US Dollar Weekly Forecast: Losing momentum as markets focus on Fed interest-rate outlook

- The USD Index (DXY) traded well on the defensive this week.

- Investors so far lean towards a rate cut by the Fed in September.

- The FOMC event disappointed USD bulls somewhat.

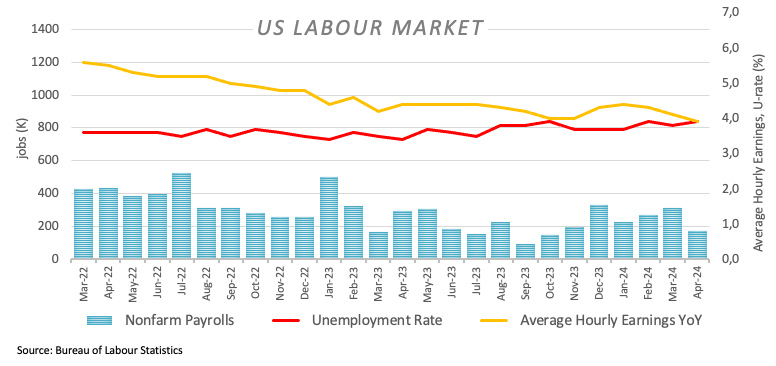

- The US economy added 175K jobs in April, missing estimates.

A marked pullback during the week prompted the US Dollar (USD) to retreat to the area of three-week lows in the mid-104.00s when tracked by the USD Index (DXY) soon after the US NFP came in below expectations in April.

Once again, the weekly performance of the Greenback mainly reflected investors' responses to shifting sentiments regarding the likely timing of the Federal Reserve’s (Fed) easing programme. The prospect of a rate adjustment at the September 18 meeting seems to have regained momentum and now appears to be the most likely option among market participants.

Reinforcing the above, the consistently resilient US inflation figures recently released are evident in both the Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) data for March. The unexpected deceleration in deflationary pressures, coupled with the ongoing tightness of the labour market, not only underscores the continued vigour of the economy but also suggests that the Fed may maintain its tighter policies for an extended period.

Chairman Jerome Powell, at his press conference on Wednesday, highlighted the need for further conviction that inflation is heading towards the bank’s 2% goal before starting to think about reducing interest rates. Powell, however, deemed a rate cut likely to be the Fed’s next move on rates.

Back to rates, according to the CME Group’s FedWatch Tool, the probability of a 25 bps reduction at the September meeting hovers around 50% vs. 36% and 40% at the July and November events, respectively.

Furthermore, the recent performance of the US Dollar aligned with a decline in US yields from recent multi-month highs across different maturity periods. This occurred amidst an unchanged macroeconomic landscape, suggesting the possibility of only one, or perhaps no rate cuts at all, for the rest of the year.

Regarding interest rate trajectories among G10 central banks and inflation dynamics, it is anticipated that the European Central Bank (ECB) may reduce interest rates during the summer, possibly followed by the Bank of England (BoE). However, both the Federal Reserve and the Reserve Bank of Australia (RBA) are expected to commence easing later this year, potentially in the fourth quarter. Despite a recent policy rate hike, the Bank of Japan (BoJ) remains an exception.

With the FOMC event already in the rear-view mirror, the slew of Fed speakers scheduled for the upcoming week are expected to gather all the attention.

USD Index (DXY) Technical Analysis

If downward pressure intensifies, the USD Index (DXY) is expected to encounter provisional support at the 55-day Simple Moving Average (SMA) at 104.49, preceding the April 9 low at 103.88. A breach of this level may expose the transitory 100-day SMA at 103.81, seconded by the March low at 102.35 (March 8). Further decline could lead to a test of the December low of 100.61 (December 28), ahead of the psychological barrier of 100.00 and the 2023 bottom at 99.57 (July 14).

Conversely, bullish momentum could prompt a revisit of the 2024 peak at 106.51 (April 16). Surpassing this level might encourage market participants to contemplate a visit to the November high at 107.11 (November 1), just before the 2023 top at 107.34 (October 3).

In a broader perspective, the prevailing bullish bias is expected to persist as long as DXY remains above the 200-day SMA.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.