US Dollar eyes PCE inflation data after CPI scare [Video]

-

Core PCE price index to be crucial for markets amid sticky inflation fears.

-

Income and consumption to be watched too as US economy stays hot.

-

But can further upside surprises boost the dollar on Thursday, 13:30 GMT.

![US Dollar eyes PCE inflation data after CPI scare [Video]](https://editorial.fxstreet.com/images/Macroeconomics/EconomicIndicator/Prices/Inflation/sale-price-on-a-rack-of-clothes-64429433_XtraLarge.jpg)

Will PCE gauge ease or fuel inflation worries?

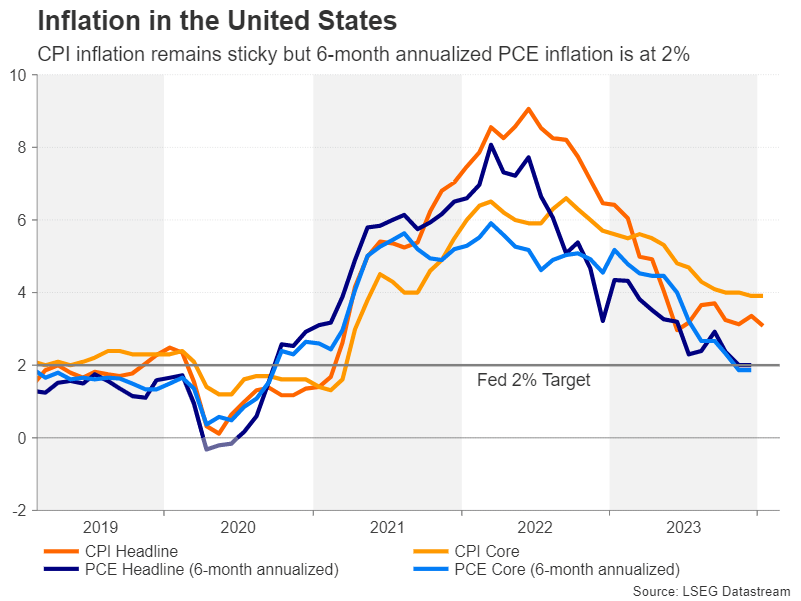

Even though the Fed has made great progress in its bid to bring inflation in the US under control, the next phase to get it all the way down to 2% is proving to be a little more difficult. The CPI measure of inflation has been stuck above 3.0% for some time now and core CPI was unchanged at 3.9% in January.

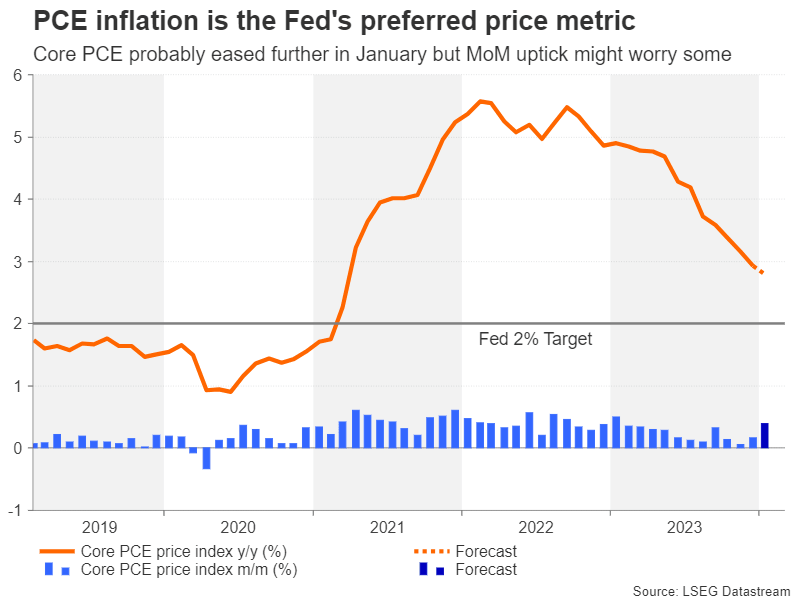

The inflation picture according to the Fed’s preferred PCE measure has been somewhat more encouraging lately, particularly when focusing on the six-month annualized rate. The headline PCE price index stood bang on the Fed’s 2.0% target in December and the core PCE price index was at 1.9% by this metric. However, the year-on-year rates still have some ground to cover and came in at 2.6% and 2.9%, respectively, in December.

For January, the core PCE price index is forecast to have cooled slightly lower to 2.8%, although the month-on-month rate is projected to have picked up to 0.4%. A stronger-than-expected reading, particularly in the month-on-month rate, would likely further stoke fears about high inflation rearing its ugly head again.

The big repricing

The recent run of upbeat indicators out of the world’s largest economy has put markets in a spin, prompting a sharp rethink on the expected Fed rate path. Markets were pricing almost seven rate cuts for this year at one point in January. A month later, those dovish bets have been scaled down to less than four cuts.

On the bright side, investors are now better aligned with the Fed’s thinking, although there is still some repricing to go as the Fed’s latest dot plot predicted three 25-bps rate cuts in 2024. Any further upside surprises in the inflation data following the CPI and PPI beats have the potential to spark some volatility across the major asset classes, including bonds and equities.

