US Dollar Index outlook: Dollar rose in reaction to shift in Trump's rhetoric

US Dollar Index

The dollar index edged higher after opening with gap higher on Monday, lifted by a significant shift in rhetorics pf President-elect Donald Trump, who turned his aims for weaker dollar to fight trade war, to threats to BRICS member countries of facing a 100% tariffs if create new or support another currency in attempts to replace dollar.

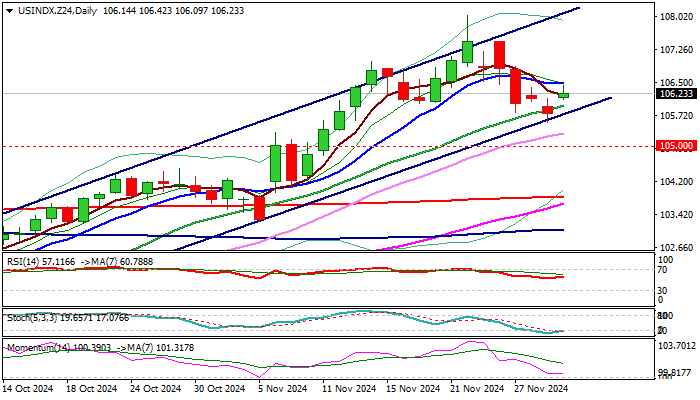

Fresh rise of dollar generated initial signal of reversal after a four-day pullback was contained rising channel support trendline, reinforced by daily Kijun-sen (at 105.60 zone), although more work at the upside is required to confirm signal.

Break of immediate resistances at 106.50 zone (Fibo 38.2% of 108.04/105.57 bear-leg / 10DMA) to firm near-term structure for attack at next pivot at 106.81 (50% retracement / daily Tenkan-sen), violation of which to shift near term focus to the upside and signal that corrective phase might be over.

Technical picture on daily chart is overall bullish, as 14-d momentum is in positive territory and turning up, stochastic is emerging from oversold zone and converging 55/200DMA’s are signaling possible formation of Golden Cross.

Near-term action is expected to remain biased higher while holding within month long bull-channel and pointing to steady uptrend.

Res: 106.50; 106.81; 107.10; 107.46.

Sup: 106.09; 105.60; 105.32; 105.00.

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.