US: February jobs and the trends ahead

The jobs report underlines the story that the US economy was in a fantastic position before the coronavirus fears hit. 273,000 jobs with an 85,000 upward revision. But that won't count for much as spending slows and recession worries mount due to the economic disruption the virus is already causing.

From good to bad

Today’s jobs report covers the period from before the Covid-19 fear factor hit, so in many respects is largely irrelevant. We know the US economy started 2020 on a firm footing, but that won’t count for much as spending slows and recession worries mount due to the economic disruption the virus is already causing. Nonetheless, there are some important trends within the report that are worthy of comment.

The 273,000 increase in February payrolls coupled with the 85,000 of upward revisions to December and January just highlights what could have been a fantastic story for 2020 - a really strong labour market helping to sustain consumer spending and corporate profits. It was way ahead of expectations (175,000 was the consensus forecast) while the unemployment dropped back to just 3.5%.

Within the details, the manufacturing sector managed to post a 15,000 rise, which was remarkable given the combination of the lingering effect of the China trade battle, slower global demand and the cessation of Boeing 737 Max production having knock-on effects for suppliers across the country. With global demand set to weaken even more in response to Covid-19 and disrupted supply chains further complicating the picture, manufacturing jobs losses unfortunately look set to return.

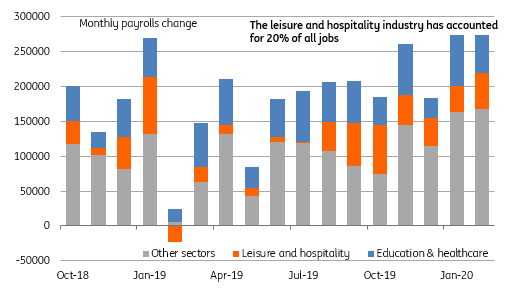

The leisure and hospitality sector has been one of the success stories over the past year and a half. Around 11% of the workforce are employed in this sector, but it has accounted for more than 17% of all the jobs created since October 2018. This is a sector that is likely going to suffer more than most as households and businesses take precautions to try and avoid contracting the virus – not going to restaurants and bars, hotel stays, cinemas, museums and sports venues, etc.

US monthly payrolls growth by sector (000s)

Source: Bloomberg, ING

Tougher times ahead

The other component that has been a key driver of employment growth has been education & healthcare. Since October 2018 this has created 875,000 jobs – equivalent to 27% of the total. On the one hand, we can’t discount the possibility that schools and universities close in response to the crisis, such as we have seen most recently in Japan and Italy, which risks resulting in weaker employment numbers. However, this is likely to be more than offset by rising employment in healthcare services as authorities try to get a grip on the crisis.

With airlines reporting sharp falls in bookings and announcing flight cutbacks the transportation sector is set to see employment growth stall while weaker trade flows may hit the warehousing component. Then, in general, if we do see a slowdown in demand employment growth more broadly looks set to slow.

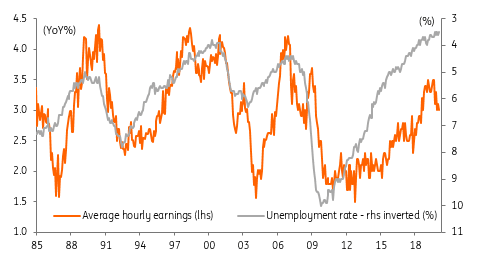

US wage growth versus unemployment rate

Source: Bloomberg, ING

No inflation threat

Certainly, we should be expecting to see a drop in hours worked in coming months and the weakness in demand for labour is likely to further limit the upside potential for wage growth even when considering low unemployment and the potential for work absenteeism relating to illness. Wage growth was already heading in the wrong direction (it slipped to 3% year on year), underlining the lack of inflation pressures in the economy.

Where does monetary policy go now?

Given this backdrop the Federal Reserve will be under pressure to support the economy with more rate cuts and we look for at least another 50bp from current levels, but the risk skew has to be towards the Fed doing even more. It won’t stimulate a turnaround in demand – only better news on the prognosis for the virus can do that – but it may help to mitigate strains within the financial system. Given today’s market moves we could be down to zero on the Fed funds rate within weeks and the prospect of QE will be firmly on the table.

Read the original analysis: US: February jobs and the trends ahead

Author

James Knightley

ING Economic and Financial Analysis

James Knightley is the Chief International Economist in London. He joined the firm in 1998 and has been covering G7 and Western European economies. He studied economics at Durham University, UK.