US Dollar Price Annual Forecast: King for longer?

- The US Dollar is en route to posting decent gains in 2024.

- The Trump 2.0 version should be supportive of strong USD in 2025.

- The Federal Reserve will slow the pace of its easing cycle next year.

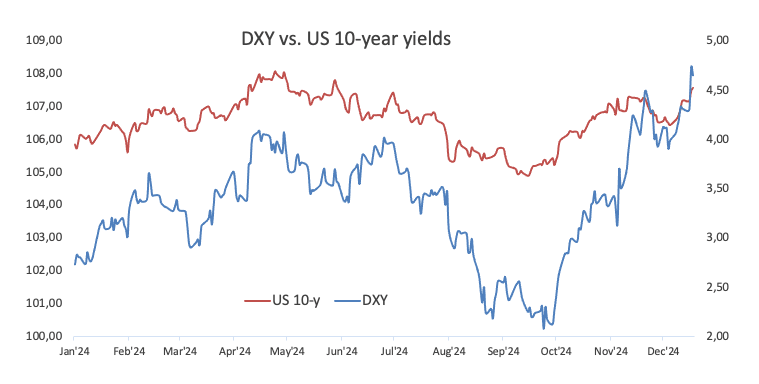

The greenback—tracked by the US Dollar Index (DXY)—started the new year with a gradual yet choppy ascent, encountering temporary resistance around the 106.50 region in May. However, it lost momentum afterward, leading to a significant pullback toward the psychological 100.00 mark by late September.

So, what stopped the US Dollar (USD) from plunging into deeper waters back then? What changed? The answer isn’t "what,” but “who.”

Enter the so-called “Trump trade,” which gained momentum alongside rising investor expectations that the former hotel magnate had a real chance of defeating Democratic candidate Kamala Harris in the November 5 election, reclaiming the Oval Office, and becoming the 47th US President.

And so it began.

The “Green Sweep”

In October, the Greenback ignited a significant rally, which paused briefly around the US elections in early November. Following the election results and the growing likelihood of a “Red Sweep,” the US Dollar Index (DXY) resumed its uptrend, climbing past the 108.00 barrier for the first time since November 2022.

This upward move in the index was mirrored in key 10-year Treasury yields, which surged to the 4.50% region—multi-month highs—by mid-November before triggering a corrective pullback.

The US economy is “in a very good place”

But the focus is not solely on Donald Trump. The US Dollar’s notable strength in 2024 has also been supported by the resilience of the US economy, particularly when compared to its global peers.

Although the US labour market has shown some signs of cooling in recent months, key indicators in this vital sector remain robust. In fact, the easing of labour market conditions appears neither sustainable nor particularly convincing. This aligns with Federal Reserve (Fed) Chair Jerome Powell’s stance that any significant deterioration in the labour market would be unwelcome.

When it comes to inflation, upward pressure on consumer prices remains persistently high, staying above the Fed’s 2.0% target. While many Fed policymakers have expressed support for additional interest rate cuts, others remain cautious about the stubbornness of both the Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) Price Index.

Extra caution has resurfaced following Donald Trump’s victory, given his well-known support for implementing tariffs. So far, he has signalled the likelihood of imposing tariffs on imports from China and the European Union, with Canada and Mexico potentially next in line.

The immediate effect of tariffs is an increase in inflation due to higher costs for importers and consumers. This, in turn, could lead to retaliatory actions, potentially escalating into a full-blown trade war and heightening global trade tensions. Such a scenario might prompt the Federal Reserve to pause its current easing cycle, bring it to a halt, or even consider raising interest rates. All these factors would likely support a stronger US Dollar in the future.

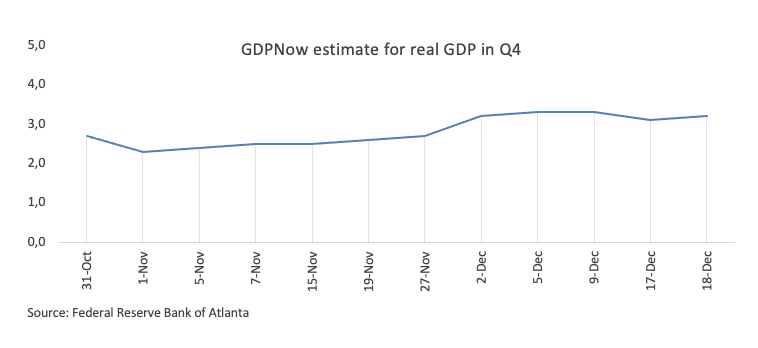

In terms of economic growth, the US economy has been significantly outperforming its G10 counterparts. For now, there appears to be little indication that this trend will reverse in the near-to-medium terms. However, it remains uncertain whether the economic consequences of Trump’s tariff policies could meaningfully dent US GDP growth.

