US Dollar strengthens as economic outlook dims

US Dollar

The US economy, when analysed, suggests a negative outlook due to the projected upcoming deterioration in GDP and interest rates that are expected to be higher for longer.

Intermarket analysis aligns with the negative macroeconomic outlook suggesting that sentiment may be bearish.

-

US Dollar Index (DXY) has gained 4.2% since July after it had fallen 4.0% in the two months prior.

-

S&P 500 has declined 4.6% since July after it had gained 27.8% in the nine months prior.

-

Six month Treasury yields have gained 0.88% since March after it had declined 0.44% in the one month prior.

Euro

The EA economy, when analysed, suggests a slightly positive outlook due to the projected stabilised GDP and falling inflation although the potential for interest rates being higher for longer is a risk to this sentiment.

Intermarket analysis does not align with the slightly positive macroeconomic outlook suggesting that sentiment may bebearish.

-

EUR/USD has declined 3.8% since July after it had gained 4.8% in the two months prior.

-

DAX has declined 5.0% since July after it had gained 5.5% in the one month prior.

-

Six month German Bund yields have gained 4.4% since November 2021 after it had remained near 0 for many years prior.

Pound Sterling

The UK economy, when analysed, suggests a slightly positive outlook due to the projected stabilised GDP and falling inflation although the potential for interest rates being higher for longer is a risk to this sentiment.

Intermarket analysis does not align with the slightly positive macroeconomic outlook suggesting that sentiment may bebearish.

-

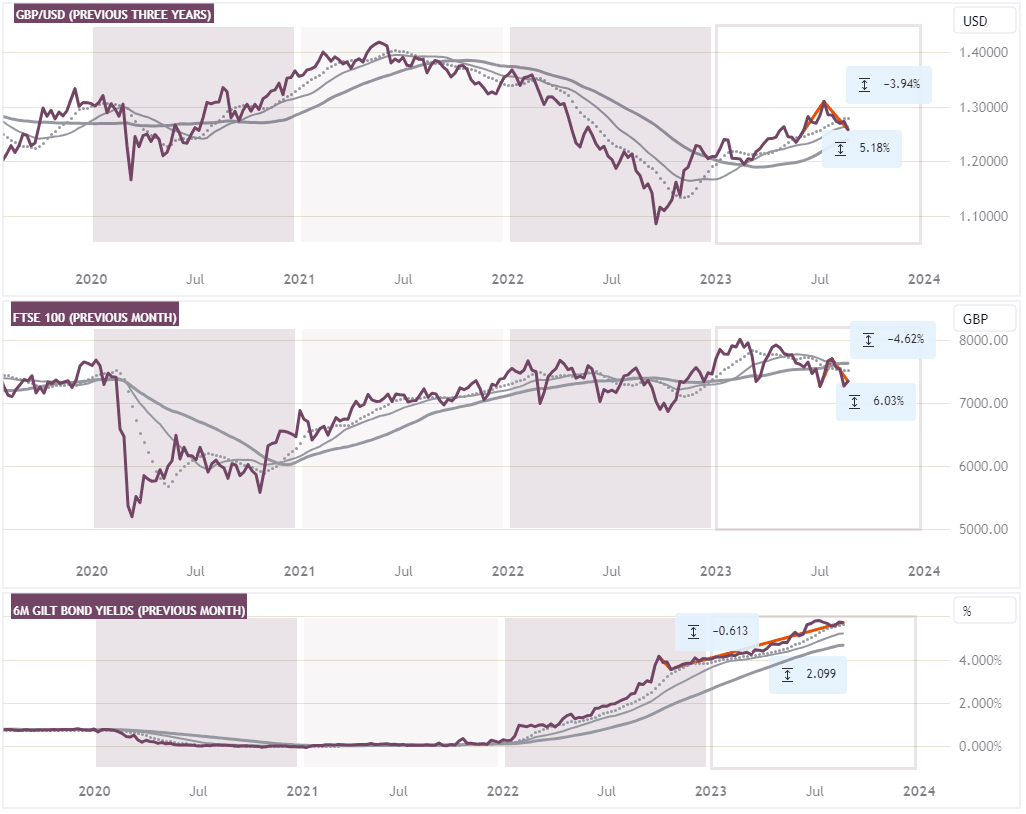

GBP/USD has declined 3.9% since July after it had gained 5.1% in the two months prior.

-

FTSE 100 has declined 4.6% since July after it had gained 5.1% in the one month prior.

-

Six month Gilt yields have gained 2.0% since October 2022 after it declined 0.6% in the one month prior.

Last week's events

Wednesday, August 23rd

-

EA PMI’s missed expectations.

-

GB PMI’s missed expectations.

-

US PMI’s missed expectations.

Thursday, August 24th

-

US Unemployment Claims slightly below expectations.

-

Day 1 of the Jackson Hole Symposium.

Friday, August 25th

- Day 2 of the Jackson Hole Symposium data-dependant central banks to remain on the hawkish side of monetary policy.

This week's events

Tuesday, August 29th

-

US CB Consumer Confidence expected to decline.

-

US JOLTS Job Openings expected to remain steady.

Wednesday, August 30th

-

DE Prelim CPI expected to remain steady.

-

US ADP Non-Farm Employment Change expected to decline.

-

US Prelim GDP expected to remain steady.

Thursday, August 31st

-

EA CPI Flash Estimate expected to slightly decline.

-

US PCE Price Index expected to remain steady.

-

US Unemployment Claims expected to remain steady.

Friday, September 1st

-

US Average Hourly Earnings expected to slightly decline.

-

US Non-Farm Employment Change expected to decline.

-

US Unemployment Rate expected to remain steady.

-

US ISM Manufacturing PMI expected to remain steady.

Next week's events

Wednesday, September 6th

- US ISM Services PMI.

Thursday, September 7th

- US Unemployment Claims.

Author

Gavin Pearson

Independent Analyst

Gavin Pearson of Jeepson Trading is a currencies speculator from the UK focused on the G7 economies and is a recognized member of the eToro Popular Investor Program as well as being a funded prop trader with The 5%ers.