US Dollar Forecast: Tariffs, stagflation, trade war in centre stage

- The US Dollar Index (DXY) extended its decline to three-year lows.

- Recession and trade war fears kept the Greenback on the back foot.

- Investors now see the Fed trimming its interest rates three times in 2025.

Another horrid week saw the US Dollar (USD) trade under heavy pressure, extending its acute sell-off for the third consecutive week and dragging the US Dollar Index back below the psychological 100.00 support for the first time since April 2022.

The downturn accelerated sharply after the White House raised tariffs on US imports of Chinese goods to 145%, a move counteracted on Friday when Beijing announced it would increase levies on US products to 125%. Both announcements stirred concerns that a global trade war was already developing in the background and lent weight to the view held by many investors of an impending US economic slowdown.

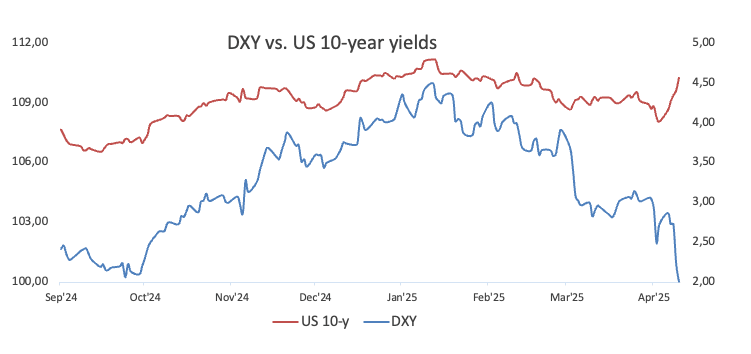

Meanwhile, the Greenback’s dramatic decline was mirrored by a pronounced rebound in US Treasury yields across multiple time frames. On this matter, a solid auction of the 10-year Note on April 9 appears to have mitigated rising concerns over the performance of the domestic debt market.

Tariff tsunami

In a dramatic shift to reshape global commerce, the United States unveiled its "Reciprocal Tariff to Rectify Trade Practices" plan on April 2, the so-called “Liberation Day”.

Under this sweeping new policy, a universal baseline tariff of 10% will be levied on all imports, with additional country-specific surcharges.

Matching some of his previous decisions and contra-decisions, just a week afterwards, on April 9, President Trump announced a 90-day pause on reciprocal tariffs aimed at non-retaliating countries. The 10% tariff baseline, however, remains untouchable for now.

However, Trump left China out of this announcement and doubled up the bet, increasing levies on Chinese goods to a staggering 145%. On Friday, Beijing said that beginning on April 12, imports of US products would pay 125% tariffs.

Tariffs serve as a double-edged sword designed both to protect domestic industries and generate government revenue.

Initially, when higher import duties are imposed, economists note that there’s typically a brief, one-off spike in consumer prices—a shock that isn’t expected to prompt an immediate response from the Federal Reserve (Fed), like a temporary blip.

However, if these tariffs remain in place or are intensified, businesses might eventually have no alternative but to maintain elevated prices—whether because the competitive landscape has shrunk or they aim to secure higher margins. This continued price pressure could then start a second wave of inflation, which may dampen consumer spending, slow economic growth, and impact employment. Some experts warned that these cascading effects might even reintroduce deflationary risks over time.

As the situation evolves, the cumulative economic impact of persistent tariffs could force the Fed to consider more aggressive policy measures, marking a significant shift in monetary strategy.

Navigating uncertainty: Dollar volatility amid tariff tensions

The growing fragility of the US Dollar has been driven by increasing speculation of an economic slowdown, particularly a stagflationary scenario, spurred by newly announced tariffs, some loss of momentum in domestic fundamentals, and dwindling market confidence.

Although inflation remains stubbornly above the Fed’s 2% target—visible in both CPI and PCE metrics—the unexpectedly resilient labour market adds a fascinating twist to the overall narrative.

Ultimately, this cocktail of factors, coupled with mounting uncertainty over how US tariffs will impact both domestic and global markets, is set to keep the Greenback volatile, leaving conditions far from stable.