Can the Dollar extend its uptrend?

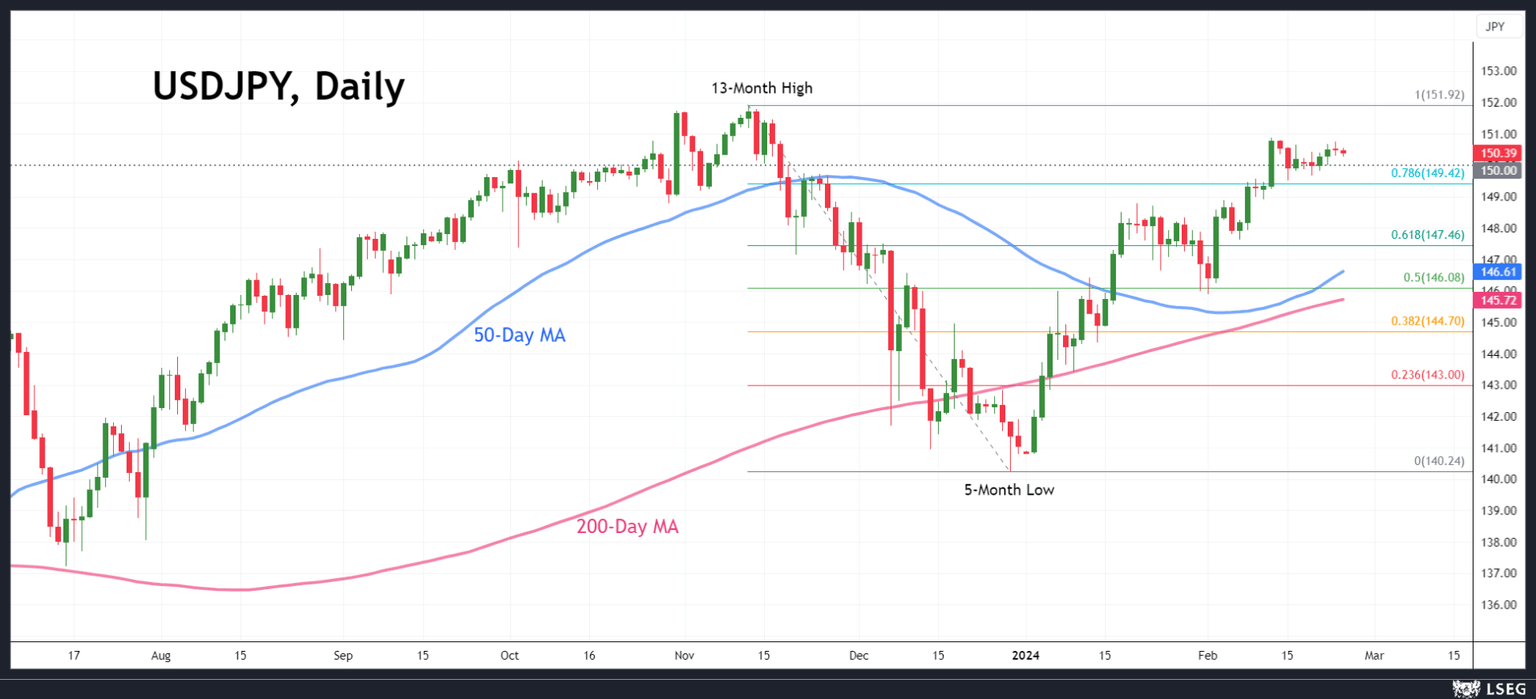

Treasury yields have been steadier lately but could resume their rally if there’s another hotter-than-expected inflation print. A jump in yields could be enough to inject some life into the US dollar, which has been drifting lower over the past 10 days, even against the beleaguered yen.

The pair has been struggling to advance past the 150 level, losing momentum as it approaches the November peak of 151.92 yen. A strong PCE report might be what it takes to jumpstart the stalled uptrend and push the dollar to a new high above 152 yen.

However, there are significant downside risks too for the greenback in the event of a miss in the core PCE price index. Whilst there are signs that the dollar’s latest upswing is running out of steam, it has nevertheless rebounded by around 2.5% against a basket of currencies this year and by more than 6% against the yen. A selloff could therefore stretch at least until the 50-day moving average in the 146.60 region if it turns into a negative correction.

Slowing consumption could be a good thing

Investors will also be watching the latest numbers on personal income and personal consumption that will be released alongside the PCE price indices. Personal income is expected to have increased by 0.4% m/m in January versus 0.3% in December. More importantly, personal consumption is forecast to have risen at a more moderate pace of 0.2% in January after surging by 0.7% in December.

A slowdown in consumer spending could ease concerns about an overheating economy and so would likely be welcomed by equity markets, though not so much by the dollar. However, markets would not react as positively if there’s a sudden deterioration in consumption as investors are positioned for a soft landing in the US economy. Anything that questions that view would weigh on risk sentiment.

Author

Mr Boyadjian graduated from the London School of Economics in 1999 with a BSc in Business Mathematics and Statistics. Following graduation, he joined PricewaterhouseCoopers in the Business Recoveries team, where he was responsibl