US Dollar Index

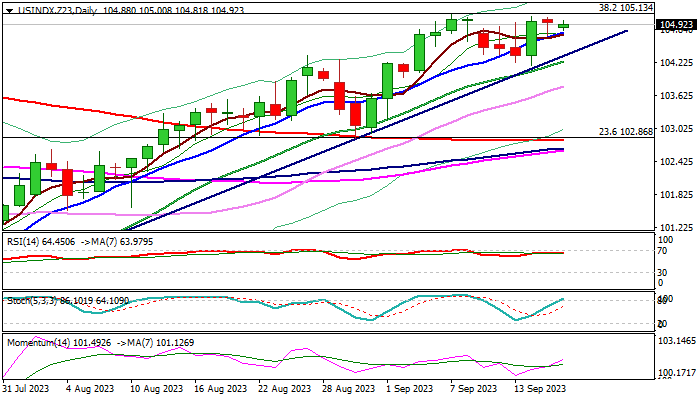

The dollar index remains steady and holding within a narrow range just under 6-month high on Monday.

Larger picture shows near-term action moving in the sideways mode for the third consecutive week, as bulls faced strong headwinds on approach to key barriers at 105.13/47 (Fibo 38.2% of 114.72/99.20 / base of thickening daily Ichimoku cloud.

Traders also reduced speed ahead of key events, last week’s US inflation data and ECB rate decision and coming policy decisions of the Fed, BoE and BOJ this week.

Markets particularly focus on the US central bank, which is widely expected to keep rates on hold in September, but signals about their next steps will be crucial for dollar’s near-term direction.

Should Fed follow the ECB’s way and announce that the tightening cycle is over and possible start of rate cuts to be expected in mid-2024, the dollar will likely lose ground.

On the other hand, hawkish tones from Fed should not be ruled out as recent data show that the economy is still in a good shape and labor sector is tight, while inflation, although still elevated, being in downward trajectory, which contributes to scenario of one more hike by the end of the year and keeping high interest rates for extended period, until inflation returns to 2% target.

The greenback should benefit in such scenario, with firm break of 105.13 Fibo barrier to generate bullish signal and spark fresh acceleration higher.

Res: 105.13; 105.47; 105.85; 106.22

Sup: 104.45; 104.17; 103.86; 103.34

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD stays near 1.0400 in thin holiday trading

EUR/USD trades with mild losses near 1.0400 on Tuesday. The expectation that the US Federal Reserve will deliver fewer rate cuts in 2025 provides some support for the US Dollar. Trading volumes are likely to remain low heading into the Christmas break.

GBP/USD struggles to find direction, holds steady near 1.2550

GBP/USD consolidates in a range at around 1.2550 on Tuesday after closing in negative territory on Monday. The US Dollar preserves its strength and makes it difficult for the pair to gain traction as trading conditions thin out on Christmas Eve.

Gold holds above $2,600, bulls non-committed on hawkish Fed outlook

Gold trades in a narrow channel above $2,600 on Tuesday, albeit lacking strong follow-through buying. Geopolitical tensions and trade war fears lend support to the safe-haven XAU/USD, while the Fed’s hawkish shift acts as a tailwind for the USD and caps the precious metal.

IRS says crypto staking should be taxed in response to lawsuit

In a filing on Monday, the US International Revenue Service stated that the rewards gotten from staking cryptocurrencies should be taxed, responding to a lawsuit from couple Joshua and Jessica Jarrett.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.