US Dollar Forecast: Investors’ focus now shifts to US CPI data and Powell

- The US Dollar Index resumed its weekly downtrend.

- Attention remains on Trump's plans around tariffs.

- The US labour market remained firm in January.

In quite volatile last few days, the US Dollar (USD) kicked off the week with fresh cycle highs just below the key 110.00 hurdle on the back of President Donald Trump’s announcement of 25% tariffs on imports from Canada and Mexico, while adding a 10% levy on goods from China.

However, all that optimism around the Greenback rapidly dissipated after President Trump decided to delay tariffs on Canadian and Mexican goods in exchange for negotiations regarding border controls. The measures against the Asian giant, however, remained in place and are waiting for a call between Trump and Xi Jinping that has yet to be heard of.

Against the intense and persistent absence of clarity around the US trade policy, the US Dollar Index (DXY) has embarked on a sharp correction that seems to have met some decent contention around the 107.00 region for the time being.

US fundamentals and the Fed bolster the constructive outlook

In light of the ongoing tariffs paraphernalia, including potential measures against the European Union (EU) in the not-so-distant future, the Greenback is expected to keep suffering the indecisive tone from the White House.

However, the US economy remains “in a very good place” and is therefore expected to maintain the US Dollar on the bid side of the FX galaxy vs. its peers.

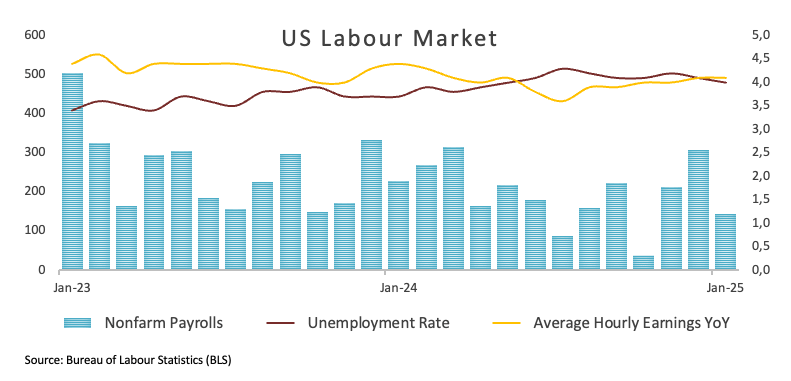

Despite the release of the Nonfarm Payrolls (NFP) showing the economy added fewer jobs than previously estimated in January (+143K), the jobless rate did come down to 4.0% and Average Hourly Earnings, a proxy for inflation via wages, surprised to the upside, increasing 4.1% over the last twelve months.

The solid labour market combines with sticky inflation figures and firm economic activity, all morphing into firm support for the Greenback coming from the real economy going forward.

While important, next week’s release of inflation tracked by the Consumer Price Index would unlikely move the Federal Reserve’s dial on monetary policy, barring of course a noticeable surprise in either direction.

In the wake of the latest NFP figures, market participants now see the Fed resuming its easing cycle at the beginning of the summer.

A prudent Fed also props up the Dollar

The Federal Reserve (Fed) opted to keep interest rates steady within the 4.25% to 4.50% target range during its January 29 gathering, marking a pause after three consecutive rate cuts in late 2024. While this decision reflects confidence in the economy’s resilience, policymakers cautioned that inflation remains "somewhat elevated," signaling persistent challenges on the horizon.

In his usual post-meeting press conference, Fed Chair Jerome Powell emphasised that the central bank is in no rush to shift its policy stance, citing the economy's ongoing strength. He stressed the importance of a cautious approach as the Fed monitors evolving economic conditions.

Powell also addressed the uncertainty surrounding tariffs, describing their potential impact as highly unpredictable. He noted the wide range of unknowns, including the duration, scale, and targets of the tariffs, possible retaliation, and how these factors could ripple through the economy to affect consumers.

Further caution on the Fed’s path, particularly amid the spectre of tariffs, was also exposed by this week’s rate-setters: Boston Fed President Susan Collins said there was no immediate need to lower rates, while Chicago Fed President Austan Goolsbee noted that policy uncertainty—especially over tariffs that might raise prices—supported a slower pace of rate cuts.

San Francisco Fed President Mary Daly mentioned that the Fed could take its time studying economic data and the effects of recent policy shifts before deciding on its next move, a sentiment echoed by Fed Vice Chair Philip Jefferson, who said that further rate cuts could continue over the medium term without haste.

Richmond Fed President Tom Barkin predicted that inflation would drop significantly in the first quarter and saw little justification for a rate hike in the near term. Dallas Fed President Lorie Logan argued she was inclined to keep rates on hold for a while, even if inflation neared the Fed’s target, as long as the labour market remained strong. Lastly, Minneapolis Fed President Neel Kashkari said that if inflation fell further, he would support modest rate cuts by year’s end, barring any major surprises from tariffs or other policy actions.

A word of caution from the positioning perspective

Non-commercial players, otherwise known as speculators, have been adding long positions to their USD holdings since last November. According to the latest CFTC Positioning Report for the week ending January 31, net long positions have reached levels last seen in September 2024—well north of 14K contracts.

Crowded longs are expected to be more susceptible to negative news coming from the Dollar’s entourage, which carries the potential to rapidly unwind and exacerbate any correction in the index.

Key events on the horizon

Looking at next week’s US docket, the publication of the US Inflation Rate and Chair Jerome Powell’s testimonies should steal the show, always seconded by comments from Fed officials and data regarding day-to-day economics.

US Dollar Index technical outlook

In case sellers regain the upper hand, the US Dollar Index (DXY) faces initial support at the 2025 bottom at 106.96 from January 27, prior to the December 2024 trough at 105.42, and the critical 200-day SMA at 104.83.

As long as the index holds above the latter, the bullish outlook remains intact.

Occasional bouts of strength could see the index potentially retesting its February top of 109.88 (February 3), just ahead of the cycle high of 110.17 from January 13. A break above this level would set the stage for a challenge of the 2022 peak at 114.77, marked on September 28.

Momentum signals are sending mixed messages. The daily RSI, picking up pace and approaching 50, points to growing upside potential, but the ADX, sitting around 17, reflects weak trend strength.

DXY daily chart

Economic Indicator

Consumer Price Index (YoY)

Inflationary or deflationary tendencies are measured by periodically summing the prices of a basket of representative goods and services and presenting the data as The Consumer Price Index (CPI). CPI data is compiled on a monthly basis and released by the US Department of Labor Statistics. The YoY reading compares the prices of goods in the reference month to the same month a year earlier.The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Next release: Wed Feb 12, 2025 13:30

Frequency: Monthly

Consensus: -

Previous: 2.9%

Source: US Bureau of Labor Statistics

The US Federal Reserve has a dual mandate of maintaining price stability and maximum employment. According to such mandate, inflation should be at around 2% YoY and has become the weakest pillar of the central bank’s directive ever since the world suffered a pandemic, which extends to these days. Price pressures keep rising amid supply-chain issues and bottlenecks, with the Consumer Price Index (CPI) hanging at multi-decade highs. The Fed has already taken measures to tame inflation and is expected to maintain an aggressive stance in the foreseeable future.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.