US economy ends 2024 in solid position

Summary

The US economy expanded at a 2.3% annualized rate in Q4. Growth was held back by a slower stockpiling in inventories, but boosted by solid consumer spending, both of which may partially reflect a pull forward in demand ahead of potential tariffs. The economy entered the year with momentum, but tariff risks loom.

Inventories hold back Q4 GDP

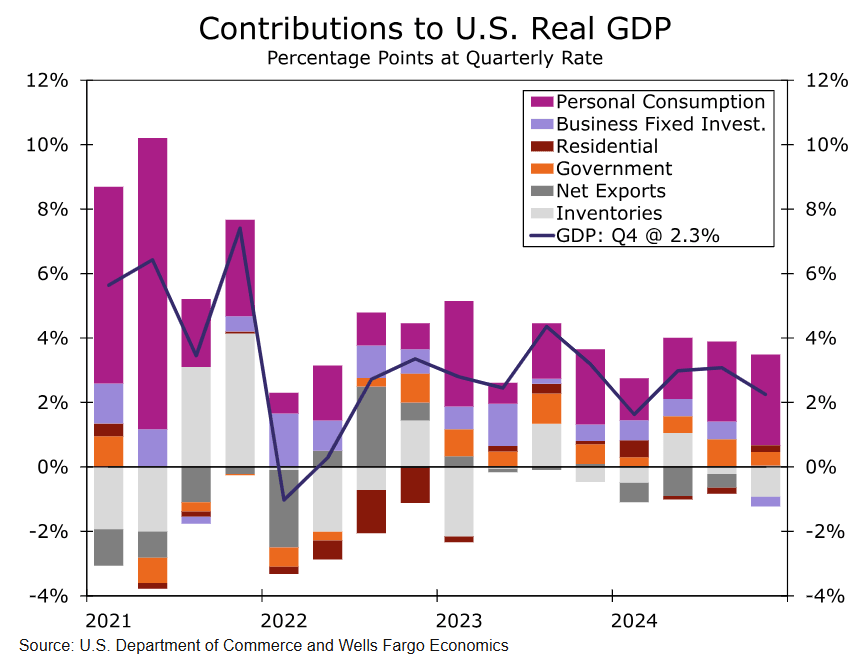

The U.S. economy expanded at a 2.3% annualized rate in the fourth quarter—that's a step down from the post-pandemic average (3.2%) but roughly in line with the average quarterly rate that prevailed in the last expansion that stretched from 2010-19 (2.4%). Further economic growth held up better than the Q4 growth rate implies as a slower stockpiling in inventories dramatically dented on output. Inventories alone sliced 0.9 percentage points off of headline GDP growth in the fourth quarter (chart), which we expect partially reflects a pull forward in demand amid concerns over tariffs toward the tail-end of last year.

We had been bracing for the drag on growth to come from both inventories and net exports after data yesterday showed weakness. Specifically, retail and wholesale inventory data fell in December and the advance goods trade balance showed a large widening in the deficit due to a surge in industrial supplies imports, likely reflecting a stockpiling of inputs amid importers. In reality, this morning's data reveal net exports were a neutral force on GDP growth and goods imports fell at a 4.0% annualized rate during the quarter. This feels abnormally at odds with the monthly data, suggesting we may see upward revisions to imports and thus downward revisions to growth in the second and third estimate of GDP growth.

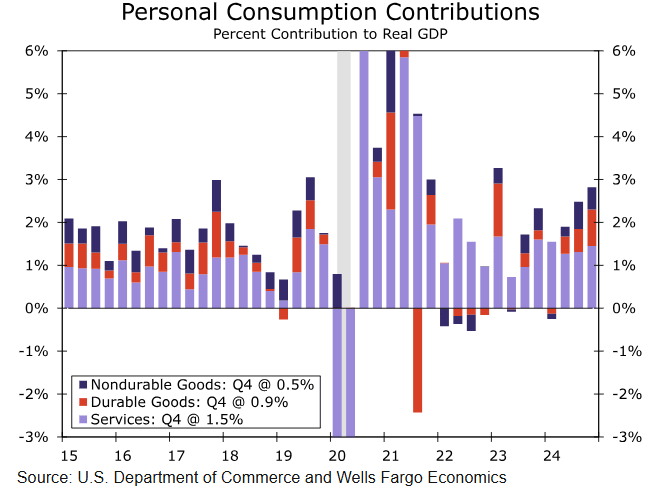

Even so, we don't expect the year-end narrative to change. While we anticipate businesses are looking to stock up ahead of potential tariffs, it appears they weren't able to do so fast enough in Q4 as real private inventories rose by just $4.4 billion. Recent consumer confidence and sentiment surveys have signaled a rise in consumer inflation expectations amid tariff concerns and consumers increasingly looking to make purchases in advance of potential price hikes. What looks to be a partial pull forward in demand among consumers led to a robust 4.2% annualized pace of consumer spending in the final quarter of the year. Underlying spending was strong across categories, but real spending on durables led the charge advancing at a 12.1% annualized clip (chart).

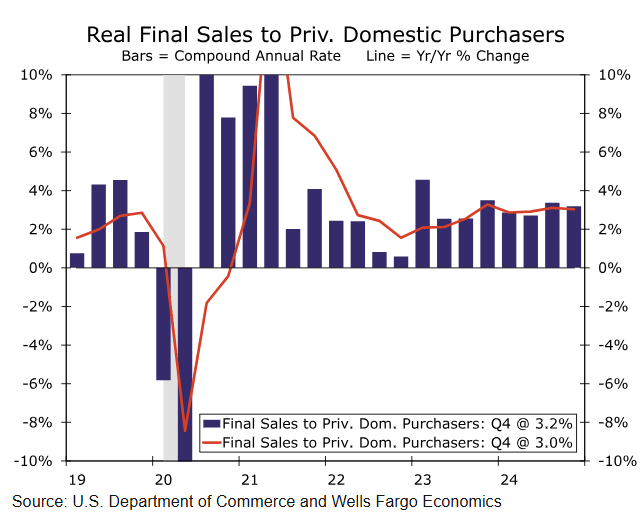

Business spending was mixed, and we're unable to untangle much sign of tariff-impact. Real equipment outlays slipped 7.8%, and while the expected large aircraft-related drop in transportation equipment due to strikes at Boeing is mostly to blame, other key areas like spending on information processing equipment were weaker than expected. Spending on intellectual property products advanced 2.6%, a continued bright spot in a flagging capex environment, while structures pulled back a modest 1.1%. Elsewhere, residential investment spending rose 5.3% and government investment was up 2.5%. Cutting through the noise, underlying domestic demand was still quite strong—real final sales to private domestic purchasers rose 3.2%—signaling the U.S. economy ended 2024 in a sturdy position (chart).

For the year as a whole, the U.S. economy expanded at a 2.8% average annual rate, just below the 2023 pace. Overall we still look for the U.S. economy to expand close to a 2% annual rate this year, though we see some slowdown in the second half. The Q4 data remind us it's not just actual policy, but the prospect of such policies that can dictate economic behavior. To the extent year-end volatility is tariff related, we'd expect to see similar forces at play in the first quarter among continued tariff threats. But any tariff pull-forward will eventually be met with a lull in demand. Further, while the macro impact from tariffs depend on the size and scope of tariffs implemented, and a stronger dollar and elevated profit margins can help mitigate some of the cost impact, tariffs will likely weigh on growth and boost inflation to some extent this year.

Author

Wells Fargo Research Team

Wells Fargo