US Dollar Index

The dollar index turned to red on Monday but remains within a narrow multi-day range, as traders stand aside, awaiting policy decisions from the US Federal Reserve, European Central Bank and the Bank of England.

The US policymakers are widely expected to further slow pace of policy tightening and hike interest rate by 25 basis points at the end of two-day policy meeting on Feb 1, while the other two central banks are likely to opt for 0.5% rate increase each, in the meetings on Thursday.

The dollar remains under strong pressure, holding in a steep fall for four straight months, deflated by dovish turn from Fed, as US inflation decreased in past few months and recent economic data showed that the US economy is performing well so far that boosted risk sentiment.

Analysts support the view of dollar’s further weakening, as the Fed is exiting its cycle of aggressive rate hikes (though the policymakers highlighted the need of further hikes and above initially estimated peak, due to expectations that inflation will remain elevated for some time), while the ECB and BOE are expected to keep hawkish stance, due to more difficult condition of their economies.

Diverging stances and converging interest rate values would add to demand for riskier assets and keep the dollar in defensive.

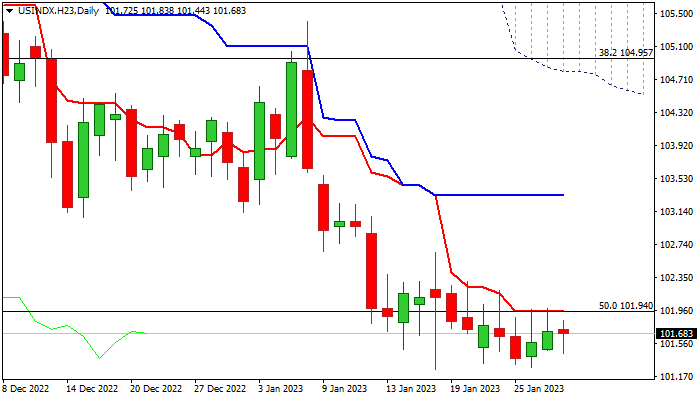

Technical picture remains firmly bearish on daily chart, with initial resistance provided by daily Tenkan-sen (101.94) which recently capped several attacks, followed by daily Kijun-sen (103.32), which should cap extended upticks and keep bears intact.

Res: 101.94; 102.64; 103.32; 104.05.

Sup: 100.52; 100.25; 100.00; 98.92.

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD extends recovery beyond 1.0400 amid Wall Street's turnaround

EUR/USD extends its recovery beyond 1.0400, helped by the better performance of Wall Street and softer-than-anticipated United States PCE inflation. Profit-taking ahead of the winter holidays also takes its toll.

GBP/USD nears 1.2600 on renewed USD weakness

GBP/USD extends its rebound from multi-month lows and approaches 1.2600. The US Dollar stays on the back foot after softer-than-expected PCE inflation data, helping the pair edge higher. Nevertheless, GBP/USD remains on track to end the week in negative territory.

Gold rises above $2,620 as US yields edge lower

Gold extends its daily rebound and trades above $2,620 on Friday. The benchmark 10-year US Treasury bond yield declines toward 4.5% following the PCE inflation data for November, helping XAU/USD stretch higher in the American session.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.