US Dollar Weekly Forecast: US CPI… a non-event?

- US Dollar Index advances to multi-week highs past 102.00.

- A soft landing of the US economy remains well on the cards.

- Solid NFP figures push back bets for a 50 bps rate cut.

It was a stellar week for the US Dollar (USD).

The Greenback, as tracked by the US Dollar Index (DXY), managed to rise for the fifth consecutive day on Friday, marking its first such streak since April. Furthermore, the index reversed four straight weeks of declines, which had included a dip below the critical 200-week SMA at 100.56, and surged to new two-month highs, comfortably surpassing the 102.00 level.

Like we inferred last week, it was not game over for the US Dollar after the Federal Reserve (Fed) unexpectedly reduced its interest rates by a half-percentage point at its gathering on September 18.

Several factors seem to justify the US Dollar’s outperformance this week: increasing inflows into the safe haven universe in the wake of Iran’s missile attack on Israel, shrinking bets of another jumbo rate cut at any of the next couple of Fed meetings, Chair Jerome Powell’s hawkish message in Nashville, and the robust US labour market report for the month of September.

Meanwhile, a glance at the Dollar’s recent price action unveils quite a solid contention zone around the psychological 100.00 level, while the next significant target on the upside emerges at the critical 200-day Simple Moving Average (SMA).

Geopolitics pushes markets toward risk-averse stance

The US Dollar gained additional momentum as global markets shifted toward risk aversion this week following Iran’s missile strike on Israel on October 1. This event caused a surge in volatility, reaching levels not seen since mid-September, as indicated by the VIX index (commonly known as the "panic index").

The flight-to-safety response further bolstered the already strong demand for the Greenback, while simultaneously putting significant pressure on risk-sensitive assets.

Another jumbo rate cut? Not likely

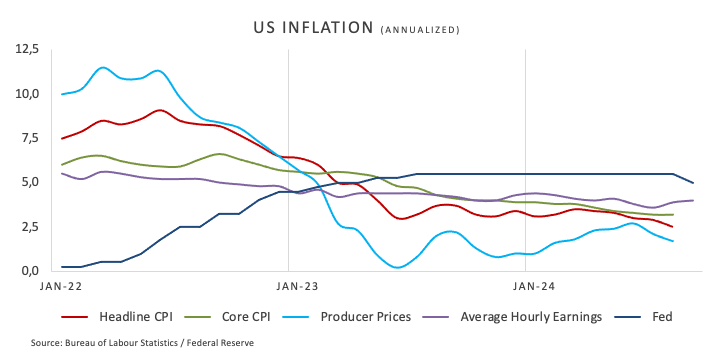

After the unexpected 50-basis-point rate cut in September, market participants are now focusing on the performance of the US economy to better assess the likelihood of further rate reductions. This view was also reinforced by the Fed after it shifted its attention to the labour market amidst a sustained downward path of inflation toward the 2% goal.

Fed Chair Jerome Powell argued on September 30 that the US economy seems poised for a further decline in inflation, potentially allowing the central bank to further lower its benchmark interest rate and ultimately achieve a neutral level that doesn't restrict economic growth. Furthermore, Powell suggested that reductions in the interest rate level of 25 basis points at each meeting would be some kind of standard move.

However, not everyone at the FOMC seems to agree. On this, Governor Michelle Bowman recently emphasized the need for caution as key inflation measures remain above the 2% core target, suggesting it may be time for the Fed to adjust its monetary policy.

In the same line, Richmond Federal Reserve President Thomas Barkin mentioned on Wednesday that the central bank's efforts to return inflation to its 2% target may take longer than expected, potentially constraining the degree to which interest rates can be lowered.

Bolstering the view that another significant rate cut is a long shot, September's Nonfarm Payrolls exceeded expectations, with the US economy adding 254K jobs and the Unemployment Rate dropping to 4.1%.

After the release of Friday’s US labour market report, CME Group's FedWatch Tool now estimates a 95% probability of a quarter-point rate cut in November, up sharply from nearly 45% just a week earlier.

Global outlook: Are interest rates headed up or down?

The Eurozone, Japan, Switzerland, and the United Kingdom are experiencing increasing deflationary pressures, with economic activity following a volatile trajectory.

In response, the European Central Bank (ECB) implemented its second interest rate cut earlier this month and has adopted a cautious outlook on further actions for October. Although ECB policymakers have not confirmed additional cuts, markets are anticipating two more reductions before year-end. Similarly, the Swiss National Bank (SNB) lowered its rates by another 25 basis points this month.

