US Dollar Index outlook: Dollar index rises on fresh hawkish signals from Fed; US NFP in focus

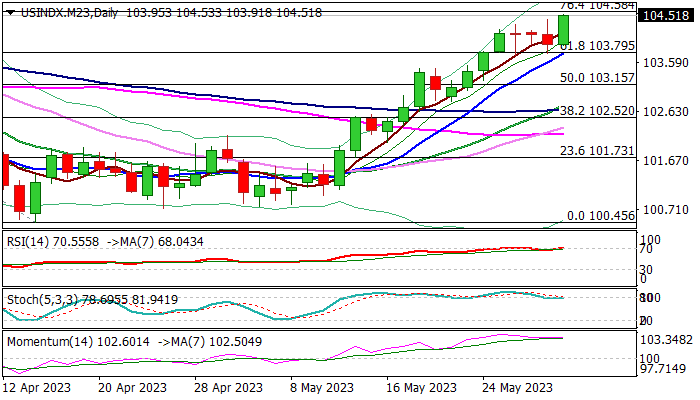

US Dollar Index

The dollar index hit new highest in two and a half months following fresh acceleration higher on Wednesday, sparked by renewed hawkishness from Fed.

Comments that there are no significant reasons for the central bank to pause its rate hiking cycle and growing signals that the Fed may keep high borrowing cost longer, provided boost to the greenback.

Fresh gains generate initial signal of bullish continuation after the action was paused for consolidation in past three days and pressuring targets at 104.58/70 (Fibo 76.4% of 105.85/100.45 / Mar 15 lower top), break of which would unmask key barriers at 105.49/85 (200DMA / Mar 8 top).

Overbought daily studies warn of possible extended consolidation, with larger bulls expected to remain intact while holding above 103.75 zone (higher base / broken Fibo 61.8% / rising 10 DMA).

Near-term action may also move at a lower pace as markets await release of US labor report for May on Friday, which is expected to generate stronger signals and also give more evidence about

Fed’s decision in mid-Jube policy meeting.

Stronger than expected NFP numbers (180K f/c) would further boost the greenback and also raise probability of another rate hike in June.

Res: 104.58; 104.70; 105.49; 105.85.

Sup: 103.91; 103.75; 103.15; 102.83.

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.