Entering a consolidative phase?

The renewed upside momentum in the Greenback lifted the USD Index (DXY) back above the 105.00 barrier earlier in the week, although that move lacked follow-through as the week drew to a close, leaving the index navigating in the negative zone and fading the positive performance of the previous week.

Focus remains on data and Fedspeak

The Dollar’s weekly developments transited a bumpy road after collapsing to the 104.00 neighbourhood in the first half of the week, only to bounce markedly afterwards and eventually return to the bearish trend in the last couple of sessions, despite reclaiming the area beyond the 105.00 hurdle.

Although a rate hike by the Federal Reserve (Fed) in the next three meetings is seen with marginal probability, it still remains on the table, bolstered by hawkish Fedspeak, sticky inflation, and unabated tightness in the labour market. The release of another revision of Q1 GDP figures showed some loss of momentum in US economic activity, although nothing that was not anticipated.

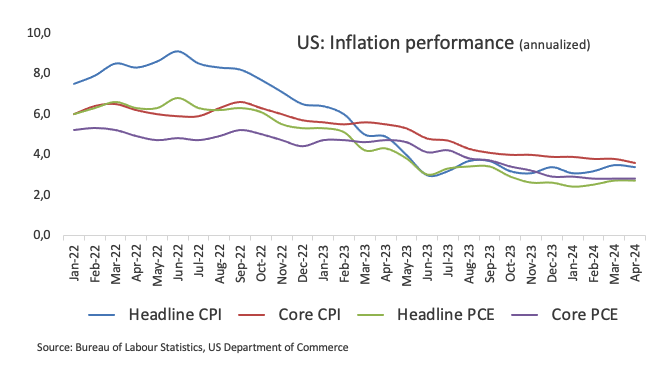

Back to inflation, it is worth noting that the headline Personal Consumption Expenditure (PCE) Price Index matched estimates in April, rising by 2.7% over the last twelve months and by 2.8% YoY when it came to the Core PCE.

Overall, the CME Group’s FedWatch Tool now predicts a roughly 50% chance of lower rates in September, influenced by the hawkish tilt from the FOMC Minutes and the tighter-for-longer narrative around the Federal Reserve. Additionally, nearly 15 bps of easing are expected at the September 18 meeting, compared to about 35 bps in December.

Fed officials remained cautious

Bolstering the prospects of a resilient Dollar in the next few months, Fed policymakers maintained their prudent stance throughout the week: Minneapolis Federal Reserve Bank President Neel Kashkari suggested that the Fed should wait for significant inflation progress before considering interest rate cuts. He even suggested raising rates if inflation doesn't decrease further. Additionally, Federal Reserve Bank of New York President John Williams stated there's no immediate need to cut interest rates, stating the Fed has the flexibility to gather more data before making policy changes. Furthermore, Chicago Fed President Austan Goolsbee said further inflation improvement might lead to higher unemployment, while Dallas Federal Reserve Bank President Lorie Logan believes inflation is on track to reach the Fed's 2% target.

US yields regain upward trend

The USD's weekly performance aligned with a rangebound theme in US yields across various timeframes, driven by a changing macroeconomic backdrop that diminished rate-cut bets for the September meeting. That said, yields maintained their price action around the upper end of the monthly range.

G10 Central Banks: Anticipated rate cuts and inflation dynamics

Looking at broader trends among G10 central banks, the European Central Bank (ECB) is expected to cut rates next week, although uncertainty keeps running high regarding subsequent rate cuts. The Bank of England (BoE) is likely to reduce rates in the last quarter, while the Fed and the Reserve Bank of Australia (RBA) are expected to start easing at some point by year-end.

Upcoming key events

Next week, the release of May’s Nonfarm Payrolls will take centre stage, followed by the ADP report and the ISM Manufacturing and Services PMIs.

Technical analysis of USD Index

The USD Index (DXY) appears somewhat consolidative between 104.00 and 105.00 for the time being. In case the index breaks above the weekly high of 105.74 (May 9), it could then attempt a move to the 2024 peak of 106.51 (April 16). Breaking this level might lead to the November high of 107.11 (November 1) and the 2023 top of 107.34 (October 3). Conversely, renewed selling pressure could bring the DXY back to the May low of 104.08 (May 16). Further declines could see the index test the weekly low of 103.88 (April 9) and the March bottom of 102.35 (March 8). A deeper retracement might target the December low of 100.61 (December 28), the psychological barrier at 100.00, and the 2023 low of 99.57 (July 14).

