US Dollar Weekly Forecast: US CPI could decide Fed’s rate cut size

- US Dollar Index (DXY) remained under pressure this week.

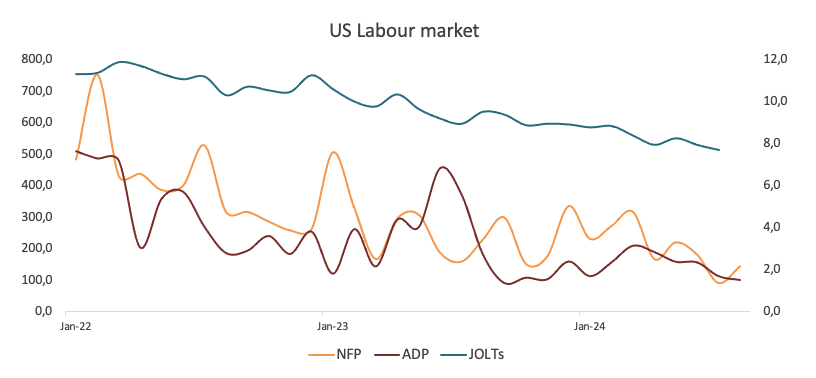

- US labour market cooled further in August.

- Investors’ focus shifts to upcoming US CPI data.

The US Dollar (USD) faded the bullish performance witnessed in the previous week and resumed its downward path these past few days.

That said, while the US Dollar Index (DXY) managed to regain some balance and reach multi-day tops near the key 102.00 barrier earlier in the week, the bearish sentiment eventually prevailed, dragging it back well below the 101.00 yardstick in the latter part of the week.

Once again, rising expectations that the Federal Reserve (Fed) might begin lowering its Fed Funds Target Range (FFTR) at its September 18 event were behind the Dollar’s negative price action in combination with the re-emergence of some threats to the US economic outlook.

The potential scale of such a rate cut, however, is still uncertain and largely depends on forthcoming economic data, particularly next week’s inflation figures.

A September rate cut is a done deal. Its size is not quite so

After hitting multi-day peaks in levels just shy of the 102.00 barrier (September 3), the Greenback came under renewed and increased downside pressure in line with a strong downtrend in US yields across different maturity periods.

That said, a firm bearish sentiment maintained the US Dollar on the defensive at the time when market participants were wondering whether the Fed would trim rates by 25 bps or go for a larger cut.

In the meantime, concerns over a potential slowdown of US economic activity continued to be persistently challenged by mixed data results from key fundamentals.

On the latter, the US economy added fewer jobs than initially estimated in August, according to the latest Nonfarm Payrolls (+142K). While the NFP missed consensus, job creation remained healthy, all pointing to some cooling of the labour market conditions rather than signalling that a recession could be in the offing.

The CME Group's FedWatch Tool indicates nearly a 73% probability of a quarter-point rate cut in September, with a roughly 27% chance of a 50-basis-point reduction.

Following the much-anticipated rate cut in September, market participants are expected to turn their attention to assessing the performance of the US economy in order to gauge future rate cuts. At this point, traders pencilled in around 100 bps of easing for the remainder of the year.

Although earlier fears of a recession appear to have mitigated, future economic data could still impact the Fed’s monetary policy decisions.

After Fed Chair Jerome Powell opened the door to lower rates by the central bank, other rate setters followed suit: Atlanta Federal Reserve President Raphael Bostic warned that keeping interest rates too high could harm employment. San Francisco Fed President Mary Daly suggested cutting interest rates to maintain a healthy labour market, but the extent of the cuts would depend on upcoming economic data.

Federal Reserve Bank of New York President John Williams suggested a more balanced economy has created the possibility for rate cuts, with the exact course of action depending on future economic performance. Williams projected the jobless rate to end the year around 4.25% before declining back to its longer-term average of approximately 3.75%. Fed Governor Christopher Waller stated that the time has come for interest rate cuts, focusing on supporting full employment and aligning wage growth with the Fed's 2% inflation target. Finally, Chicago Fed President Austan Goolsbee argued on Friday that the Federal Reserve needs to lower interest rates to maintain a healthy labour market and that multiple rate cuts would be necessary.

What can we expect in terms of international monetary policy?

The Eurozone, Japan, Switzerland and the United Kingdom are all facing increasing deflationary pressure. In response, the European Central Bank (ECB) implemented a 25-basis-point rate cut in June and maintained a cautious stance in July. While ECB policymakers remain uncertain about additional rate cuts after the summer, investors are already pricing in two more reductions later this year.

Similarly, the Swiss National Bank (SNB) surprised markets with a 25-basis-point cut in June, and the Bank of England (BoE) followed with a quarter-point cut on August 1. Meanwhile, the Reserve Bank of Australia (RBA) took a different approach by keeping rates unchanged at its August 6 meeting and signaling a more hawkish outlook. Market expectations suggest the RBA could start easing rates sometime in the fourth quarter of 2024.

In contrast, the Bank of Japan (BoJ) took markets by surprise on July 31 with a hawkish move, raising rates by 15 basis points to 0.25%. Despite the recent hawkish tone from some BoJ officials, money markets see only 25 bps of tightening by the central bank in the next 12 months.

Refocusing on political dynamics

Since Kamala Harris became the Democratic Party's presidential candidate for the upcoming US election on November 5, polls now present a mixed view on the potential outcome. However, it is important to note that another Trump administration, along with the possible reintroduction of tariffs, could disrupt or even reverse the current disinflationary trend in the US economy, potentially leading to a shorter cycle of Fed rate cuts. On the other hand, some analysts suggest that a Harris victory could result in higher taxes and increased pressure on the Fed to ease monetary policy if economic activity slows down.

Upcoming key events

The salient event on the US calendar next week will definitely be the release of inflation figures measured by the CPI. Further signals that the disinflationary pressure remains well and sound should cement the case for lower rates later in the month. A positive surprise, however, could set the stage for a 50 bps rate cut. The Fed’s blackout period kicks in this weekend.

Techs on the US Dollar Index

The chances of continued downward pressure on the US Dollar Index (DXY) have risen after it broke decisively below the important 200-day Simple Moving Average (SMA), currently positioned at 103.90. If the bearish momentum continues, the DXY could first target the 2024 low of 100.51, recorded on August 27, and then the psychologically important 100.00 level.

Bullish attempts should meet immediate resistance at the September top of 101.95 seen on September 3, prior to the weekly peak of 103.54 from August 8, and the critical 200-day SMA.

The day-to-day Relative Strength Index (RSI) has bounced back to around the 40 level after dipping into the oversold zone in the past couple of weeks.

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.