Let the Trump 2.0 show begin

The so-called “Trump trade” has been a driving force behind the pronounced rally in the US Dollar since early October, fuelled by a shift in US investor sentiment towards a potential Donald Trump victory in the November 5 election.

A glimpse into what a Trump 2.0 administration might look like reveals that, in terms of economic policy, Trump emphasises corporate deregulation, a more lenient approach to fiscal policy, and a focus on promoting domestic manufacturing. He also advocates for tariffs to protect American industries and reduce reliance on imports.

Strict immigration enforcement remains central to Trump’s agenda, including increased border security, tighter asylum policies... and the possible completion of the southern border wall?

In foreign policy, Trump prioritises US self-interest, supporting reduced US military involvement overseas, pressuring NATO allies to increase defence spending, and confronting China both economically and diplomatically.

On energy and environmental policy, Trump promotes energy independence by expanding fossil fuel production, rolling back environmental regulations, and withdrawing from international climate agreements.

Trump, the Fed, and Chair Powell

Monetary policy is another area likely to draw attention, particularly the dynamic between Trump and Fed Chair Powell. During his first term, Trump frequently criticised Powell, accusing him of being too slow to cut interest rates. Recently, Trump has floated the idea that the president should have influence over interest rate decisions—a role traditionally reserved for the independent Federal Reserve. How this tension plays out could have significant implications for economic policy and the Fed’s independence.

Earlier this month, Powell addressed concerns about his role being undermined by the incoming administration. Speaking at a New York Times event, he dismissed the notion of a "shadow Fed chair" and expressed confidence in building a strong relationship with Treasury Secretary Scott Bessent, who recently said that Powell should serve the remainder of his term.

Against the backdrop of a resilient US economy, some gradual (debatable?) easing in the labour market, and persistent inflationary pressures, Powell suggested that the Fed is in no hurry to further reduce its Federal Funds Target Rate (FFTR). He also highlighted the importance of a cautious approach in determining the neutral rate.

Powell’s stance aligns with that of FOMC Governor Michelle Bowman, who recently argued that inflation remains a significant risk to the economy. She also noted that the labour market's continued strength, nearing full employment, raises concerns about price stability. Bowman advocated for a gradual and measured approach to reducing the policy rate as long as inflation remains elevated.

The above was reinforced at the final FOMC meeting of the year. On December 18, the central bank aligned with broad expectations and lowered its Fed Funds Target Range by 25 basis points to 4.25%-4.50%. However, it signalled a more cautious pace of easing for the next year, with the majority of officials expressing concerns that inflation could reignite.

Regarding the so-called “dot plot,” the updated version provided insight into central bankers' economic expectations. It revealed plans for two small interest rate cuts next year, as inflationary pressures remain persistent. This measured approach suggests the Fed is in no hurry to act in January, when Trump begins his second term in the White House.

The new projections hint at a more cautious stance following the Fed’s third consecutive rate cut in December. Policymakers expect the benchmark lending rate to end in 2025 in the 3.75%-4.00% range. By late 2026, they anticipate rates will ease further, reaching about 3.4%. Even at that level, borrowing costs would remain above their revised estimate of the “neutral” rate—now set at 3%—the level where the economy neither overheats nor slows.

The message? The Fed is treading carefully, trying to control inflation without overcorrecting in an uncertain economic environment.

US economic exceptionalism to extend into 2025

What about updated projections for economic activity and inflation? Fed officials expect the domestic economy to grow faster than previously forecast, with growth pegged at 2.5% this year and 2.1% in 2025. These figures represent an upgrade from September’s projections, which predicted 2% growth for both years.