Calculated steps: Fed response amid a cloud of market uncertainty

On March 19, the Federal Reserve concluded its meeting by holding the federal funds rate steady between 4.25% and 4.5%. Faced with escalating uncertainty—from evolving policies to mounting trade tensions—the Committee chose a cautious path.

In tandem, it tweaked its 2025 forecasts, lowering real GDP growth from 2.1% to 1.7% while nudging inflation expectations up from 2.5% to 2.7%. These adjustments underscore mounting worries about a potential stagflation scenario, where sluggish growth collides with rising inflation.

During his routine press conference, Fed Chair Jerome Powell emphasised that there is no immediate need for additional rate cuts. Yet, he didn’t mince words when discussing President Donald Trump's new tariffs, describing them as “larger than expected.” Powell warned that the ensuing economic fallout—characterised by higher inflation and slower growth—could be substantial. "We face a highly uncertain outlook with elevated risks of both higher unemployment and higher inflation," he remarked, underlining that such a development could compromise the Fed's dual mandates of maintaining 2% inflation and achieving maximum employment. While refraining from directly criticizing the Trump administration's policies, Powell stressed that it is the Fed’s role to counter their impact, especially in an economy that, until recently, was enjoying a "sweet spot" of falling inflation and low unemployment.

Recent comments from several Federal Reserve officials have underscored growing concerns about the impact of escalating US trade tensions and new tariff policies on inflation, economic growth, and the overall stability of financial markets.

Trade tensions and tariff impact

Chicago Fed President Austan Goolsbee noted that President Trump's newly announced tariffs were “way bigger” than expected. He reported uncertainty about the pace and extent to which these higher costs would be passed on to consumers, suggesting that both businesses and households might react by curbing spending. In a related sentiment, Minneapolis Fed President Neel Kashkari warned that the sweeping tariffs might unanchor inflation expectations while dealing a blow to the US economy, leaving policymakers the option to adjust rates up or down.

Inflation and economic growth

San Francisco Fed President Mary Daly indicated that while the economy appeared strong, the uncertain effects of the Trump administration’s policies meant that the central bank should avoid rushing changes to interest rates. Boston Fed President Susan Collins warned that the aggressive trade tariffs would almost certainly drive inflation higher and depress near-term growth. St. Louis Fed President Alberto Musalem emphasized that a rise in short-term inflation expectations could seep into longer-term forecasts, complicating efforts to control inflation and limiting the Fed’s flexibility amid a potential rise in unemployment.

Monetary policy perspectives

Several officials stressed the need for caution when considering monetary policy adjustments. Dallas Fed President Lorie Logan expressed concern that higher-than-expected tariffs could likely drive both inflation and unemployment higher. Kansas City Fed President Jeff Schmid asserted his intent to stay “squarely focused” on inflation, particularly how new import taxes might shift prices upward. Meanwhile, Federal Reserve Governor Michelle Bowman highlighted that recent data showed a decrease in inflation and a resilient economy; however, she refrained from committing to any view on how tariffs might affect future inflation or labour market conditions. Goolsbee later added that once the uncertainty is resolved, there could be room for interest rate cuts, provided the economy gets back on track.

What’s next for the Dollar

With tariffs remaining at the forefront of the narrative, market participants are set to zero in on key Retail Sales figures and a host of other hard data releases on the US calendar in the upcoming week. Additionally, a flurry of remarks from Fed rate setters is expected to maintain traders entertained.

Dollar's technical path

The US Dollar Index (DXY) remains under significant pressure, trading below its 200-day Simple Moving Average of 104.77—a clear sign of prevailing bearish sentiment.

Initial contention for DXY appears at the 2025 floor of 99.01 (April 11) prior to the weekly low at 97.68 (March 30, 2022).

Meanwhile, a recovery could propel the index back to last week’s high of 104.68 (March 26) and potentially challenge the 200-day SMA. The next hurdles include provisional moving averages—the 55-day SMA at 105.37 and the 100-day SMA at 106.41—as well as resistance around the weekly high of 107.66 (from February 28).

Momentum indicators hint at the possibility of a technical bounce, as the Relative Strength Index (RSI) sank to around 26, while the Average Directional Index (ADX) has advanced above 42, suggesting that the current trend has gained strength.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.