US Dollar Weekly Forecast: Fed rate cut bets seen ruling the sentiment

- The USD Index (DXY) traded with a gradual downside bias this week.

- The likelihood of a potential rate cut by the Fed in September lost some traction.

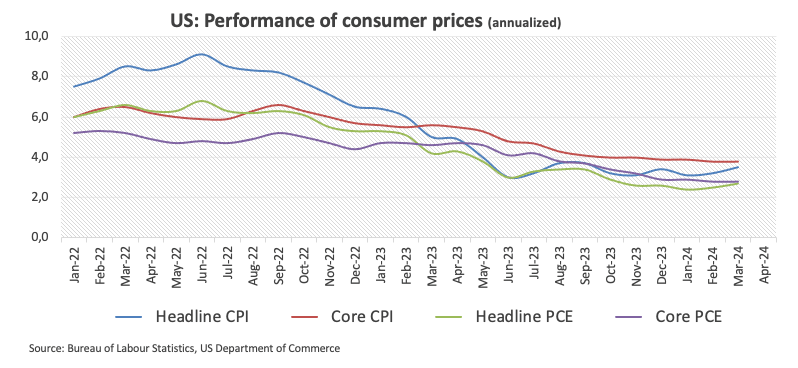

- US inflation gauged by the PCE rose above estimates in March.

- Markets’ attention now shifts to the FOMC event and the NFP.

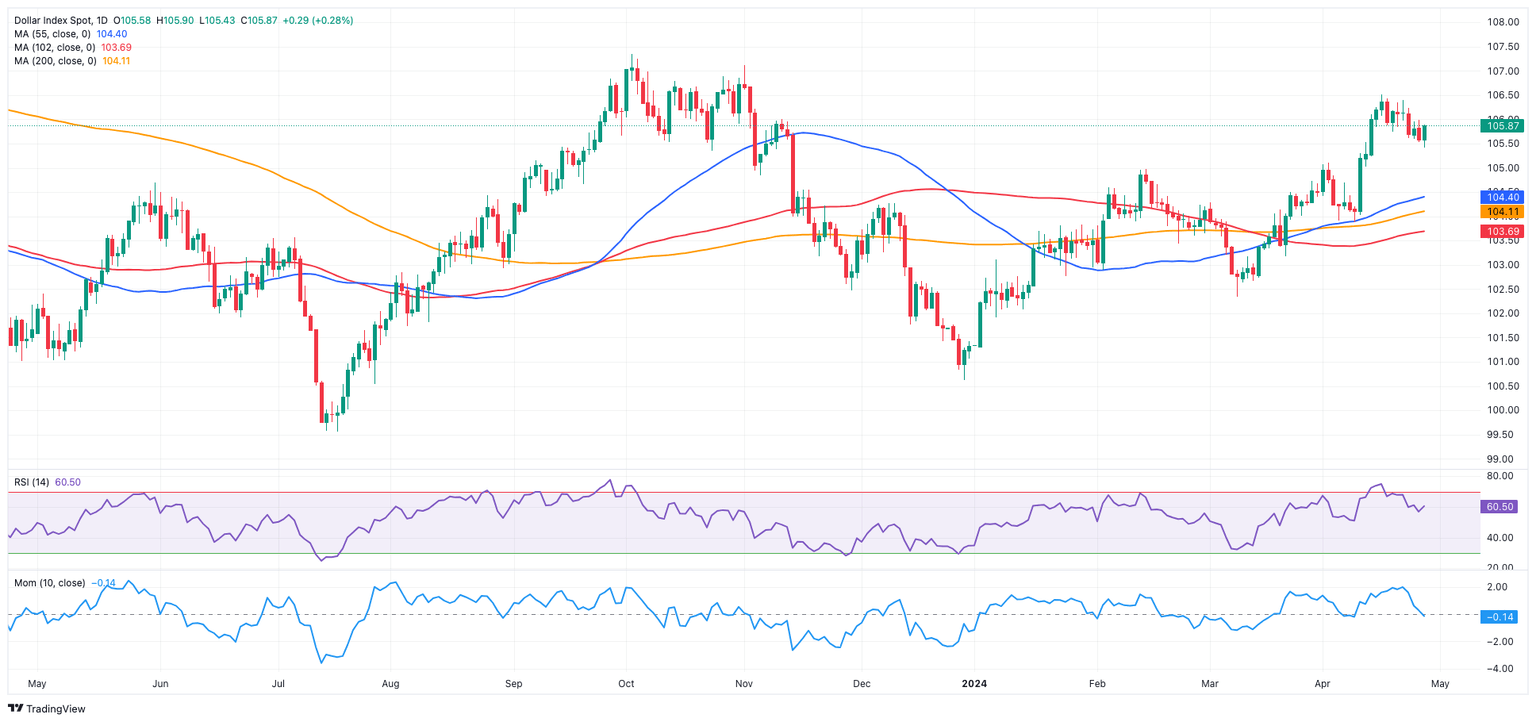

A modest weekly retracement saw the Greenback reverse two consecutive advances, motivating the USD Index (DXY) to retreat further from yearly peaks at around 106.50 recorded earlier in the month.

