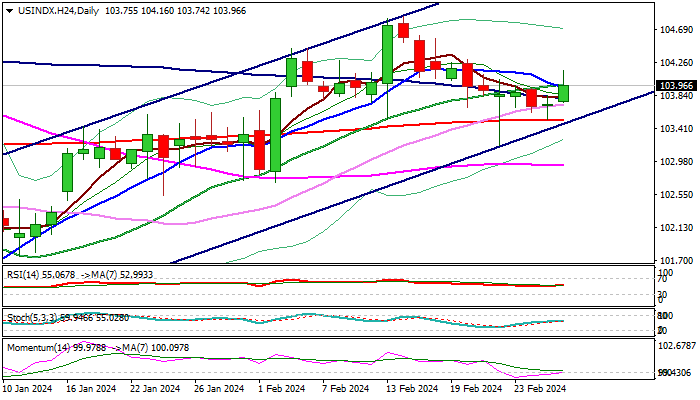

US Dollar Index

The dollar index bounced on Wednesday, after 200DMA (103.52) repeatedly contained dips in recent sessions.

Reversal pattern is forming on daily chart and 14-d momentum is ascending from negative territory and pressuring the centreline, contributing to positive signals, which will still look for additional confirmation on daily close above cracked Fibo barriers at 104.00/02 (converged 10/20DMA’s / 50% retracement of 104.85/103.19 bear-leg).

However, firmer direction signals are expected to come from releases of inflation data from the US on Thursday, which will give more details about Fed’s plans to start cutting interest rates.

Near-term action is expected to keep bullish bias while holding above 103.80 zone (broken Fibo 38.2% / daily Tenkan-sen).

Res: 104.02; 104.22; 104.46; 104.85.

Sup: 103.80; 103.52; 103.19; 102.93.

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

AUD/USD: Bulls need to clear 0.6540

AUD/USD reversed part of Monday’s optimism and came all the way down to revisit the 0.6450 region, where its critical 200-day SMA also sits. The marked daily pullback in the pair followed the solid rebound in the US Dollar despite steady concerns on the trade front.

EUR/USD: Tough resistance emerges around 1.1450

EUR/USD gave away most of the gains recorded at the beginning of the week, coming back to the area below the 1.1400 support on the back of the resurgence of the bid bias in the Greenback. Market participants will now shift their attention to the upcoming data releases in the US labour market.

Gold holds on to higher ground around $3,350

Gold is falling from its multi-week high of over $3,400 achieved on Monday. It is currently losing further momentum and flirting with the $3,350 region per troy ounce on the back of a strong Greenback, higher yields and mixed US data.

Ripple Price Prediction: XRP could stage massive recovery amid growing institutional adoption

Ripple’s (XRP) gains momentum as the crypto market broadly consolidates, trading at $2.22 at the time of writing on Tuesday. The slight uptick in the XRP price comes amid recovery in the broader crypto market, particularly with Bitcoin (BTC) stepping above $106,000.

AUD/USD: Bulls need to clear 0.6540

AUD/USD reversed part of Monday’s optimism and came all the way down to revisit the 0.6450 region, where its critical 200-day SMA also sits. The marked daily pullback in the pair followed the solid rebound in the US Dollar despite steady concerns on the trade front.