US Dollar Weekly Forecast: Investors' focus now shifts to US macro data

- The US Dollar Index clinches its third weekly gain in a row.

- Fed’s 25-basis-point rate cut in November looks likely.

- Geopolitics, firm US data, and politics prop up the US Dollar.

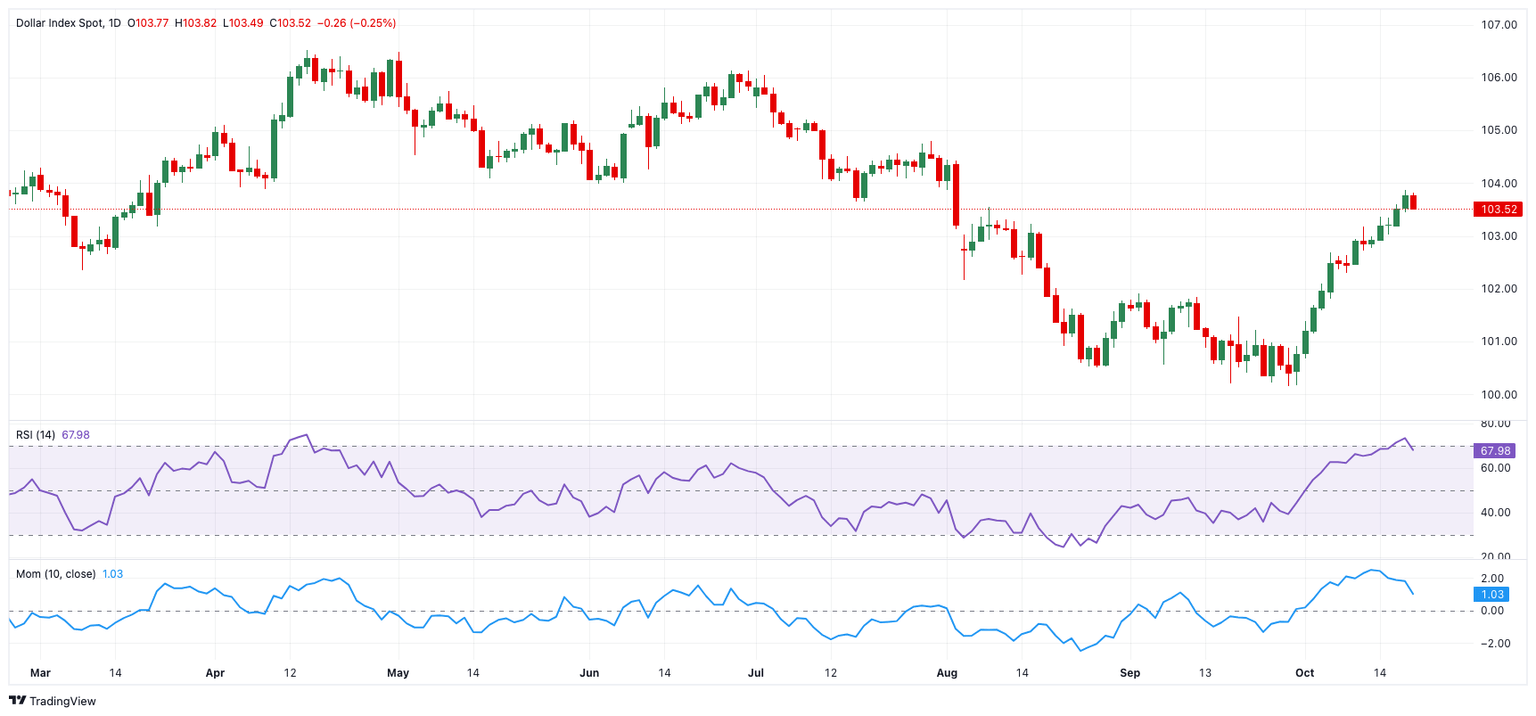

The US Dollar (USD) had another strong performance these past few days, extending its gains for the third consecutive week, including a test of the critical 200-day SMA around 103.80 when tracked by the US Dollar Index (DXY) for the first time since the summer.

