US Durable Goods Orders August Preview: Retail Sales have led the way

- Goods purchases expected to rebound at 0.6% from the July drop.

- Retail Sales were much better than forecast in August.

- Sales ex-autos were strong at 1.8% in August.

- Strong good orders will keep the Fed’s taper on track and support the dollar.

The US consumer belied predictions that a slowing economy would cut into Retail Sales in August. Instead of falling 0.8% as forecast, sales jumped 0.7%. Sales outside of the production crippled auto sector were even stronger, rising 1.8% in place of the projected 0.2% decline.

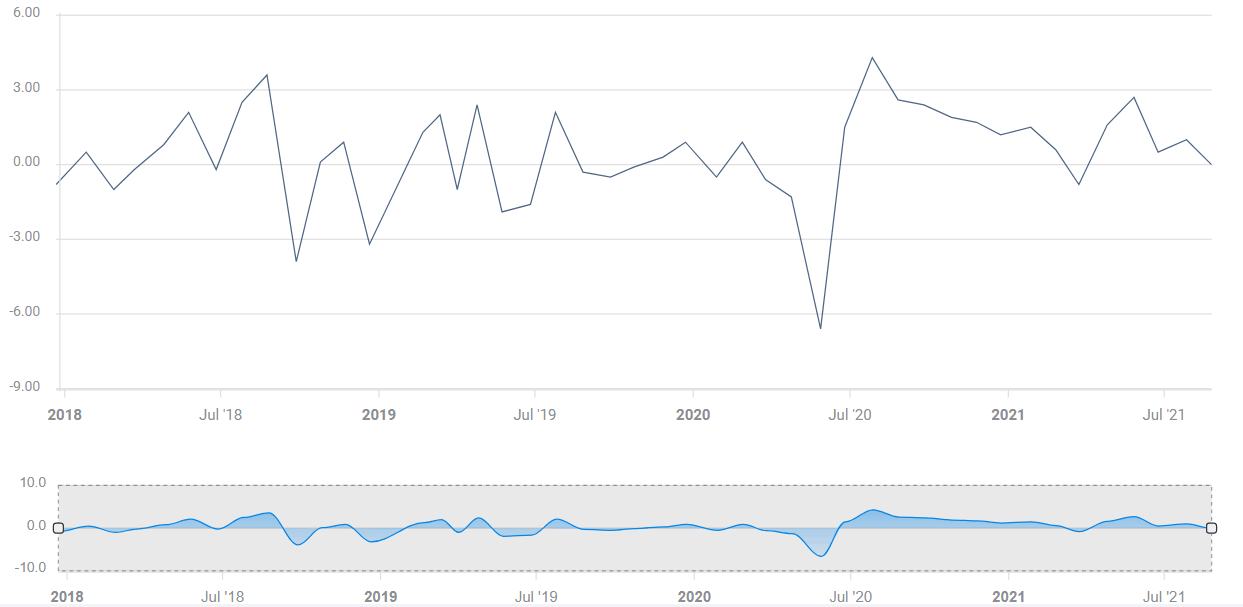

Retail Sales ex-autos

There is every reason to expect that Durable Goods Orders, the subset of sales items designed to last three years, will follow that lead.

Durable Goods Orders are predicted to rise 0.6% in August, after falling 0.1% in July. Orders ex-Transportation rose 0.8% in July and ex-Defense orders fell 1.1%. Nondefense Capital Goods Orders, the business investment analog, were flat in July.

Nondefense Capital Goods

FXStreet

GDP and the labor market

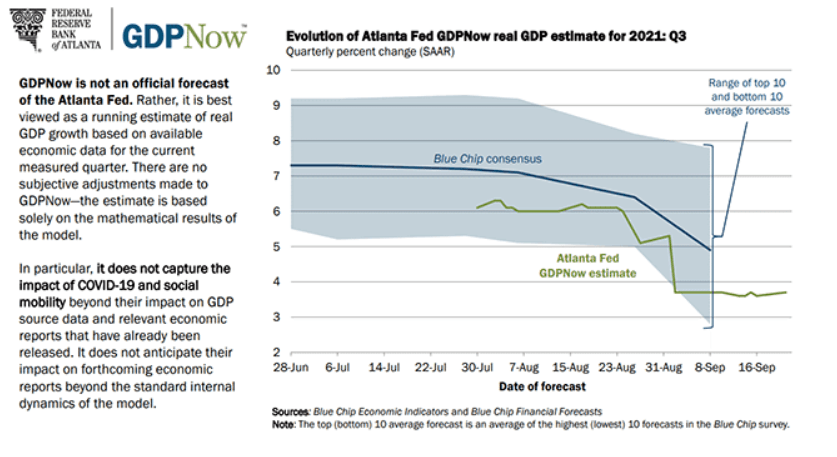

The US economy has slowed in the third quarter. From a 6.4% annualized expansion in the first half, the Atlanta Fed estimates that GDP is running at 3.7% in the third quarter.

Nonfarm Payrolls fell from one million new positions in June and July to 235,000 in August.

Combined with restarted pandemic restrictions from the delta wave in some states, the weakening job market was thought to be a logical lead into slower consumption.

Although seven million people are still unemployed from last year’s lockdowns, this backlog of reluctant workers has had little effect on Retail Sales and Durable Goods Orders.

One reason is certainly the extended and supplemented jobless benefits that the federal and some state governments have enacted. Another is the record numbers of jobs on offer, 11 million in the August Jobs Offering and Labor Turnover Survey (JOLTS). Workers in almost any field can be confident of finding employment whenever they choose to return.

Nondefense Capital Goods Orders

This category of business investment is the main market interest in Durable Goods Orders.

Business investment, along with consumer spending and government expenditures are the main categories of consumption.

Business spending on capital equipment tends to be strongest when executives are expecting increasing future sales. Investments are not only a gauge of current expenditures but a window into sales expectations.

Capital goods spending has averaged 0.8% a month this year and has helped to keep the economic expansion vibrant.

Conclusion

The Federal Reserve’s near approach to its taper moment is dependent on the continuing expansion of the US economy and labor market.

According to Fed Chair Jerome Powell, the FOMC members are agreed that the economy has met the criteria for a reduction in bond purchases to begin.

Yet, at the Wednesday meeting, the Fed chose caution rather than action.

August’s dismal job numbers are probably the chief reason for the hesitation, but the July drop in Retail Sales is likely another. A strong August Durable Goods number, especially in business spending, will help to reassure the governors that the economy is in full recovery.

Durable Goods will likely cast their vote for the taper, higher Treasury rates and a higher dollar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.