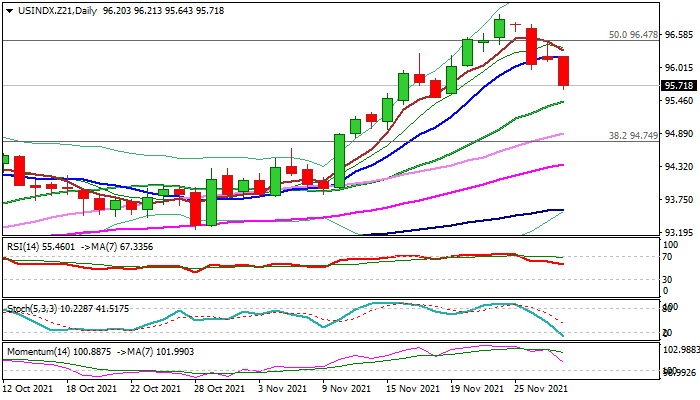

US Dollar Index

The dollar index is holding in red for the third straight day and extending pullback from new multi-month high at 96.92.

Bears gained control after the news that new variant of coronavirus was detected last Friday, with narrower range on Monday preceding fresh acceleration lower on Tuesday.

Key supports at 95.52/43 (Fibo 38.2% of 93.24/96.92 / rising 20DMA) are under pressure, with break here to further weaken the structure.

Strong bearish signal is developing on weekly chart as last week’s action ended in a shooting star candlestick, while bulls were trapped above 96.78 (50% retracement of 103.80/89.15 downtrend) and subsequent weakness on Mon/Tue adds to the strength of the signal.

Break of 95.52/43 pivots would risk deeper pullback towards 94.75 (200WMA) violation of which would generate initial signal that dollar’s larger uptrend might be coming to an end.

Res: 95.99; 96.21; 96.47; 96.92.

Sup: 95.43; 95.08; 94.75; 94.36.

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.