US February CPI Preview: Will hot inflation force Fed’s hand?

- Annual CPI inflation in US is expected to rise to new multi-decade highs in February.

- Fed grows increasingly concerned about inflation outlook amid Russia-Ukraine war.

- Dollar's market valuation is likely to be driven by risk mood in near term.

The greenback has been gathering strength since the beginning of the Russia-Ukraine war despite plunging US Treasury bond yields, suggesting that the currency’s valuation has been driven by risk-aversion rather than the Federal Reserve’s policy outlook. The US Dollar Index rose more than 2% in the first week of March and reached its strongest level since May 2020 above 99.00.

The latest remarks from Fed officials confirmed that the central bank will hike its policy rate by 25 basis points (bps) at the March policy meeting. Investors see little to no chance of a 50 bps hike next week but Thursday's inflation report could force the Fed’s hand. Cleveland Fed President Loretta Mester told CNBC last week that the primary task for the Fed was to remove accommodation at a pace necessary to bring inflation down. “There is potential for a large rise in energy prices and supply chain issues continuing for longer,” Mester further noted and warned that there was now a stronger chance of high inflation getting embedded in the US.

Annual inflation in the US, as measured by the Consumer Price Index (CPI), is expected to rise to a fresh multi-decade high of 7.9% in February from 7.5% in January. Core CPI, which excludes volatile energy and food prices, is forecast to climb to 6.4% from 6%.

It’s worth noting that the CPI report will not reflect the increase witnessed in crude oil prices in March. In February, the price for a barrel of West Texas Intermediate (WTI) rose nearly 8% and it’s already up 27% in March. Additionally, US President Joe Biden announced on Tuesday that they will ban all Russian imports of oil, gas and energy. “There will be a cost for these measures in the US,” Biden acknowledged but noted that both the Republicans and Democrats agree that they had to do this.

In the meantime, the data published by the US Bureau of Labor Statistics revealed earlier in the month that Nonfarm Payrolls rose by 678,000 in February. This print surpassed the market expectation of 400,000 by a wide margin, confirming the Fed’s view that they need to remain focused on inflation rather than improving labor market conditions.

Market implications

Markets already expect inflation in the US to continue to rise in February. A stronger-than-forecast CPI print should help the dollar continue to outperform its rivals even if it doesn’t translate into a 50 bps rate hike in March. The Fed could always go for a 25 bps hike to avoid triggering a significant market reaction but suggest that they could consider a double-dose rate increase moving forward. While testifying before the US House Financial Services Committee on March 3rd, Powell said that they would be prepared to raise the rate by 50 bps increments if inflation were to persist for longer than they expected.

On the flip side, a dollar-negative reaction to a soft inflation print is likely to remain short-lived due to the fact that it will not include March’s increase in energy prices.

It needs to be mentioned that until next week’s FOMC meeting, changes in risk perception are likely to have a more significant impact on the dollar’s valuation than any macroeconomic data. If geopolitical tensions ease on renewed optimism for a diplomatic solution to the Russia-Ukraine conflict, the greenback could struggle to find demand regardless of the inflation report and vice versa.

US Dollar Index (DXY) technical outlook

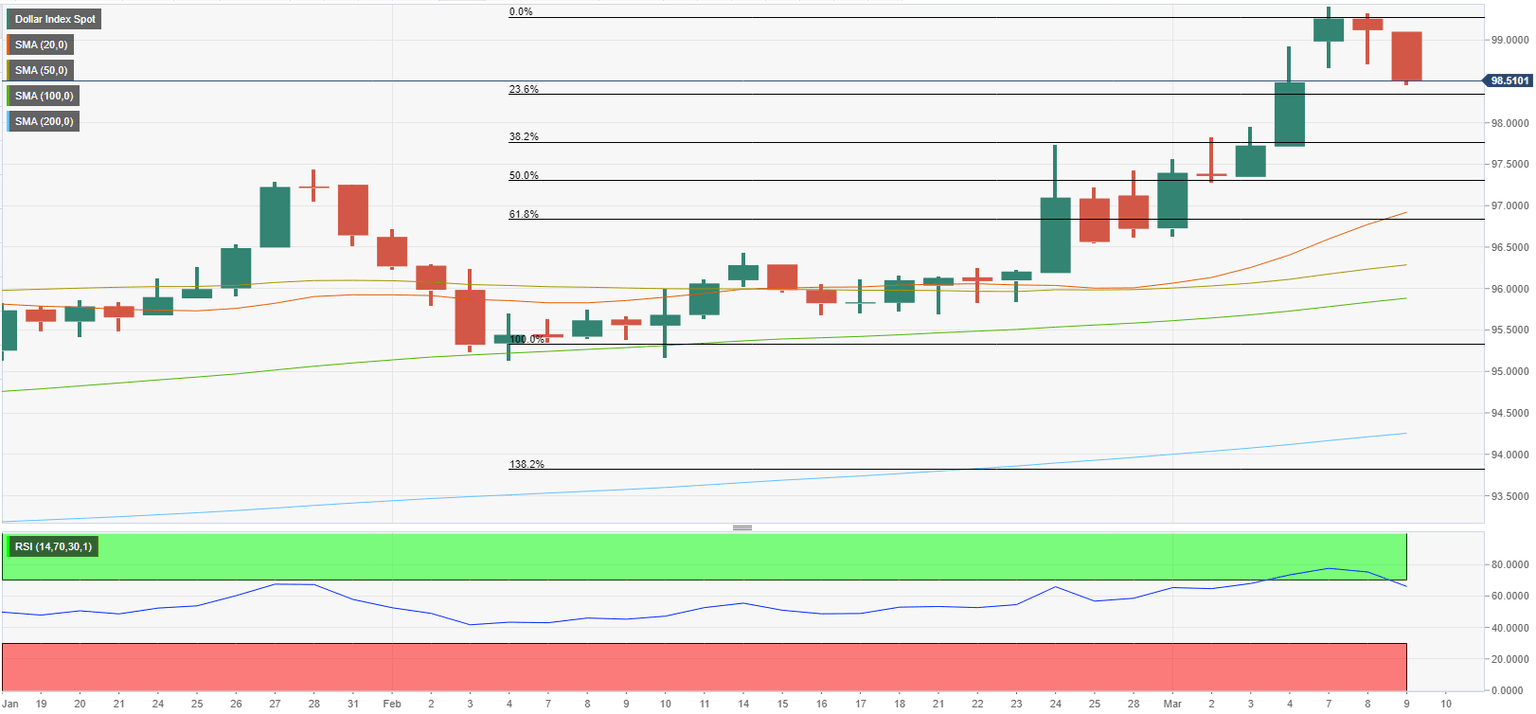

The technical picture suggests that the DXY has gone into a consolidation phase following the sharp upsurge that started in early February. The Relative Strength Index (RSI) indicator on the daily chart is below 70 for the first time in a week, suggesting that the recent decline is a technical correction rather than a reversal.

A daily close below 98.30 (Fibonacci 23.6% retracement) could open the door for an extended correction toward 97.75 (Fibonacci 38.2% retracement) and 97.25 (Fibonacci 50% retracement) afterwards.

On the other hand, the index is likely to face resistances at 99.00 (psychological level) and 99.40 (22-month high set on March 7) before it can target 100.00 (psychological level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.