Key points

The confusion: The US economy is showing mixed signals, keeping markets guessing whether it is headed for a soft landing or a recession.

Sahm rule debate: The jump in July unemployment rate has triggered a classic recession indicator called the Sahm rule. However, the higher unemployment rate is potentially driven by increased worker supply rather than lower demand for workers.

Duality of the consumer: Consumption data has also been mixed, with retail sales still solid, but household debt is going up.

Caution, not concern: Overall, cracks in the US economy are widening, but they don’t appear to be alarming yet. Still, economic conditions can deteriorate quickly from here and investors should stay informed and flexible in their strategies.

The response: Those with a high portfolio beta relative to the market, but worried about a recession, may consider exposures to low-volatility and high-quality stocks or overweighting bonds. Those who think that recession concerns are overblown could consider adding exposure to undervalued cyclical stocks, emerging markets or commodities.

As the US economy navigates through the complex landscape of post-pandemic recovery, high interest rates and ongoing geopolitical tensions, investors are closely watching for signals that could indicate whether the economy will experience a soft landing or a recession (hard landing). This is the biggest market debate right now, and understanding these scenarios and how to position investment strategies accordingly is crucial for mitigating risks and capitalizing on opportunities.

What is a soft landing?

A soft landing occurs when an economy slows down from a rapid growth phase to a more sustainable pace without falling into a recession. It is characterized by moderate economic growth, manageable inflation, and relatively stable employment levels. In this scenario, the Federal Reserve (Fed) typically adjusts monetary policy to ensure that inflation is controlled while supporting economic stability. A soft landing also means a decline in market volatility, which can be beneficial for investors.

What is a hard landing?

A hard landing refers to a sharp and sudden economic slowdown that typically results in a recession. This scenario is marked by significant declines in economic activity, rising unemployment, and possibly deflation. A hard landing can be triggered by aggressive monetary tightening, a financial crisis, or severe external shocks.

According to the National Bureau of Economic Research (NBER), a recession is "a significant decline in economic activity that is spread across the economy and lasts more than a few months." This decline is visible in indicators such as real GDP, real income, employment, industrial production, and wholesale-retail sales. Recessions are marked by a sustained period of economic contraction. Unemployment rates rise, consumer spending and business investment decrease, and overall economic output declines. Typically, financial markets experience increased volatility in a hard landing.

Current macroeconomic backdrop

Investors have been cautioned by significant volatility in the equity markets over the last week. The key question on everybody’s mind is whether the US economy would be able to achieve a soft landing, or faces threat of a hard landing pushing it to a recessionary scenario. The US macro backdrop remains mixed, much like a two-lane economy. Some parts of the economy continue to be resilient, while others are feeling the pain from the high interest rates.

This continues to make the market narrative split, with some calling for an intermeeting cut from the Fed or a 50bps rate cut in September, while others are calmer and looking for the Fed to move slower in this cycle amid resurgent inflation concerns.

The Sahm rule debate

Certain classic recession indicators are emerging. The labor data report from August 2 was one of the key triggers for the meltdown in markets. It showed unemployment rate jumping to 4.3%, the highest since 2021, and triggering the Sahm rule. This rule is triggered when the 3-month average US unemployment rate is up more than 0.5% from its low over the previous 12 months. This indicator has correctly identified every recession since WWII. This is because there is a powerful feedback loop here, which suggests that small increases in the unemployment rate can turn into large ones. Workers without paycheck weigh on consumer demand, leading to more workers without paycheck.

But does that mean that the US economy is now entering a recession? Claudia Sahm, the creator of the Sahm rule, has herself said that the US is not in a recession despite the indicator bearing her name suggesting so.

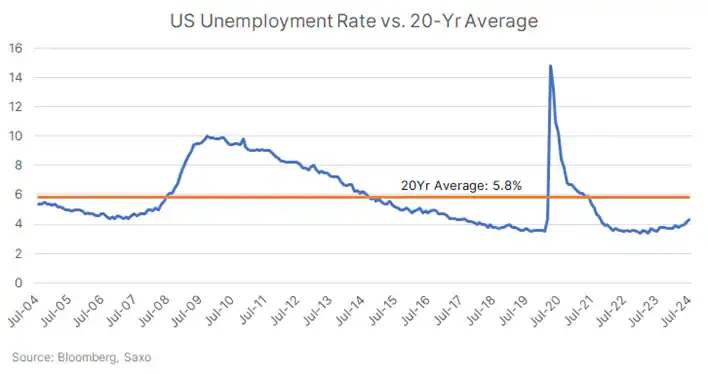

Most of the indicators that the NBER tracks for a recession continue to look solid. Real consumer spending in the second quarter rose at 2.6%, and monthly payroll gains have averaged 170k in the last three months. Even the jump in unemployment rate that triggered the Sahm rule may not be alarming to some, given the unemployment rate has averaged at 5.8% in the last 20 years. But some others would argue that the absolute rate of unemployment matters less than the pace of change and the US economy entered a recession in 1969-70 with 3.5% unemployment rate.

