US Dollar Index analysis: Hawkish FOMC pause, Trump's Fed criticism, and technical outlook

-

The Federal Reserve held interest rates steady and signaled a "wait and see" approach as uncertainties remain.

-

US Commerce Secretary Nominee Lutnick expressed support for sweeping tariffs, claiming they don't impact inflation.

-

President Trump blamed the Fed for inflation, escalating tension between him and the central bank.

-

The US Dollar Index (DXY) experienced volatility following the FOMC, but struggles at key resistance level.

The FOMC meeting has officially passed and let me start by saying that there were no real surprises. Looking at Fed Chair Powell's press conference, the Fed Chair delivered a very balanced statement, keeping all market participants interested in the Central Bank's next moves.

Fed Chair Powell said that there would be no rush to cut rates again until inflation and jobs data made it more appropriate. No surprises here, as I have been saying in many articles of late there are too many uncertainties around the US economy moving forward. Most of this comes down to how markets will react to the implementation of tariffs as well as their potential effect.

Yesterday we heard some interesting comments from US Commerce Secretary Nominee Lutnick who is the frontrunner for the position. Lutnick stated that is in favor of sweeping tariffs saying it does not impact inflation. Lutnick was also hawkish on China which does not bode well for markets moving forward.

All of these uncertainties are the main reasons the Fed needed to adopt a more balanced and an almost ‘wait and see’ approach moving forward.

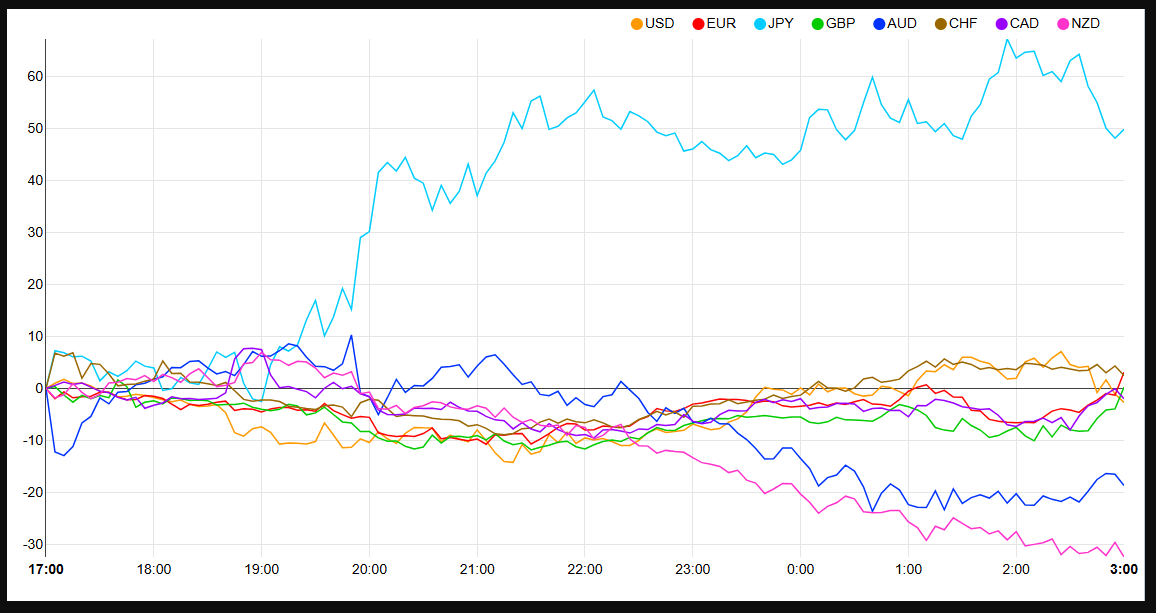

Currency strength chart: Strongest JPY, EUR, CHF, GBP, CAD, USD, AUD, NZD - Weakest.

Source: FinancialJuice (click to enlarge)

President Trump and Fed on a collision course?

President Trump has never been the biggest fan of the Federal Reserve and has not directly called for lower rates yet as he promised but did blame inflation on the Fed. Yesterday the President said that If the Fed had spent less time on DEI, gender ideology, "green" energy, and fake climate change, inflation would never have been a problem.

Whether or not you agree with President Trump, there does appear to be some friction which may come to a head in the coming months. When asked yesterday about President Trump, Federal Reserve Chair Jerome Powell did not comment but said he had not been in touch with the President.

This will come to a head at some stage and is worth keeping an eye on as well over the coming weeks and months.

Key comments from chair Powell

A quick summary of some of the key comments from Fed Chair Powell yesterday.

-

Economy has made "significant progress toward goals"

-

Inflation has moved much closer to goal remains somewhat elevated

-

Labor market is not a source of inflationary pressures

-

Fed does "not need to be in a hurry to adjust policy"

-

Fed to continue meeting-by-meeting approach

-

Fed's 2% long-term inflation goal will not change

The inflation conundrum is also something the Fed needs to consider given the recent uptick has come ahead of any proposed tariffs being implemented.