Looking at the broader picture, the overall bullish bias is expected to persist as long as DXY remains above the 200-day SMA at 104.42.

Nonfarm Payrolls FAQs

Nonfarm Payrolls (NFP) are part of the US Bureau of Labor Statistics monthly jobs report. The Nonfarm Payrolls component specifically measures the change in the number of people employed in the US during the previous month, excluding the farming industry.

The Nonfarm Payrolls figure can influence the decisions of the Federal Reserve by providing a measure of how successfully the Fed is meeting its mandate of fostering full employment and 2% inflation. A relatively high NFP figure means more people are in employment, earning more money and therefore probably spending more. A relatively low Nonfarm Payrolls’ result, on the either hand, could mean people are struggling to find work. The Fed will typically raise interest rates to combat high inflation triggered by low unemployment, and lower them to stimulate a stagnant labor market.

Nonfarm Payrolls generally have a positive correlation with the US Dollar. This means when payrolls’ figures come out higher-than-expected the USD tends to rally and vice versa when they are lower. NFPs influence the US Dollar by virtue of their impact on inflation, monetary policy expectations and interest rates. A higher NFP usually means the Federal Reserve will be more tight in its monetary policy, supporting the USD.

Nonfarm Payrolls are generally negatively-correlated with the price of Gold. This means a higher-than-expected payrolls’ figure will have a depressing effect on the Gold price and vice versa. Higher NFP generally has a positive effect on the value of the USD, and like most major commodities Gold is priced in US Dollars. If the USD gains in value, therefore, it requires less Dollars to buy an ounce of Gold. Also, higher interest rates (typically helped higher NFPs) also lessen the attractiveness of Gold as an investment compared to staying in cash, where the money will at least earn interest.

Nonfarm Payrolls is only one component within a bigger jobs report and it can be overshadowed by the other components. At times, when NFP come out higher-than-forecast, but the Average Weekly Earnings is lower than expected, the market has ignored the potentially inflationary effect of the headline result and interpreted the fall in earnings as deflationary. The Participation Rate and the Average Weekly Hours components can also influence the market reaction, but only in seldom events like the “Great Resignation” or the Global Financial Crisis.

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.19% | 0.00% | 0.22% | -0.33% | -0.19% | -0.42% | -0.13% | |

| EUR | 0.19% | 0.22% | 0.41% | -0.13% | -0.03% | -0.23% | 0.06% | |

| GBP | -0.01% | -0.22% | 0.22% | -0.34% | -0.23% | -0.45% | -0.16% | |

| JPY | -0.22% | -0.41% | -0.22% | -0.51% | -0.39% | -0.65% | -0.34% | |

| CAD | 0.33% | 0.13% | 0.34% | 0.51% | 0.12% | -0.10% | 0.18% | |

| AUD | 0.19% | 0.03% | 0.23% | 0.39% | -0.12% | -0.23% | 0.04% | |

| NZD | 0.42% | 0.23% | 0.45% | 0.65% | 0.10% | 0.23% | 0.28% | |

| CHF | 0.13% | -0.06% | 0.16% | 0.34% | -0.18% | -0.04% | -0.28% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD consolidates gains below 1.1400 on weaker US Dollar

EUR/USD consolidates its recovery gains below 1.1400 in early Europe on Monday. Upbeat risk sentiment on Trump's tairff concession news fails to lift the US Dollar, supporting the pair. US-China trade headlines will continue to dominate ahead of Fedspeak.

GBP/USD climbs above 1.3150 as USD sellers refuse to give up

GBP/USD preserves its bullish momentum and trades above 1.3150 in the European session on Monday. The sustained US Dollar weakness suggests that the path of least resistance for the pair remains to the upside. US-China trade updates remain in focus.

Gold retreats from record-high, holds above $3,200

Gold pulls away from the new record-high it set at $3,245 at the weekly opening but manages to hold comfortably above $3,200. Easing concerns over a deepening trade conflict between the US and China seem to be causing XAU/USD to enter a consolidation phase.

Six Fundamentals for the Week: Tariffs, US Retail Sales and ECB stand out Premium

"Nobody is off the hook" – these words by US President Donald Trump keep markets focused on tariff policy. However, some hard data and the European Central Bank (ECB) decision will also keep things busy ahead of Good Friday.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.