Also, the increase in unemployment rate to 4.3% in July, which triggered the Sahm rule, may have been distorted by the pandemic and is particularly a result of surge in immigration. This makes the rise in unemployment rate due to an increase in supply of workers rather than the decrease in demand of workers that usually triggers a recession. The increased immigrant population can, on the other hand, propel economic growth via consumption. This could eventually bring an increase in the number of jobs, putting downward pressure on the unemployment rate.

Mixed signals on the US economy

Other labor market indicators such as job openings, quits rate or initial and continuing jobless claims have also been signalling a slowdown. There are also other indicators suggesting some stress on the economy include household and credit card debt. Data from the Federal Reserve Bank of New York showed total household debt increased by over 1% in Q1 as households ran out of pandemic-era savings. But on the positive side, wage increases are outpacing inflation. Retail sales remained solid in June, with online store sales rising almost 2% month-over-month and spending at food and drink establishments showing modest growth.

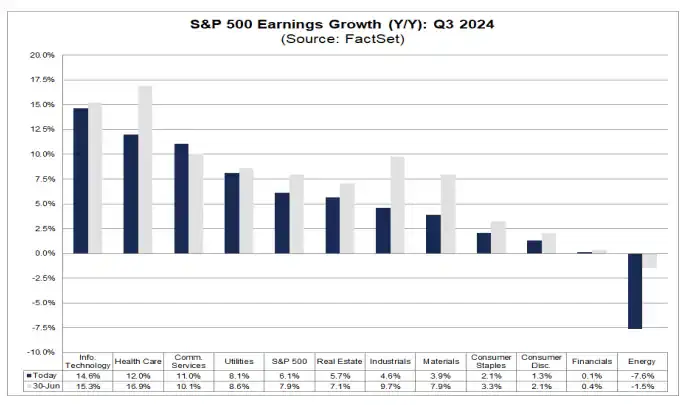

The US corporate earnings season has also been a mixed bag. As on August 2, 75% of the companies in the S&P 500 have reported actual results for Q2 2024. FactSet reported that 59% of S&P 500 companies have reported actual revenues above estimates, which is below the 5-year average of 69% and below the 10-year average of 64%. But on the other, 78% have reported better-than-predicted earnings-per-share (EPS) figures, and that’s above the 10-year average of 74%. Meanwhile, guidance cuts have picked up. Overall, the earnings season has not provided the enthusiasm that the equity markets had priced in after a strong run higher year-to-date.

This duality reflects a robust spending environment among wealthier Americans who have the capacity to maintain their spending habits, contrasted with growing financial strain in other segments.

So, What is the state of the US economy?

Zooming out, there are evident cracks in the US economy, but these are not yet alarming. Investors need to closely monitor economic data to see if further slowdowns in spending, employment or income could spark recession concerns further, while also remaining on alert for external shocks from geopolitics or tight financial conditions.

These factors will determine whether the US economy can achieve the coveted soft landing or faces steeper recession risks. This will also have an impact on how quickly the Fed moves in its easing cycle.

Investor positioning – Soft vs hard landing scenarios

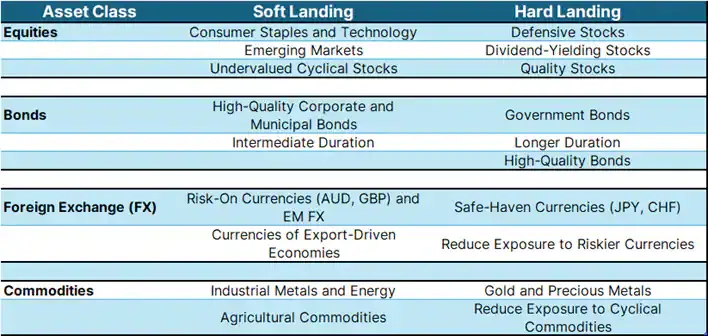

This split market narrative can make it rather difficult for investors to position themselves. The prudent next step could be to assess the beta of your portfolio relative to the market. If your portfolio outperforms the market on up days, and underperforms the market on down days, then that is signal that the portfolio has a relatively higher beta than the market.

Now, if you think that a recession is incoming, then it may be prudent to reduce the beta of your portfolio to hedge against the risk of falling markets. This can be achieved by introducing exposures to factors like low-volatility and high-quality stocks or overweighting bonds that tend to outperform in declining markets.

However, if you think that the markets are unduly worried about a recession and have over-priced one, then it may be prudent to consider increasing the beat of your portfolio by adding exposure to undervalued cyclical stocks, emerging markets or commodities.

Below we outline strategies for both soft and hard landing scenarios:

Soft landing

Equities

-

Consumer staples and technology: Sectors that can benefit from continued consumer spending and technological advancements.

-

Emerging markets: Potential for higher growth due to global economic stability.

