The US dollar index was weaker on Tuesday after having surged on Monday above the key 94.00 level. During the current period of fluctuation, the dollar index has thus far remained ensconced in a tight consolidation during this shortened Thanksgiving week in the U.S. While last week featured a pronounced drop for the dollar, the early part of the current week has seen the US currency vacillate in anticipation of key upcoming monetary and fiscal policy developments.

As US equities soared once again to new record highs on Tuesday, due in large part to a continuing series of strong earnings reports, markets were awaiting: a late afternoon speech by Fed Chair Janet Yellen, Wednesday’s release of minutes from the last FOMC meeting, and further details on the Republican tax reform plans.

With little in the way of major scheduled economic releases out of the US for the balance of this week and into next week (with the exception of Wednesday’s FOMC minutes and next week’s preliminary GDP reading), the dollar will likely take more of its cues from the progress of US fiscal policy, most notably tax reform, for the time being.

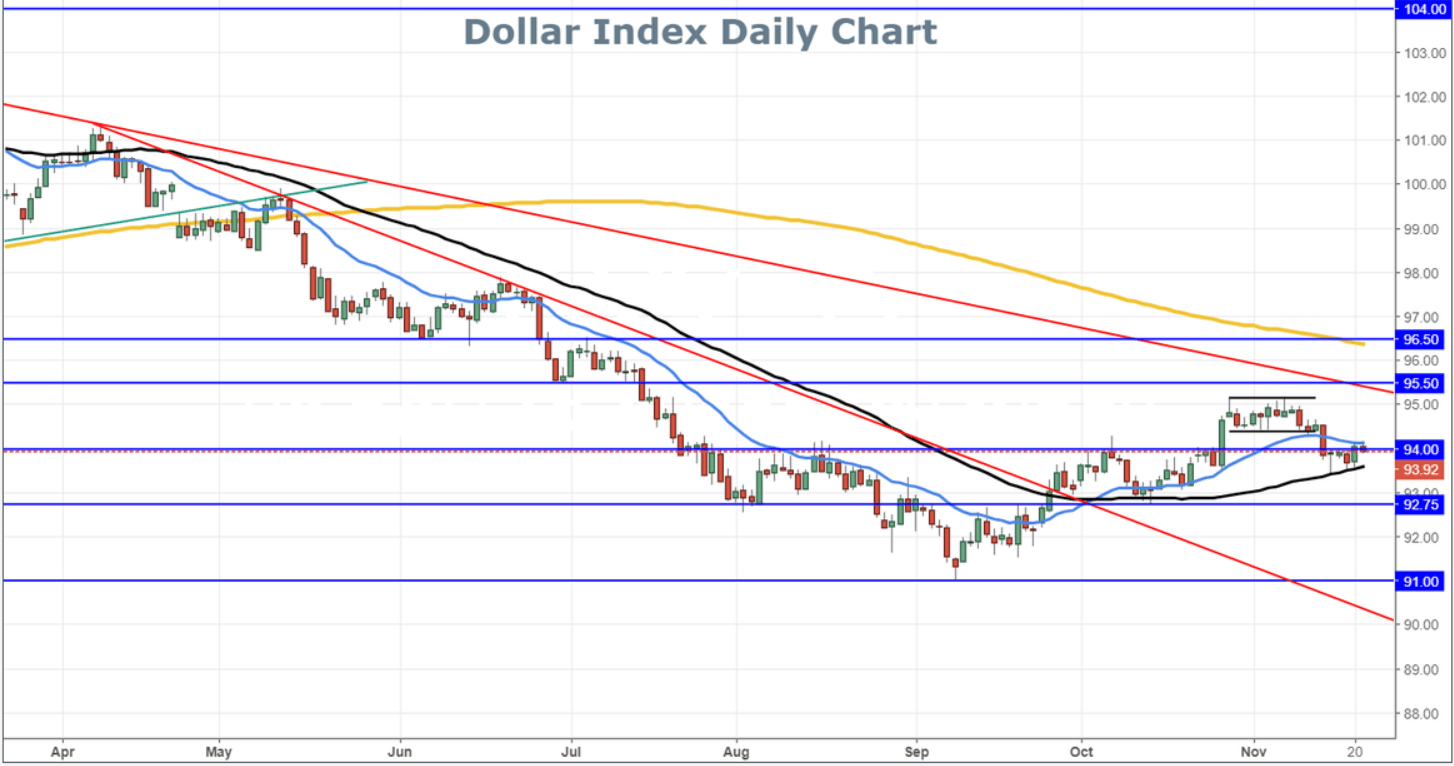

From a technical perspective, the dollar index, which tracks the US dollar against a basket of six other major currencies, is currently fluctuating around the key 94.00 level and entrenched between its 20-day moving average to the upside and 50-day moving average to the downside. The current consolidation is apt to be broken on any new revelations regarding US tax reform or from Wednesday’s FOMC minutes. With respect to the minutes, expectations for the likelihood of a December Fed rate hike continue to remain elevated well above 90%. Therefore, much of the rate hike anticipation is likely already priced-in, and any dovish indications to be found in the FOMC minutes on Wednesday could have a pronounced negative effect on the dollar.

The same may hold true for the long-awaited tax reform plan – since much of the positive anticipation has already been priced-in to the dollar, any major disappointments on the content or timing of the tax plan could have a significantly negative effect on the dollar index. Any breakdown below the current consolidation should target key downside support around 92.75, the area of the last major swing low in mid-October. To the upside, a consolidation breakout amid the FOMC minutes release or tax reform developments should target key resistance around 95.15, the level of the last major high earlier this month.

Investopedia does not provide individual or customized legal, tax, or investment services. Since each individual’s situation is unique, a qualified professional should be consulted before making financial decisions. Investopedia makes no guarantees as to the accuracy, thoroughness or quality of the information, which is provided on an “AS-IS” and “AS AVAILABLE” basis at User’s sole risk. The information and investment strategies provided by Investopedia are neither comprehensive nor appropriate for every