US Dollar Weekly Forecast: Focus now shifts to FOMC Minutes, Fedspeak

- The USD Index (DXY) clinched its fifth straight week of gains.

- Higher-than-estimated US CPI lent extra legs to the Greenback.

- Markets now see the Fed reducing its interest rates in June.

- Investors will now assess the upcoming FOMC Minutes.

Another positive week saw the US Dollar (USD) gather extra steam and advance to fresh 2024 peaks at levels just shy of the key 105.00 barrier when gauged by the USD Index (DXY).

The positive performance of the Greenback throughout the week was supported by increasing speculations that the Federal Reserve (Fed) might kick off its easing cycle later than anticipated by market participants.

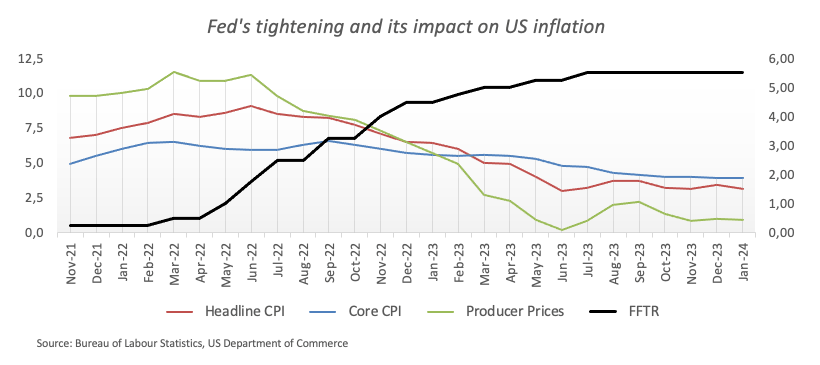

This perception was strengthened after US inflation figures measured by the US Consumer Price Index (CPI) rose more than estimated during the first month of the year. Another confirmation that disinflationary pressure could be losing momentum emerged on Friday after US Producer Prices unexpectedly rose above consensus in the same period.

The sharp increase in DXY came pari passu with the equally robust move higher in US Treasury yields, which climbed to fresh multi-week highs across different time frames in tandem with shrinking bets for a potential reduction of 25 bps in the Fed Funds Target Range (FFTR) in May.

On the latter, CME Group's FedWatch Tool sees the probability of another “on hold” decision by the Fed at the May 1 event just above 70% vs. around 50% likelihood of a rate cut in June.

On the US data front, the week was utterly dominated by the release of the US CPI for the month of January. In the macro scenario, bets around the timing of the potential first interest rate cut by the Fed also ruled the sentiment among market participants. A parallel between th

In the meantime, the increasing likeliness of a “soft landing” in the US economy (despite soft Retail Sales in January), the still tight labour market and persistent uncertainty surrounding inflation prospects continue to prop up the view of later-than-expected rate cuts by the Fed.

Somewhat soothing the above, Chicago Fed President Austan Goolsbee emphasized that even in the event of slightly higher inflation over the coming months, it would still align with the Committee’s trajectory toward the target. He also expressed disagreement with the notion of waiting until core inflation reaches 2% on a 12-month basis before considering rate cuts, advocating instead for rate adjustments to be linked to confidence in progress toward the target rate. In addition, Goolsbee characterized the current policy stance as notably restrictive, cautioning that prolonged restrictions could pose concerns regarding the employment aspect of their mandate.

DXY technical outlook

The daily chart of the DXY index shows that immediate resistance emerges around the 2024 highs near 105.00 (February 14). Once this area is cleared, there is a minor hurdle at the weekly peak of 106.00 (November 10) ahead of the November top of 107.11 (November 1).

However, if sellers take control, the immediate contention zone aligns at the 200-day SMA of 103.69 ahead of the temporary 55-day SMA at 103.14 and the weekly low of 102.77 set on January 24. A deeper pullback could see the Dollar Index embark on a potential visit to the December low of 100.61 (December 28) before the psychological 100.00 barrier and the 2023 low of 99.57 (July 14).

While above the key 200-day SMA, the outlook for the index is expected to remain constructive, opening the door to the continuation of the ongoing uptrend.

Economic Indicator

United States FOMC Minutes

FOMC stands for The Federal Open Market Committee that organizes 8 meetings in a year and reviews economic and financial conditions, determines the appropriate stance of monetary policy and assesses the risks to its long-run goals of price stability and sustainable economic growth. FOMC Minutes are released by the Board of Governors of the Federal Reserve and are a clear guide to the future US interest rate policy.

Read more.Why it matters to traders

Minutes of the Federal Open Market Committee (FOMC) is usually published three weeks after the day of the policy decision. Investors look for clues regarding the policy outlook in this publication alongside the vote split. A bullish tone is likely to provide a boost to the greenback while a dovish stance is seen as USD-negative. It needs to be noted that the market reaction to FOMC Minutes could be delayed as news outlets don’t have access to the publication before the release, unlike the FOMC’s Policy Statement.

US Dollar price today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.23% | 0.31% | 0.24% | 0.30% | 0.37% | 0.18% | 0.29% | |

| EUR | -0.20% | 0.06% | 0.05% | 0.04% | 0.13% | -0.03% | 0.05% | |

| GBP | -0.32% | -0.11% | -0.07% | -0.01% | 0.05% | -0.11% | -0.02% | |

| CAD | -0.25% | -0.02% | 0.05% | 0.06% | 0.12% | -0.07% | 0.03% | |

| AUD | -0.28% | -0.05% | 0.00% | -0.03% | 0.08% | -0.14% | 0.00% | |

| JPY | -0.35% | -0.15% | -0.06% | -0.12% | -0.05% | -0.16% | -0.04% | |

| NZD | -0.20% | 0.04% | 0.12% | 0.07% | 0.11% | 0.17% | 0.09% | |

| CHF | -0.31% | -0.06% | -0.01% | -0.02% | -0.01% | 0.07% | -0.12% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.