Israeli Shekel falls to new multi-year low vs US Dollar

US Dollar Index

The Israeli Shekel fell to the lowest since February 2016 against the US dollar on Monday, as the currency lost ground on violent clashes in the region which started during the weekend.

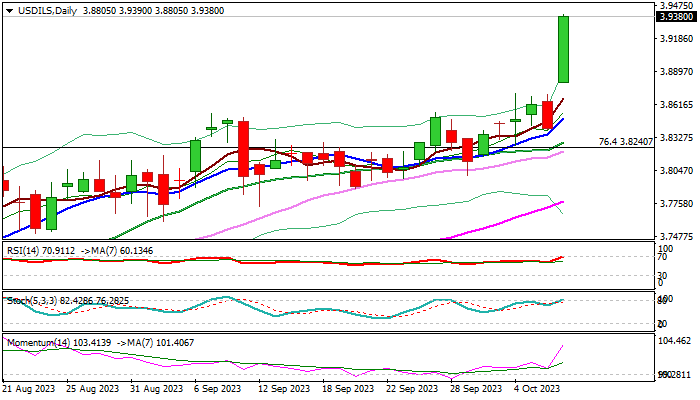

The USDILS was holding within a larger uptrend since late 2021, which accelerated on Monday after trading started with gap-higher opening.

Fresh advance broke above previous tops at 3.88/ zone (Mar 2020/Nov/Dec 2016) as well as round-figure barrier at 3.90, hitting new multi-year highs at 3.935 zone.

Bulls so far do not show signs of fatigue as conflict is threatening to escalate, dampening demand for Shekel and prompting investors into safe-haven US dollar.

However, daily studies are turning overbought, which may result in a partial profit-taking, while Bank of Israel expressed readiness to support the currency and probably ease pressure on Shekel.

Limited dips are likely to provide better buying opportunities in current conditions, as bulls eye target at 3.95 and may challenge psychological 4.00 barrier in case of stronger acceleration.

Res: 3.9400; 3.9500; 3.9604; 3.9825.

Sup: 3.9060; 3.9000; 3.8805; 3.8666.

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.