-

Undervalued cyclical stocks: Stocks that may rebound as the economy stabilizes and grows.

Bonds

-

High-quality corporate and municipal bonds: These bonds offer stability and decent returns as the economy grows moderately.

-

Intermediate duration: Balancing interest rate risk and return potential.

Foreign Exchange (FX):

-

Risk-on currencies: Currencies like AUD and GBP could benefit from global economic stability.

-

Emerging market FX: The US dollar could face some pressure in a soft landing while a resilient growth can help EM FX.

-

Currencies of export-driven economies: These currencies might perform well as global trade stabilizes.

Commodities:

-

Industrial metals and energy: Demand for these commodities could rise with sustained economic activity.

-

Agricultural commodities: Steady demand and potential for growth with economic stability, but weather patterns can influence the supply dynamics.

Hard landing

-

Defensive Stocks: Sectors such as consumer staples, healthcare and utilities, which are less sensitive to economic cycles.

-

Dividend-Yielding Stocks: Companies with a strong track record of paying dividends provide income and stability.

-

Quality Stocks: Companies with healthy cash flows and low debt levels tend to weather downturns better.

Bonds

-

Government Bonds: Safe-haven assets that offer security during economic downturns.

-

Longer Duration: Benefiting from falling interest rates during recessions.

-

High-Quality Bonds: Investment-grade bonds that offer stability and lower risk.

Foreign Exchange (FX)

-

Safe-haven currencies: JPY and CHF are likely to appreciate during economic uncertainty.

-

Reduce exposure to riskier currencies: Minimizing risk in volatile markets.

Commodities

-

Gold and precious metals: Safe-haven assets that retain value during economic instability, but broader market liquidation can impact all assets including safe-havens.

-

Reduce exposure to cyclical commodities: Lowering risk associated with demand-sensitive commodities such as copper.

Source: Saxo

Read the original analysis: US economy: Soft landing hopes vs hard landing fears

The Saxo Bank Group entities each provide execution-only service and access to Analysis permitting a person to view and/or use content available on or via the website. This content is not intended to and does not change or expand on the execution-only service. Such access and use are at all times subject to (i) The Terms of Use; (ii) Full Disclaimer; (iii) The Risk Warning; (iv) the Rules of Engagement and (v) Notices applying to Saxo News & Research and/or its content in addition (where relevant) to the terms governing the use of hyperlinks on the website of a member of the Saxo Bank Group by which access to Saxo News & Research is gained. Such content is therefore provided as no more than information. In particular no advice is intended to be provided or to be relied on as provided nor endorsed by any Saxo Bank Group entity; nor is it to be construed as solicitation or an incentive provided to subscribe for or sell or purchase any financial instrument. All trading or investments you make must be pursuant to your own unprompted and informed self-directed decision. As such no Saxo Bank Group entity will have or be liable for any losses that you may sustain as a result of any investment decision made in reliance on information which is available on Saxo News & Research or as a result of the use of the Saxo News & Research. Orders given and trades effected are deemed intended to be given or effected for the account of the customer with the Saxo Bank Group entity operating in the jurisdiction in which the customer resides and/or with whom the customer opened and maintains his/her trading account. Saxo News & Research does not contain (and should not be construed as containing) financial, investment, tax or trading advice or advice of any sort offered, recommended or endorsed by Saxo Bank Group and should not be construed as a record of our trading prices, or as an offer, incentive or solicitation for the subscription, sale or purchase in any financial instrument. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, would be considered as a marketing communication under relevant laws.

Recommended Content

Editors’ Picks

EUR/USD stabilizes above 1.1350 on Easter Friday

EUR/USD enters a consolidation phase above 1.1350 on Friday as the trading action remains subdued, with major markets remaining closed in observance of the Easter Holiday. On Thursday, the European Central Bank (ECB) announced it cut key rates by 25 bps, as expected.

GBP/USD fluctuates below 1.3300, looks to post weekly gains

After setting a new multi-month high near 1.3300 earlier in the week, GBP/USD trades in a narrow band at around 1.32700 on Friday and remains on track to end the week in positive territory. Markets turn quiet on Friday as trading conditions thin out on Easter Holiday.

Gold ends week with impressive gains above $3,300

Gold retreated slightly from the all-time high it touched at $3,357 early Thursday but still gained more than 2% for the week after settling at $3,327. The uncertainty surrounding US-China trade relations caused markets to adopt a cautious stance, boosting safe-haven demand for Gold.

How SEC-Ripple case and ETF prospects could shape XRP’s future

Ripple consolidated above the pivotal $2.00 level while trading at $2.05 at the time of writing on Friday, reflecting neutral sentiment across the crypto market.

Future-proofing portfolios: A playbook for tariff and recession risks

It does seem like we will be talking tariffs for a while. And if tariffs stay — in some shape or form — even after negotiations, we’ll likely be talking about recession too. Higher input costs, persistent inflation, and tighter monetary policy are already weighing on global growth.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.