US Federal Reserve Meeting April Preview: Buying time before the inevitable taper

- No change forecast in Fed rate policy or bond purchase program.

- The rapidly expanding US economy and labor market have pressured Treasury rates.

- Markets are alert for any reference to a reduction in the Fed bond program.

- Dollar has weakened as Treasury rates have dropped from late March high.

This may be the last time Federal Reserve Chairman Jerome Powell will be able to mollify markets concerned that the central bank is in danger of falling behind the economic expansion and inflation curves.

The Federal Reserve Open Market Committee (FOMC) two-day meeting concludes on Wednesday with the policy announcement at 2:00 pm (EST) followed by Chairman Powell’s press conference at 2:30 pm.

No change is expected in the fed funds target range of 0.0%-0.25%, or in the $120 billion a month of Treasury and mortgage asset purchases.

In his prepared statement and answers to press questions, Chairman Powell will undoubtedly offer the same analysis of the US economy that he and other officials have proffered over the past several months.

The inflation spike is temporary, largely due to the base effect from last year’s lockdown collapse. Economic growth is strong but part of that is replacement for last year’s losses. The expansion will moderate as the year goes on. Unemployment is still high and the large pool of workers will forestall pay increases and the beginning of a wage price spiral.

US economy: GDP and inflation

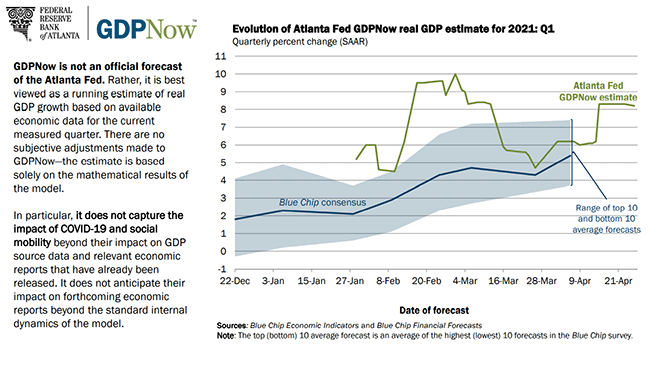

The American economy is forecast to expand at a 6.5% annual rate in the first quarter, a 50% jump from the 4.3% pace in the fourth quarter of last year.

The estimate from the Atlanta Fed’s GDPNow program is 8.2%. For the year the Fed’s own Projection Materials posit a 6.5% expansion as well.

Inflation has increased sharply in the last two months. The Producer Price Index (PPI) vaulted from 3.1% in February to 4.2% in March. Core prices rose to 2.8% from 2.5%.

Consumer prices followed suit with the index (CPI) reaching 2.6% from 1.7% and the core rate gaining 1.6% from 1.3%. Personal Consumption Expenditure Prices are expected to be more restrained in March, with the headline unchanged at 1.6% and the core rising to 1.8% from 1.4%.

CPI

Labor market

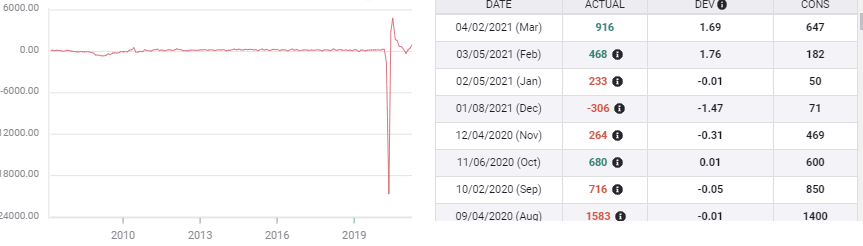

Nonfarm Payrolls rose 1.617 million in the first quarter. Job creation increased almost four-fold in three months, from 233,000 in January to 916,000 in March. Unemployment dropped from 6.3% in January (6.7% in December) to 6% in March.

Notwithstanding the first quarter improvement, about 8.4 million people remain out of work, by the payroll count from last February.

Initial Jobless Claims have fallen more than 200,000 in the last two weeks from 769,000 on April 2 to 547,000 on the 16th. The four-week moving average is down from a high of 856,500 in the week of January 29 to 651,000 last reported.

