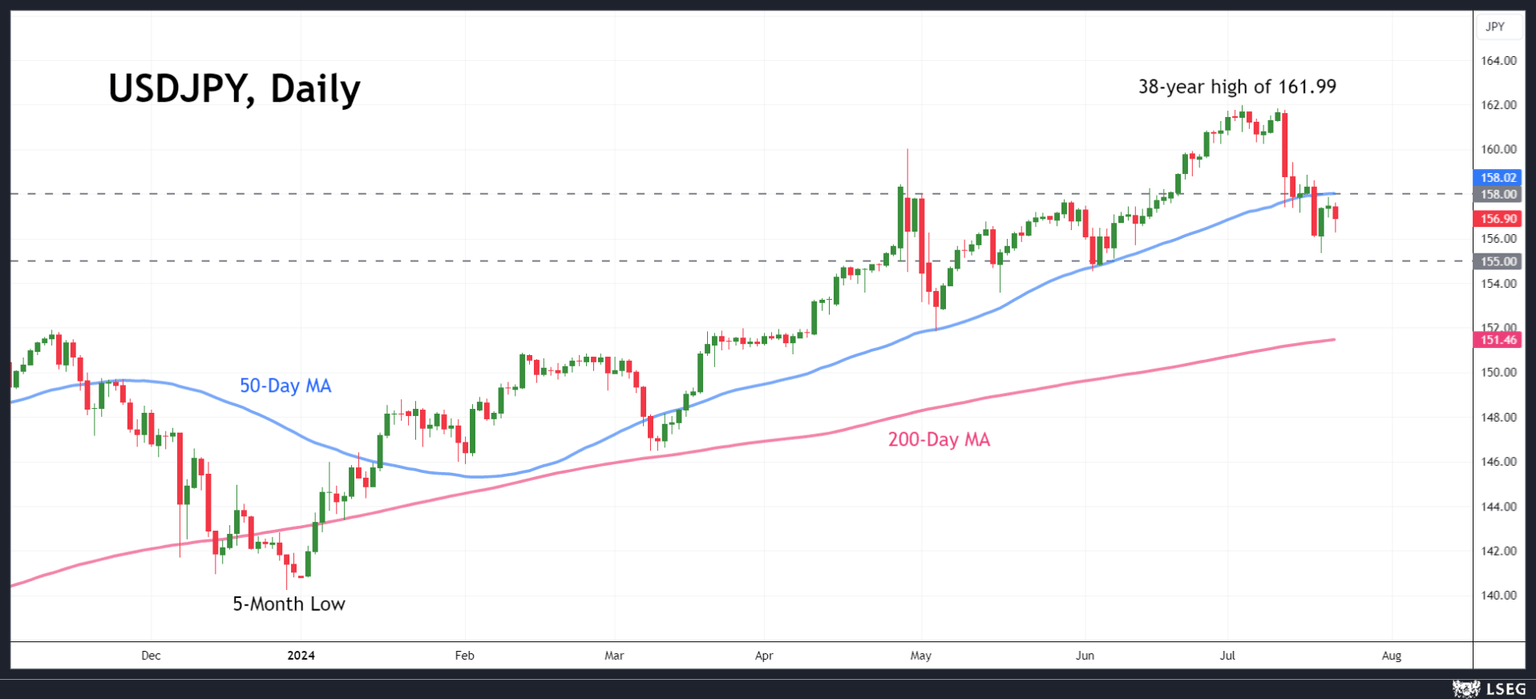

Dollar on the backfoot

The US dollar could come under pressure if this week’s releases bring a September cut closer. Against currencies such as the Japanese yen, the greenback has already suffered substantial losses over the past couple of weeks and a further selloff could bring the 155.00 support into view.

However, any setback from the data to rate cut bets, particularly from a hotter-than-expected core PCE number, could spur a rebound in the dollar, pushing it above its 50-day moving average (MA), which has started to flatten at 158.00 yen.

US elections keeping markets on edge

In the meantime, investors will also be keeping a close watch on the US presidential race as the Democrats’ chances of securing another victory got a boost following President Biden’s decision on Sunday not to stand for re-election and to instead endorse his vice president, Kamala Harris, as the party’s nominee.

There’s still some way to go before the Democrats formally pick their candidate at the party’s convention next month but should the opinion polls suggest that Harris poses a threat to Trump’s bid to re-enter the White House, the dollar could slip a little as there would be less of a risk of higher trade tariffs from a Trump presidency, which have the potential to push up inflation.

Author

Mr Boyadjian graduated from the London School of Economics in 1999 with a BSc in Business Mathematics and Statistics. Following graduation, he joined PricewaterhouseCoopers in the Business Recoveries team, where he was responsibl