individual. Some of the information is relevant only in Canada or the U.S., and may not be relevant to or compliant with the laws, regulations or other legal requirements of other countries. It is your responsibility to determine whether, how and to what extent your intended use of the information and services will be technically and legally possible in the areas of the world where you intend to use them. You are advised to verify any information before using it for any personal, financial or business purpose. In addition, the opinions and views expressed in any article on Investopedia are solely those of the author(s) of the article and do not reflect the opinions of Investopedia or its management. The website content and services may be modified at any time by us, without advance notice or reason, and Investopedia shall have no obligation to notify you of any corrections or changes to any website content. All content provided by Investopedia, including articles, charts, data, artwork, logos, graphics, photographs, animation, videos, website design and architecture, audio clips and environments (collectively the "Content"), is the property of Investopedia and is protected by national and international copyright laws. Apart from the licensed rights, website users may not reproduce, publish, translate, merge, sell, distribute, modify or create a derivative work of, the Content, or incorporate the Content in any database or other website, in whole or in part. Copyright © 2010 Investopedia US, a division of ValueClick, Inc. All Rights Reserved

Recommended Content

Editors’ Picks

EUR/USD stays in positive territory above 1.0850 after US data

EUR/USD clings to modest daily gains above 1.0850 in the second half of the day on Friday. The improving risk mood makes it difficult for the US Dollar to hold its ground after PCE inflation data, helping the pair edge higher ahead of the weekend.

GBP/USD stabilizes above 1.2850 as risk mood improves

GBP/USD maintains recovery momentum and fluctuates above 1.2850 in the American session on Friday. The positive shift seen in risk mood doesn't allow the US Dollar to preserve its strength and supports the pair.

Gold rebounds above $2,380 as US yields stretch lower

Following a quiet European session, Gold gathers bullish momentum and trades decisively higher on the day above $2,380. The benchmark 10-year US Treasury bond yield loses more than 1% on the day after US PCE inflation data, fuelling XAU/USD's upside.

Avalanche price sets for a rally following retest of key support level

Avalanche (AVAX) price bounced off the $26.34 support level to trade at $27.95 as of Friday. Growing on-chain development activity indicates a potential bullish move in the coming days.

The election, Trump's Dollar policy, and the future of the Yen

After an assassination attempt on former President Donald Trump and drop out of President Biden, Kamala Harris has been endorsed as the Democratic candidate to compete against Trump in the upcoming November US presidential election.