The weekly performance of the US Dollar (USD) mirrored investors' reactions to the alternating trends in bets regarding the probable timing of the start of the Federal Reserve’s (Fed) easing programme.

The possibility of a rate adjustment at the September 18 meeting appears to have lost momentum, especially given the persistently sticky US inflation figures recently reported, as reflected in both the Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) data for March.

The unexpected slowdown in deflationary pressures, coupled with the unabated tightness of the labour market, not only confirms the ongoing strength of the economy but also suggests that the Fed may maintain tighter policies for longer.

Furthermore, the likelihood of the Fed starting an easing cycle in September has decreased significantly to around 45%, according to the CME Group’s FedWatch Tool.

The Greenback’s performance for the week also coincided with US yields stabilizing near recent multi-month highs across different maturity periods, against a macro environment that indicates fewer interest rate cuts for the rest of the year.

Despite the Fed’s blackout period, it is worth recalling the latest comments from Fed officials, who have been vocal about prolonging the current restrictive stance. That said, Atlanta Federal Reserve Bank President Raphael Bostic suggested a potential move by year-end. His colleague from the New York Fed, John Williams, emphasized the positive economic data and the need for rate adjustments based on the data, while FOMC Governor Michelle Bowman expressed uncertainty about whether interest rates are sufficiently high to address inflation concerns.

Those views from Fed policymakers matched Chairman Jerome Powell's recent remarks, indicating no rush to initiate interest rate cuts.

Regarding interest rate trajectories among G10 central banks and inflation dynamics, it's anticipated that the European Central Bank (ECB) may cut interest rates during the summer, possibly followed by the Bank of England (BoE). However, both the Federal Reserve and the Reserve Bank of Australia (RBA) are expected to start easing later this year, probably in the fourth quarter. Despite a recent policy rate hike, the Bank of Japan (BoJ) remains an outlier.

DXY technical outlook

In case the downside pressure picks up pace, the USD Index (DXY) is expected to meet the next contention zone at the key 200-day Simple Moving Average (SMA) at 104.07, which precedes the April 9 low at 103.88. The breakdown of this level reveals the provisional 100-day SMA at 103.73, prior to the March low of 102.35 (March 8). A deeper slide might lead to a test of the December low of 100.61 (December 28), which is ahead of the psychological 100.00 barrier and the 2023 bottom of 99.57 (July 14).

On the other hand, bulls should look to revisit the 2024 top of 106.51 (April 16). Surpassing this level may inspire market players to consider a visit to the November high at 107.11 (November 1), just ahead of the 2023 peak at 107.34 (October 3).

Looking at the bigger picture, the constrictive tone is predicted to remain unchanged while DXY trades above the 200-day SMA.

Nonfarm Payrolls FAQs

Nonfarm Payrolls (NFP) are part of the US Bureau of Labor Statistics monthly jobs report. The Nonfarm Payrolls component specifically measures the change in the number of people employed in the US during the previous month, excluding the farming industry.

The Nonfarm Payrolls figure can influence the decisions of the Federal Reserve by providing a measure of how successfully the Fed is meeting its mandate of fostering full employment and 2% inflation. A relatively high NFP figure means more people are in employment, earning more money and therefore probably spending more. A relatively low Nonfarm Payrolls’ result, on the either hand, could mean people are struggling to find work. The Fed will typically raise interest rates to combat high inflation triggered by low unemployment, and lower them to stimulate a stagnant labor market.

Nonfarm Payrolls generally have a positive correlation with the US Dollar. This means when payrolls’ figures come out higher-than-expected the USD tends to rally and vice versa when they are lower. NFPs influence the US Dollar by virtue of their impact on inflation, monetary policy expectations and interest rates. A higher NFP usually means the Federal Reserve will be more tight in its monetary policy, supporting the USD.

Nonfarm Payrolls are generally negatively-correlated with the price of Gold. This means a higher-than-expected payrolls’ figure will have a depressing effect on the Gold price and vice versa. Higher NFP generally has a positive effect on the value of the USD, and like most major commodities Gold is priced in US Dollars. If the USD gains in value, therefore, it requires less Dollars to buy an ounce of Gold. Also, higher interest rates (typically helped higher NFPs) also lessen the attractiveness of Gold as an investment compared to staying in cash, where the money will at least earn interest.

Nonfarm Payrolls is only one component within a bigger jobs report and it can be overshadowed by the other components. At times, when NFP come out higher-than-forecast, but the Average Weekly Earnings is lower than expected, the market has ignored the potentially inflationary effect of the headline result and interpreted the fall in earnings as deflationary. The Participation Rate and the Average Weekly Hours components can also influence the market reaction, but only in seldom events like the “Great Resignation” or the Global Financial Crisis.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.