US Federal Reserve Rate Decision Preview: Projections, projections, projections

- The final FOMC meeting of a tumultuous year will feature new economic and rate forecasts.

- No change in rates or the bond purchase program is expected.

- Markets will be keenly interested in the Fed's view forward, the Projection Materials.

- No Federal Reserve outcome likely to assist the dollar.

Markets are looking past the pandemic to a full-fledged global recovery in the next two quarters and the Federal Reserve will partake of that optimism by leaving its current policies intact even if its language remains full of warnings.

The Federal Reserve Open Market Committee (FOMC), the policy body of the central bank, will keep the fed funds target range at 0.00% to 0.25% and its loan and monthly $120 billion bond purchase program unchanged at its final meeting of 2020 on Wednesday.

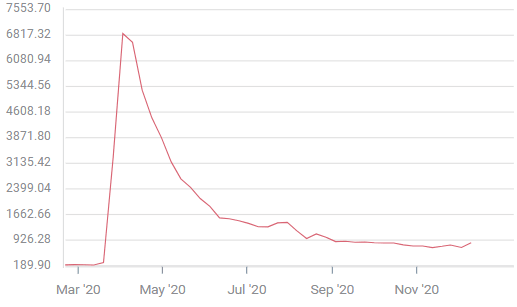

Federal Reserve Assets

US economic recovery

American economic activity has recovered forcefully from the lockdown induced 31.4% collapse in the second quarter with growth at 33.1% in the third. The expansion in the final three months of the year is estimated to be running at 11.2% in the latest estimate from the Atlanta Fed GDPNow model.

One of the reasons for the strong rebound has been the sustained recovery in consumption.

Retail Sales and the GDP component Control Group have had a surprisingly robust return from the collapse in sales brought on by the government ordered business closures in March in April.

Retail Sales Control Group

The eight months from the beginning of the shutdown in March through October have seen some of the best sales reports in a decade. Retail Sales and the Control Group averaged monthly increases of 0.89% and 1.06% for the period. These results are higher than the comparable averages of 0.46% and 0.51% for 2019 and suggest that despite the pandemic the retail sector is essentially functioning normally.

A possible caveat to the retail levitation may have started in October when both major categories of Sales, Retail and Control, missed forecasts: Sales came in at 0.3% on a 0.5% prediction and Control registered 0.1% on a 0.5% estimate.

The November forecasts, -0.3% in Sales and 0.2% for the Control Group, would continue that lower trend. If correct it would be further evidence that the fall business closures, higher layoffs and weaker rehiring, are reducing consumer spending.

Initial claims and Nonfarm Payrolls

The addition of 245,000 workers to the November payrolls was the smallest of the seven-month recovery and slightly over half of the 469,000 consensus forecast.

A rise in the weekly Initial Claims figures three weeks before the November payrolls release on December 4, had warned that the labor market might be reversing under the new business closures ordered by several states.

New claims rose from 711,000 in the November 6 week (reported on November 12) to 787,000 in the November 20 week (reported on November 25). Claims then reversed, as they did after several summer increases, and dropped to 716,000 the following week, November 27, which were issued on December 3.

Yet the subsequent week, December 4 (released on December 10) they reversed again and jumped 137,000 to 853,000, the highest number in 11 weeks. This Thursday, Claims are projected to fall to 800,000 in the December 11 week. December payrolls are not issued until Friday January 8.

Initial Jobless Claims

Projection Materials

The Fed issues its economic and rate forecasts, the Projection Materials four times a year at the March, June September and December meetings. This year the March version was canceled in the series of pandemic emergency meeting early in the month.

September's figures were a notable improvement over the June release. Growth in 2020 was -3.7% rather than -6.5%, the unemployment rate moved down to 7.6% from 9.3% and core PCE inflation rose to 1.5% from 1.0%. The governors also added a fourth year of projections, 2023, for the first time in Fed history.

In June the pandemic was at an ebb but the future was uncertain. Now cases have been rising for weeks but vaccines would seem to make the future far more positive and thus far the economic fallout from the current wave has been relatively minor.

Market response

Currency markets have been securely in the risk acceptance mode selling the dollar on almost any provocation. It is quite likely that good economic and rate projections from the Fed or optimism from Chairman Jerome Powell will feed the risk-on desertion of the greenback.

Another stimulus package from Congress, a development the Chairman has long requested, seems to be headed for completion. That could, as it assists a global recovery, add to the dollar's decline.

Markets have not yet reached the fork in the analytical road that leads to national economic performance. The shocks and fears of the pandemic are still too real.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.