US Durable Goods Orders May Preview: Is the consumer really absent?

- Durable Goods Orders expected to revive in May .

- Retail Sales fell in May in all three categories.

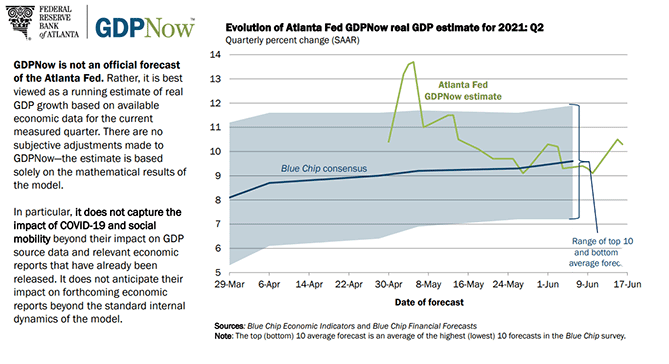

- Second quarter GDP estimate is at 10.3% annualized.

- Markets will note but not trade on Durable Goods.

The US economy is in the unusual position of anticipating excellent second quarter economic growth absent a sustained expansion in its largest single component, consumer spending.

Retail Sales are negative for April and May, the first two months of the second quarter, according to the categories tracked by the US Census Bureau. The latest GDPNow reading (June 16) from the Atlanta Fed has annualized growth at 10.3%. Consumer spending accounts for about 70% of US economic activity and it is hard to reconcile anemic or falling consumption with robust growth.

Durable Goods Orders, the long duration sub-set of Retail Sales, are expected to increase 2.7% in May, after shrinking 1.3% in April. Goods Orders excluding the transportation sector are forecast to rise 0.7%, following a 1% gain in April. Nondefense Capital Goods Orders ex-Aircraft, a business investment proxy, is predicted to add 0.8% in May, after rising 2.2% in April.

Durable Goods

Retail Sales

Overall Retail Sales declined 1.3% in May, considerably more than -0.8% forecast. The Control Group, which approximates the consumption component of the government’s GDP calculation, dropped 0.7% in May, on par with its -0.6% forecast. The ex-autos category fell 0.7% in May, well below its 0.2% forecast.

Retail Sales

FXStreet

Two considerations about Retail Sales in the second quarter stand out.

First, all three groups are negative for the two extant months. Overall sales are down 0.4% (May-1.3%, April 0.9%). The Control Group is down -1.1%, (May -0.7%, April -0.4%) and the ex-autos series is down 0.7% (May-0.7%, April 0.0%). It is the May results in overall sales and ex-autos that brings the two-month totals below zero.

Second, all three categories saw substantial upward revision to the April numbers. The average positive adjustment across the three groups in April was 0.93%,

Overall sales for April jumped to 0.9% from its initial flat release. The forecast had been 1%. The Control Group climbed from -1.5% to -0.4%. Its estimate was -0.2%. The ex-autos grouping, rose from -0.8% to flat, making it the only one appreciable below its forecast of 0.7%.

Retail Sales Data

Statisticians and economists have had a difficult time modeling the events of the past 18 months.

Given the strength and consistency of the Atlanta Fed GDPNow forecast, the lowest of the 15 second quarter estimates has been 9.1%, there is an excellent chance that the initial May figures for Retail Sales will be revised substantially higher.

Durable Goods and Retail Sales

Durable Goods are a subset of Retail Sales for items designed to last three years or more in normal use. Automobiles, refrigerators, hair dryers, computers and nuclear power plants all qualify as consumer or industrial goods.

Due to their lifespan and usually higher cost, these purchases are considered a view into the medium and long term outlook for businesses and consumers. A plant manager is more likely to buy new machinery, or a family a new car when the sales and job prospects are good.

How do we justify the projections for a sizable increase in Durable Goods purchases in May, 2.7%, with the 1.3% decline in overall Retail Sales.

The simplest is to note that from January through April the initial Retail Sales figures have been revised higher by an average of 1.05%. A continuation of that adjustment would put the May Retail Sales near -0.25%.

Still, a quarter-point decline is far from the forecast 2.7% gain in Durable Goods.

A second consideration is the difference between the overall Durable Goods projection of 2.7% and the ex-transport estimate of 0.7%.

Automobile sales plummeted during the lockdowns of the last 15 months. Many consumers have rushed to replace their aging vehicles in the past few months, purchases made more urgent by a scarcity of many makes and brands due to the world wide computer chip shortage.

Similar logic holds for the commercial aircraft sales of Boeing Company of Chicago, whose sales have revived now that its 737 Max jet has returned to flying.

It is possible that the particular circumstances of vehicle and airplane sales in May might account for a large portion of the 2.7% forecast.

Conclusion

The specifics of American consumption patterns available in the Durable Goods Orders are not going to change market views on the US economy. The economic information is an elaboration on the already issued Retail Sales figures.

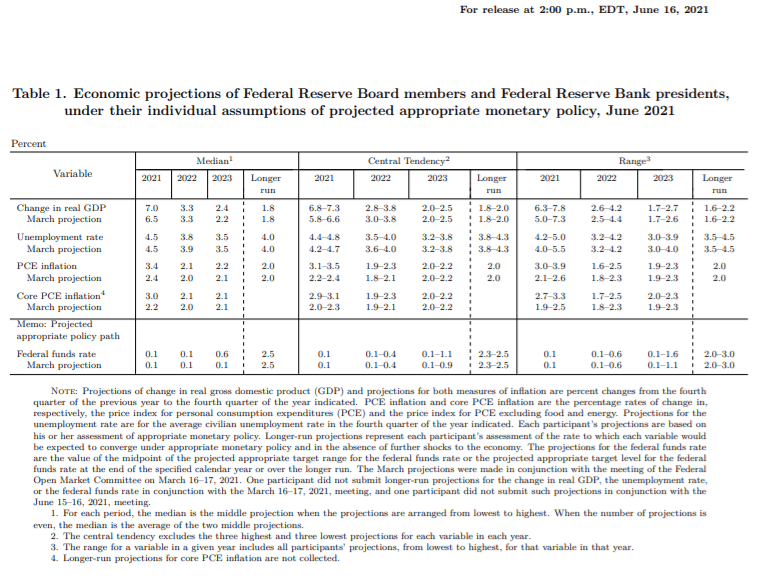

The Federal Reserve’s upward revisions of its GDP, inflation and interest rate projections last week are the standard view of the US economy.

Durable Goods will fit into that more optimistic assessment or not, but they will not impact trading in the equity, credit or currency markets.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.