US Durable Goods Orders Preview: Will the part reflect the retail whole?

- Durable Goods Orders are forecast to expand 0.5% in September.

- Retail Sales and the Control Group were much stronger than expected last month.

- US dollar risk parameters will not change from Durable Goods.

September's strong Retail Sales figures suggest a similar performance will be registered by orders for long-lasting consumer and business goods.

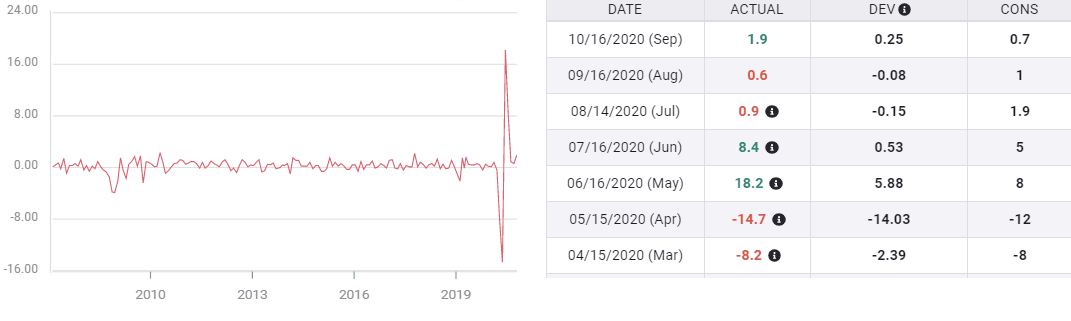

Durable Goods Orders, a subset of the larger retail category, are expected to rise 0.5% in September following August's 0.5% increase. Nondefense Capital Goods Orders, an analog for business investment, is forecast to climb 0.5% after August's 1.9% gain. Durable Goods Orders outside of the transportation sector are predicted to rise 0.4% after the 0.6% increase in the prior month and orders ex-Defense, that is without Pentagon procurement, are projected to increase 0.2% after a 0.9% gain in September.

Pandemic recovery, Durable Goods and Retail Sales

The rebound of orders for Durable Goods, items designed to last three years and more in normal use, has just covered its lockdown collapse. Overall goods orders fell 35% in March and April as the economy was ordered closed by state and local governments. In the subsequent four months orders have returned 34.8%. Orders are essentially flat from March to August.

Durable Goods

Business orders in the Nondefense Capital Goods category fared a bit better, falling 7.9% in the early pandemic and recovering 10.2% from May through August. The gain of 2.1% for the half-year is an uninspired 0.35% monthly.

In comparison Retail Sales have had a much more robust and immediate recovery.

After plunging 22.9% in the two lockdown months, sales have zoomed back 30% in the five months of May through September. Averaged across all seven months Retail Sales increased 1.01% each or 7.1% for the period.

Retail Sales

The Control Group's spending was even stronger in the recovery. Receipts declined 12.4% in April after rising 3.2% in March. From May through August they rose 18.1% or a surprising 1.27% monthly, 8.9% in total for the seven-month period

In any normal economy such figures would be considered evidence of a healthy consumer and a secure job market. In the current pandemic times they are remarkable.

Retail Sales in September

Retail Sales were much stronger in September than the consensus forecast. Overall sales jumped 1.9%, nearly thrice the 0.7% prediction. The GDP component Control Group soared 1.4%, seven times its 0.2% projection. The Retail Sales ex-Autos category increased 1.5%, also three times its 0.5% estimate.

In estimating the September Retail Sales results analysts were logically projecting the impact of the sharp slowdown in Nonfarm Payrolls to 661,000 from 1.489 million in August and the still high number of weekly layoffs as reasons for the minimal projected increase in consumption.

Logic is one thing but the American consumer is another.

Conclusion and the dollar

Durables may be set to out perform in September.

There is pragmatism to the idea that as the lockdowns ended consumers first attended to their immediate needs buying food, clothing, general goods and supplies before turning to the larger and more expensive items of the Durable Goods category.

Considering the strong performance of the two retail groups in the pandemic with increases of 1.01% and 1.27% monthly and contrasting those with the uninspired results from the two main goods categories through August, overall Durable Goods flat, and Nondefense Capital Goods up 0.35% per month, it may be past time for consumers to catch up on their purchases of washing machines, computers, cubicles and other such largely discretionary items. That is certainly what the Retail Sales figures would seem to predict.

For the markets the Durable Goods numbers are old news, their economic information is contained in the Retail Sales figures from almost two weeks ago. No impact should be expected on the dollar, equities, gold or Treasuries.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.