US Dollar Index outlook: Dollar falls further on rising bets for Fed rate cut

Dollar Index

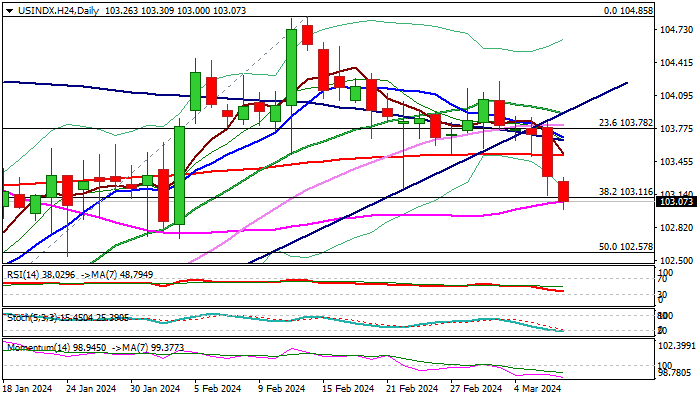

The dollar index falls to five-week low on Thursday, remaining under increased pressure from growing expectations for June rate cuts.

Fed Chair Powell added to expectations by relatively dovish remarks in his testimony on Wednesday, saying that rate cuts will likely be appropriate later this year if economy evolves broadly as expected.

Markets shift focus on Friday’s release of US labor report, with weaker than expected February numbers to further sour the sentiment and increase pressure on greenback.

Fresh extension lower on Thursday broke through pivotal Fibo support at 103..11 (38.2% of 100.29/104.85 rally, reinforced by 55DMA) which contained Wednesday’s drop, with close below this level to generate fresh bearish signal and open way for extension towards supports at 102.57 and 102.04 (Fibo 50% and 61.8% respectively).

Technical studies on daily chart turn to full bearish setup, adding to negative outlook.

Oversold conditions, on the other hand, warn of price adjustment, with broken 200DMA (103.51) offering solid resistance and expected to cap upticks and keep bears in play for fresh push lower.

Res: 103.30; 103.51; 103.68; 103.91.

Sup: 102.71; 102.57; 102.04; 101.74.

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.