It is worth recalling that the Greenback embarked on the current rally soon after investors digested the Federal Reserve's (Fed) unexpected half-point rate cut on September 18. It has been underpinned since then by a resilient US economy, a gradual cooling in the labour market, and growing speculation of a 25-basis-point (bps) rate cut next month instead of a 50 bps cut.

Looking ahead, the Dollar should shift its outlook to a more constructive one on a clear breakout of the always-relevant 200-day Simple Moving Average (SMA) on Friday at 103.77.

A 25 bps rate cut gains traction amid US economic resilience

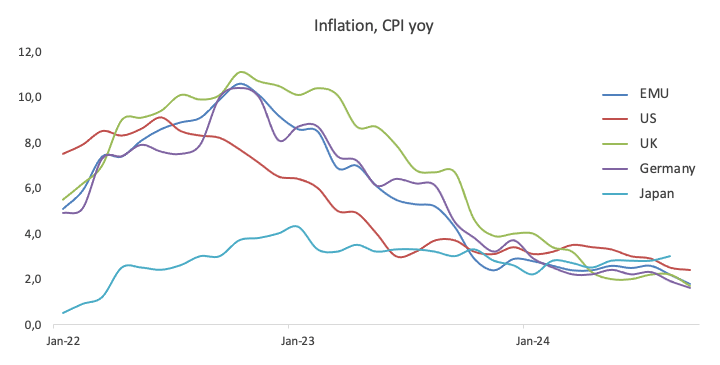

After the unexpected 50-basis-point rate cut in September, market participants are now closely watching the performance of the US economy to assess the likelihood of additional cuts. This heightened focus mirrors the Federal Reserve’s shift toward labour market conditions, though core inflation — excluding food and energy — has proven more persistent than initially anticipated.

On September 30, Fed Chair Jerome Powell remarked that the US economy seems to be on course for continued inflation declines, potentially allowing the central bank to lower its benchmark interest rate further and move toward a neutral level that supports economic growth. He also suggested that future rate cuts of 25 basis points per meeting could become the standard approach.

Fed officials offered a variety of perspectives on future interest rate cuts throughout the week. While many policymakers appear to favour a quarter-point reduction next month, not all share this view.

On that, Neel Kashkari, President of the Federal Reserve Bank of Minneapolis, indicated that further rate cuts are likely as the Fed moves closer to its 2% inflation target. His colleague, San Francisco Fed President Mary Daly, mentioned that if inflation decreases as anticipated, "one or two" rate cuts this year could be a sensible course for the central bank, though she stressed that future decisions would be data-dependent, allowing flexibility to adjust rates accordingly. Raphael Bostic, President of the Atlanta Federal Reserve, argued that he had accounted for just one additional 25-basis-point rate cut for this year in his projections. However, he clarified that his forecast isn't fixed, emphasising that he would adjust based on new economic data, particularly around inflation and employment, adding that he was "keeping [his] options open."

The CME Group's FedWatch Tool now estimates a 92% likelihood of a 25-basis-point rate cut at the November 7 meeting, up sharply from the 62% probability projected just a month ago.

As the Fed shifts its focus from closely monitoring inflation to paying greater attention to the labour market, the performance of the broader economy has become a crucial factor in shaping future monetary policy decisions.

In September, Nonfarm Payrolls (NFP) data showed the addition of 254K jobs, with the Unemployment Rate edging down to 4.1%. The ADP report also exceeded expectations last month, while weekly jobless claims continue to support the view of a strong labour market.

Despite a slight slowdown in industrial sector activity, it remains remarkably resilient, and the services sector continues to show robust growth.

Recent GDP figures further support this outlook, reinforcing the belief that the economy is not heading for a recession — neither a soft landing nor a hard one appears imminent.

When comparing the current performance of the US economy to its G10 counterparts, it's clear why the US Dollar could continue to strengthen against its rivals over the medium to long term.

