US Dollar Weekly Forecast: Later rate cuts prop up the Dollar

- The USD Index (DXY) closed the week on a robust note.

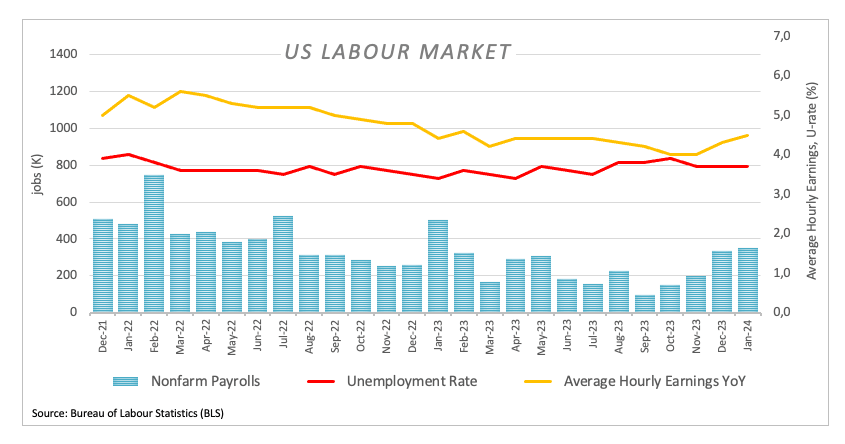

- US Nonfarm Payrolls crushed estimates in January.

- The Fed left its interest rates unchanged, as widely expected.

- Chief Powell (almost) ruled out a rate cut in March.

Friday’s strong performance helped the Greenback maintain its multi-week positive streak unchanged, after the USD Index (DXY) clinched its fifth consecutive week of gains.

Everything now points to a later-than-expected rate cut in May or June rather than March.

The index navigated choppy waters throughout the week, in a context marked by increasing prudence ahead of the key FOMC event on January 31, where the Federal Reserve eventually matched estimates and left its Fed Fund Target Range (FFTR) intact at 5.25%-5.50%.

Federal Reserve Chair Jerome Powell declared that the Federal Reserve is ready to sustain the current policy rate for an extended period, if needed. He noted that consistent advancements in inflation are uncertain and hinted at the possibility of initiating rate reductions at some point this year. Powell underscored the tightness of the labour market while also recognizing the potential adverse impact on the economy if the policy rate reduction is delayed. He emphasised (once again) that decisions will be made on a meeting-by-meeting basis, expressing the belief that the policy rate has likely reached its peak and suggesting at the same time that a rate cut in March looked unlikely. It now looks highly unlikely in light of January Payrolls.

The US Dollar was also underpinned by improvements in the Conference Board’s Consumer Confidence, Construction Spending and the ISM Manufacturing PMI. Regarding the labour market, firmer prints from the JOLTs Job Openings and Employment Cost index rapidly offset the disheartening result from the ADP report, although another stellar reading from Nonfarm Payrolls in January (+353K jobs) put any suspicion that the labour market was cooling further to rest.

All in all, this week’s data appears to prop up Powell’s suggestion that a rate cut in March looks unlikely, at the time when market participants have started to price in a rate reduction in May… or June.

On this, the probability of a 25 bps rate cut in March shrank to around 17%, while a move in May increased to nearly 57% when measured by CME Group’s FedWatch Tool.

This unabated resilience of the US economy reinforced the case for a “soft landing” and coupled with the pick-up in inflation figures in the last month of 2023 and the persevering strength of the domestic labour market all prompted a hawkish narrative from some Fed officials, who appear to favour an interest rate cut in H1, but later than anticipated, something that still appears at odds with investors’ belief.

DXY daily chart

DXY Technical Outlook

The daily chart of the DXY index shows that immediate resistance is likely around the 2024 high of 103.86 (February 2). Further up comes the provisional 100-day SMA at 104.24 seconded by the December top of 104.26 (December 8 and 11). If the index surpasses this level, it might pave the way for a rally to the November peak of 107.11 (November 1), prior to the weekly high of 106.10 (November 10).

However, if sellers take control, there is first support around the weekly low of 102.77 set on January 24. The fall of this level should see no significant support zone until the December low of 100.61 (December 28). If this level is breached, the index may begin to fall towards the psychological 100.00 barrier before reaching a low of 99.57 in 2023. (July 14).

US Dollar price today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.61% | 0.69% | 0.58% | 0.67% | 0.94% | 0.94% | 0.72% | |

| EUR | -0.64% | 0.06% | -0.04% | 0.07% | 0.31% | 0.31% | 0.08% | |

| GBP | -0.68% | -0.06% | -0.08% | 0.01% | 0.25% | 0.25% | 0.02% | |

| CAD | -0.59% | 0.02% | 0.11% | 0.10% | 0.33% | 0.34% | 0.11% | |

| AUD | -0.71% | -0.07% | -0.01% | -0.09% | 0.26% | 0.24% | 0.01% | |

| JPY | -0.94% | -0.33% | -0.25% | -0.36% | -0.27% | -0.05% | -0.22% | |

| NZD | -0.94% | -0.33% | -0.19% | -0.35% | -0.28% | 0.00% | -0.23% | |

| CHF | -0.74% | -0.07% | -0.04% | -0.10% | -0.03% | 0.23% | 0.24% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.