Unemployment, currently at 4.2%, is expected to remain steady through this quarter before rising slightly to 4.3% by late 2025. This marks an improvement from earlier projections, which had forecast a rate of 4.4% for both periods.

Inflation, however, remains stubborn. Core inflation, a key measure that excludes volatile food and energy prices, is now projected to stay elevated for longer than previously expected. It is forecast to hit 2.8% this year before gradually easing to 2.5% by the end of 2025. These figures are higher than September’s projections, which anticipated core inflation at 2.6% this year and 2.2% next year.

The updated outlook highlights the ongoing challenges of managing economic growth alongside inflation control, as price pressures persist despite a cooling labour market.

In his final press conference of 2024, Chair Jerome Powell reiterated that policymakers are focused on bringing inflation closer to their 2% target before considering further rate cuts. He acknowledged that inflation has exceeded year-end expectations, underscoring the need for continued progress toward price stability.

Powell also remarked that the labour market is softening, but in a gradual and orderly manner. He described the current economic conditions as relatively balanced between the Fed’s dual mandates of low inflation and full employment.

When asked about the possibility of raising interest rates instead of cutting them, Powell did not entirely rule out the idea but said it was unlikely. "You don't rule things completely in or out in this world. That doesn't appear to be a likely outcome," he commented.

On the topic of the incoming Trump administration, Powell emphasised it was too early to predict how President-elect Trump’s economic policies might impact the economy or the Fed’s decisions. He noted the significant uncertainty surrounding these plans, saying, "It’s very premature to make any kind of conclusion. We don’t know what will be tariffed, from what countries, for how long, in what size."

Powell urged patience, adding, "We need to take our time, not rush," as the central bank waits for clearer signals on the new administration’s policies. While there is growing speculation that Trump’s preferences for tariffs and stricter immigration policies could drive inflation higher, Powell made it clear that the Fed will wait for concrete developments before adjusting its approach.

US Dollar Index Technical Analysis: Bullish outlook prevails

The yearly high above the 108.00 barrier, recorded soon after the Fed’s hawkish cut on December 18, was confirmed by the daily RSI, which initially flirted with the overbought region, leaving some room for a potential near-term corrective move.

At the upper end of the range, the continuation of a bullish bias is likely to face immediate resistance at the 2024 high of 108.26. Beyond this level, resistance aligns with the November 2022 peak of 113.14, reached on November 3, followed by the October 2022 top of 113.94, marked on October 21, and the 2022 peak of 114.77, registered on September 28.

If sellers regain control, initial support lies at the December low of 105.42, clocked on December 6. A break below this level could pave the way for a test of the provisional 55-day SMA at 105.22, situated above the more critical 200-day SMA at 104.24.

A deeper pullback might revisit the November low of 103.37 (November 5), further reinforced by the nearby 100-day SMA. South of this area, the 200-week SMA at 101.40 provides additional support, followed by the 2024 bottom of 100.15, achieved on September 27.

For now, further upside remains plausible as long as the index holds above the key 200-day SMA. The bullish outlook is supported by the index trading well above its Ichimoku cloud, with the RSI trending upward near 70. Additionally, the Average Directional Index (ADX) at approximately 35 signals moderate strength in the current trend.

DXY daily chart

Conclusion

It appears that 2025 should be a positive year for the US Dollar.

On the geopolitical front, there is no clear end in sight for the Russia-Ukraine war or the Israel-Iran-Lebanon conflict, while the volatile situation in Syria continues to fuel uncertainty in the Middle East. This persistently complex landscape is likely to sustain demand for safe-haven assets, which should provide support for the Greenback.

Furthermore, if the Trump 2.0 scenario materialises as many market participants anticipate, significant tariffs are likely to return, potentially triggering retaliatory measures and reigniting global trade tensions. Rising inflationary pressures could compel the Fed to act, potentially halting the ongoing rate-cut cycle or even initiating a rate-hiking programme. This would likely push US yields higher and further strengthen the US Dollar.

The stark contrast between the resilience of the US economy and the struggles of its global peers is expected to deepen the monetary easing cycle abroad next year, compared to the limited rate reductions—or lack thereof—in the United States. This divergence supports the case for further depreciation of rival currencies, reinforcing a constructive outlook for the Greenback into 2025.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.