Treasury yields

Treasury yields have reflected the quickly improving prospects for the US economy as the vaccination program has ended most economic restrictions, if not the changed habits of many consumers.

The yield curve has steepened notably with the near end at 2-years and less held constant by the Fed’s bond purchases while longer returns have increased by varying amounts.

The yield on the benchmark 10-year Treasury had added 83 points in the three months from 0.916% at the close on December 31 to 1.746% at the end of March. It has since given back about 12 basis points to the close on Tuesday April 27 at 1.624%. That modest retreat in yields, reversed the three month trend higher in the US dollar. The trading correlation was nearly exact.

10-year Treasury yield

CNBC

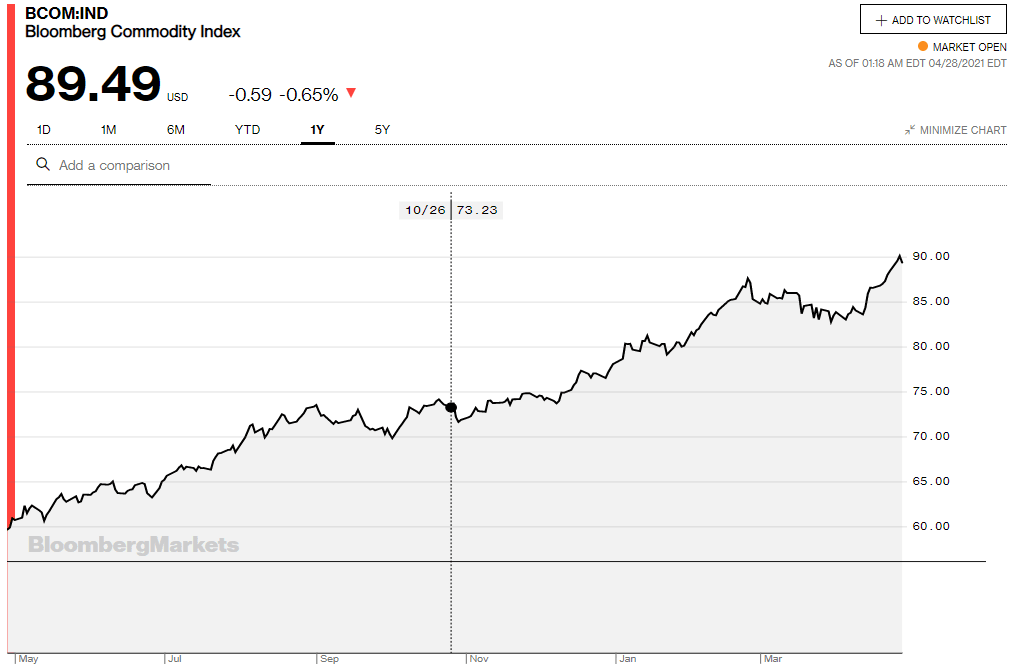

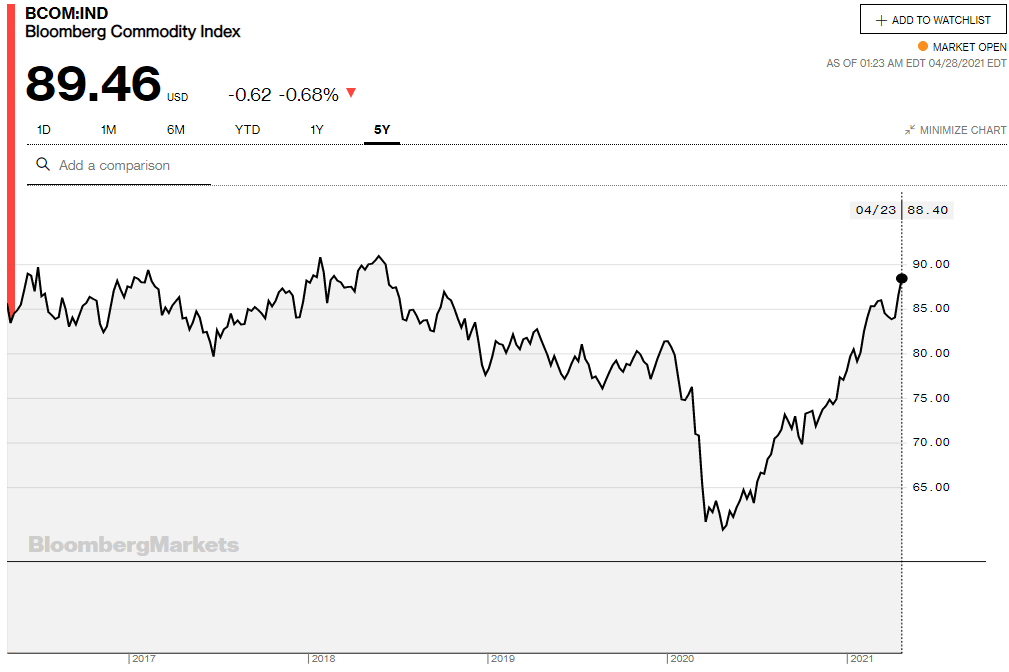

Commodity prices

A long rise in the Bloomberg Commodity Index (BCOM) from the pandemic bottom last April topped out in late February at 87.58. Commodity prices then weakened to the second week of this month with the index slipping to 83.58 on the 12th. Prices have since reversed sharply. The index closed at 89.48 on Tuesday the highest it has been since June 2018.

Conclusion

The Fed is right that the major part of the recent inflation increase is due to the comparison to last year's price plunge and that the labor market with more than 8 million unemployed is far from healed.

That does not mean that the traditional unemployment restraint on inflation is functional.

Standard economic correlations between inflation and unemployment have proven less than accurate since the financial crisis.

After the 2008-2009 recession, quantitative easing was thought certain to bring on inflation in the classic monetary formulation of vastly greater cash chasing a relatively fixed number of goods. In reality, inflation never arrived and lagged the Fed's own predictions for almost the entire decade. The missing item was consumer demand.

Retails sales soared 9.8% in March, the second outsize gain in the quarter after 7.6% in January. Stimulus funds from Washington, $600 and then $1400, gave families extra cash to spend, but the recovery of the labor market was the background that gave consumers the confidence to return to the stores.

Current economic conditions are likely giving the governors pause. Despite their public assurances that inflation is not a problem the economic situation is unique and does not inspirel confidence in prediction.

The list of inflation precursors is long.