The interest rate puzzle: Global perspectives

The Eurozone, Japan, Switzerland and the United Kingdom are grappling with increasing deflationary pressure, with economic activity becoming increasingly unpredictable.

In response, the European Central Bank (ECB) cut interest rates by 25 basis points on October 17, though officials refrained from providing additional details or forward guidance on the central bank's future actions.

Similarly, the Swiss National Bank (SNB) also reduced rates by 25 basis points on September 26.

The Bank of England (BoE) recently held its policy rate steady at 5.00%, citing persistent inflation, elevated service sector prices, robust consumer spending, and stable GDP as reasons for the decision. However, recent comments from Governor Andrew Bailey suggested the BoE could adopt a more aggressive approach to rate cuts in the future.

Meanwhile, the Reserve Bank of Australia (RBA) kept rates unchanged at its September 24 meeting but maintained a hawkish tone in subsequent statements, with analysts predicting potential rate cuts by late 2024 or early 2025.

The Bank of Japan (BoJ) maintained its dovish stance at its September 20 meeting, with market expectations pointing to only a modest 25 bps rate hike over the next 12 months.

The delicate dance of politics and economic strategy

As the November 5 election nears, recent polls still indicate a close contest between Vice President Kamala Harris, the Democratic presidential nominee, and Republican challenger, former President Donald Trump.

Looking at the potential scenarios, a Trump victory could result in a reintroduction of tariffs, potentially disrupting or reversing the current disinflationary trend in the US economy, which might in turn prompt the Fed to interrupt its easing cycle.

Conversely, a Harris administration may favour higher taxes and could push for more accommodative monetary policy from the Fed, particularly if signs of an economic slowdown begin to surface.

In any case, it appears that fiscal policy will remain a central focus of the debate, regardless of who becomes the next US President.

What’s up next week?

Next week provides new insights into this month’s business activity with the release of advanced Manufacturing and Services PMIs. Alongside these reports, Durable Goods Orders and the Michigan Consumer Sentiment gauge will be published, as well as the Fed's Beige Book.

Meanwhile, activity around speeches from Fed officials is expected to be minimal.

Techs on the US Dollar Index

Amidst the ongoing rally in the US Dollar Index (DXY), the next key target is the October high of 103.87 (set on October 17), a level bolstered by the 200-day Simple Moving Average (SMA). A sustained move above this area could pave the way for a push toward the weekly high of 104.79, recorded on July 30.

On the flip side, while downward pressure on the DXY has subsided in recent days, strong support remains at the year-to-date low of 100.15, set on September 27. Should selling pressure reappear and the DXY breaches this level, it may retest the psychological 100.00 milestone, potentially leading to a drop to the 2023 low of 99.57 from July 14.

Additionally, the Relative Strength Index (RSI) on the daily chart has returned from the overbought region, hinting at a potential corrective move in the short-term horizon. Additionally, the Average Directional Index (ADX) has climbed a tad to around 33, signalling the modest strength of the current trend.

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Canadian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.29% | -0.20% | -0.48% | 0.04% | -0.13% | -0.18% | -0.03% | |

| EUR | 0.29% | 0.11% | -0.16% | 0.33% | 0.14% | 0.13% | 0.26% | |

| GBP | 0.20% | -0.11% | -0.27% | 0.22% | 0.05% | 0.02% | 0.13% | |

| JPY | 0.48% | 0.16% | 0.27% | 0.52% | 0.34% | 0.28% | 0.42% | |

| CAD | -0.04% | -0.33% | -0.22% | -0.52% | -0.17% | -0.21% | -0.10% | |

| AUD | 0.13% | -0.14% | -0.05% | -0.34% | 0.17% | -0.05% | 0.08% | |

| NZD | 0.18% | -0.13% | -0.02% | -0.28% | 0.21% | 0.05% | 0.12% | |

| CHF | 0.03% | -0.26% | -0.13% | -0.42% | 0.10% | -0.08% | -0.12% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.