The Bank of England (BoE) recently held its policy rate steady at 5.00%, citing persistent inflation, high service sector prices, strong consumer spending and stable GDP data as factors in its decision.

Meanwhile, the Reserve Bank of Australia (RBA) kept rates unchanged at its September 24 meeting but maintained a hawkish tone in subsequent remarks, with analysts predicting potential easing by year-end or early 2025.

The Bank of Japan (BoJ), at its September 20 meeting, retained its dovish stance, and money markets are expecting only a modest tightening of 25 basis points over the next 12 months.

At the crossroads: The influence of politics on economics

As the November 5 election nears, recent polls indicate a close contest between Vice President Kamala Harris, the Democratic Party's presidential candidate, and Republican challenger and former President Donald Trump.

A Trump victory could result in the reinstatement of tariffs, which might disrupt or reverse the current disinflationary trend in the US economy, potentially shortening the timeline for Fed rate cuts.

Conversely, some analysts suggest that a Harris administration could pursue higher taxes and may pressure the Fed to ease monetary policy, particularly if signs of an economic slowdown begin to surface.

What’s up next week?

The key event on the US calendar next week will be the release of the FOMC Minutes from the September 17-18 meeting, followed closely by the publication of September's inflation data, as measured by the Consumer Price Index (CPI).

Additionally, a series of scheduled speeches from Fed officials is expected to keep investors focused on the potential interest rate trajectory for the rest of the year.

Techs on the US Dollar Index

Following the sharp advance of the US Dollar Index (DXY) in past days, the main target now emerges at the critical 200-day Simple Moving Average (SMA) at 103.73.

Despite the downward trend in DXY mitigating this week, there is still a strong support level at its year-to-date (YTD) low of 100.15 (September 27). Further bouts of selling pressure could trigger a move to the psychological 100.00 mark, with a potential retest of the 2023 low at 99.57 (July 14) emerging on a breach of that level.

On the upside, the continuation of the ongoing recovery is expected to meet the next hurdle at the provisional 100-day SMA at 103.35, prior to the pivotal 200-day SMA. The surpass of this region could open the door to a potential visit to the weekly peak of 104.79 (July 30).

Additionally, the Relative Strength Index (RSI) on the daily chart surged past the 63 level, hinting at the idea that further gains could still be in the pipeline in the short-term horizon. Meanwhile, the Average Directional Index (ADX) eased to around 33, signalling some loss of momentum for the current trend.

Economic Indicator

Consumer Price Index (YoY)

Inflationary or deflationary tendencies are measured by periodically summing the prices of a basket of representative goods and services and presenting the data as The Consumer Price Index (CPI). CPI data is compiled on a monthly basis and released by the US Department of Labor Statistics. The YoY reading compares the prices of goods in the reference month to the same month a year earlier.The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Next release: Thu Oct 10, 2024 12:30

Frequency: Monthly

Consensus: 2.3%

Previous: 2.5%

Source: US Bureau of Labor Statistics

The US Federal Reserve has a dual mandate of maintaining price stability and maximum employment. According to such mandate, inflation should be at around 2% YoY and has become the weakest pillar of the central bank’s directive ever since the world suffered a pandemic, which extends to these days. Price pressures keep rising amid supply-chain issues and bottlenecks, with the Consumer Price Index (CPI) hanging at multi-decade highs. The Fed has already taken measures to tame inflation and is expected to maintain an aggressive stance in the foreseeable future.

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.59% | 0.00% | 1.28% | 0.16% | 0.61% | 0.85% | 0.72% | |

| EUR | -0.59% | -0.56% | 0.67% | -0.41% | 0.02% | 0.28% | 0.11% | |

| GBP | -0.01% | 0.56% | 1.25% | 0.15% | 0.59% | 0.83% | 0.66% | |

| JPY | -1.28% | -0.67% | -1.25% | -1.11% | -0.66% | -0.44% | -0.58% | |

| CAD | -0.16% | 0.41% | -0.15% | 1.11% | 0.44% | 0.72% | 0.51% | |

| AUD | -0.61% | -0.02% | -0.59% | 0.66% | -0.44% | 0.24% | 0.05% | |

| NZD | -0.85% | -0.28% | -0.83% | 0.44% | -0.72% | -0.24% | -0.18% | |

| CHF | -0.72% | -0.11% | -0.66% | 0.58% | -0.51% | -0.05% | 0.18% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.