Source: LSEG (click to enlarge)

The Fed will now get a peak at their preferred inflation gauge, the PCE data due for release tomorrow. Markets are expecting consumer spending MoM to have ticked up to 0.5% from a previous 0.4% with the YoY print forecast to rise to 2.6% from a previous 2.4%.

Technical analysis and DXY reaction

US Dollar Index (DXY)

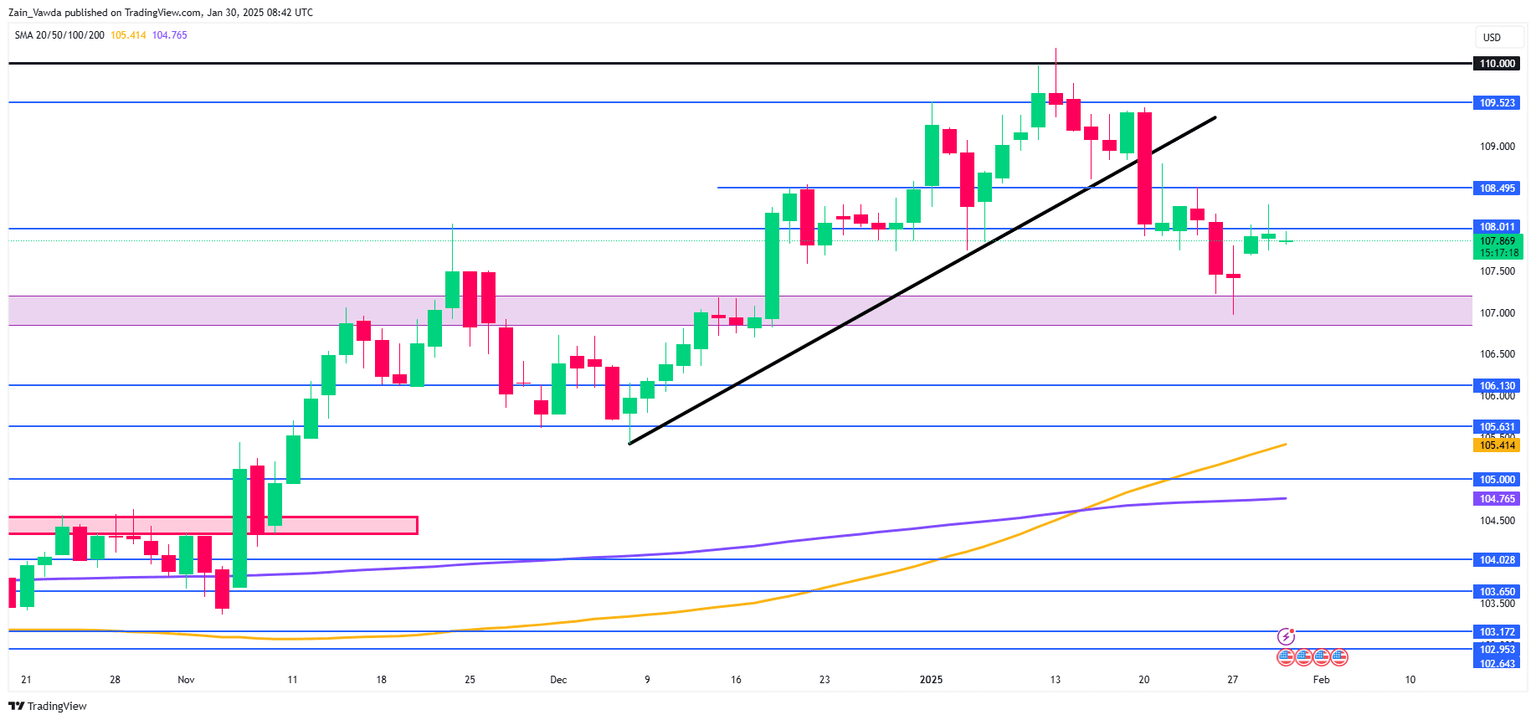

The US Dollar index rose briefly after the Powell presser yesterday but struggled to push on.

The US Dollar has been on a rollercoaster of late, with tariff chatter either supporting the US Dollar or dragging it lower.

This is likely to continue over the coming days until more clarity on the tariff picture is given. President Trump remains on course to implement 25% tariffs on Mexico and Canada on February 1, such a move could aid the US Dollar and provide support. However, any retaliatory tariffs may then see the Dollar face some weakness.

Looking at the DXY chart below and as you can see, the 108.00 handle has stood firm over the past two days, with yesterdays wick to the upside a sign of selling pressure. The daily candle closed as an inverted hammer which usually hints at further upside. However, the fact that the inverted hammer was printed at a resistance level means that further upside may not materialize.

Immediate resistance rests at 108.00 before the 108.49 comes into focus.

Support rests at 107.00 before the 106.13 and 105.63 handles come into focus.

US Dollar Index (DXY) daily chart, January 30, 2025.

Source: TradingView.com (click to enlarge)

Support

-

107.00.

-

106.13.

-

105.63.

Resistance

-

108.49.

-

109.52.

-

110.00.

Author

Zain Vawda

MarketPulse

Zain is a seasoned financial markets analyst and educator with expertise in retail forex, economics, and market analysis.