Federal deficits have run well over a trillion dollars a year with pandemic relief alone clocking in at somewhere north of four trillion. And that is without the additional two trillion from an infrastructure plan.

Commodity prices have risen fast and shortages, distribution problems and demand may prompt further gains.

Economic growth in the US is predicted to be the strongest this year in over three decades, with consumer demand expected to lead the recovery. Given the resource and supply dislocations from the lockdowns, production delays could well lead to consumer goods shortages, adding to price pressures.

Although the overall labor market is far from reconstituted, the disparity between the production and services sectors is pronounced. Labor shortages in many areas have begun to appear. While there may be a surplus of waiters and retail clerks in urban areas, many positions are going begging elsewhere in the country. If this persists employers will be forced to raise wages to secure workers.

The combination of rising consumer demand, higher commodity prices and potentially higher wages operating on the enormous liquidity provided by the Federal rescue and stimulus plans, may have set the stage for a sustained bout of inflation.

While Federal Reserve rate projections expect the fed funds rate to be unchanged until the end of 2023, Treasury yields and the market rates that key on them, are a different matter.

The 10-year Treasury return, the touchstone for many longer term commercial rates, has climbed about 70 basis points this year. The Fed has been remarkably restrained in criticism, considering that its official monetary policy is complete support until the economy and labor markets are fully healed.

In effect, the Fed has been conducting a two part interest rate policy. The short end of the yield curve has been contained by the Fed bond purchases. The return on the 2-year note has gained just 6 basis points since January, it has hardly moved in 12 months. The longer side of the curve has been allowed to float with the market. This buys the Fed insurance should inflation gain a foothold.

2-year Treasury yield

CNBC

The FOMC statement is the official and fixed fed funds policy.

Chairman Powell's description of the economy and his answers to press questions reference the bond purchase program and market rates. At the slightest hint from the Chairman that the Fed may reduce its buying, Treasury yields and the dollar will fly.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.