- Nonfarm Payrolls in the US are forecast to increase by 200,000 in December.

- Gold is likely to react slightly stronger to a disappointing jobs report than an upbeat one.

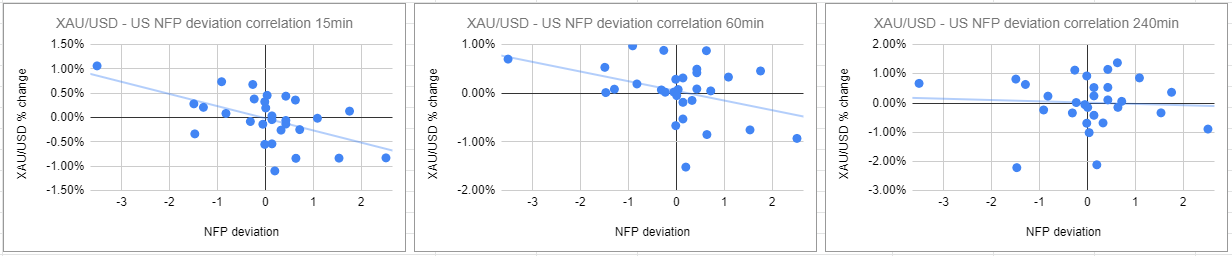

- Gold's movement has no apparent connection with NFP deviation four hours after the release.

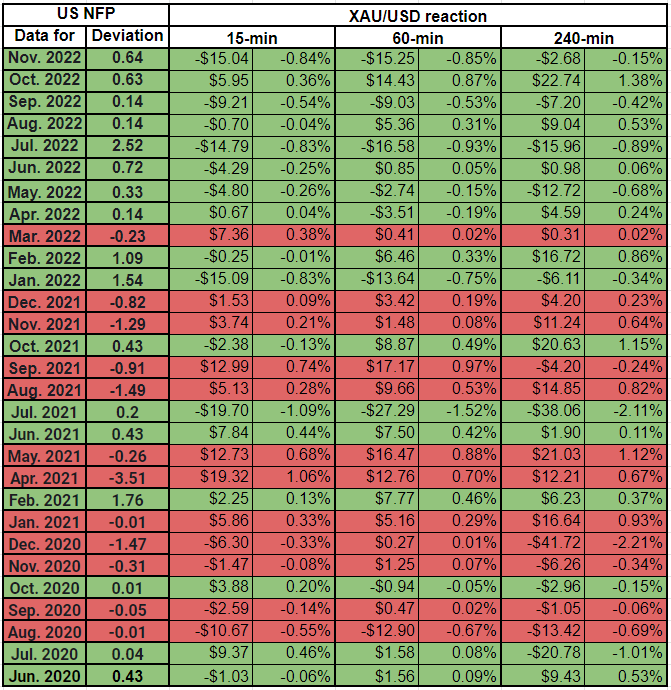

Historically, how impactful has the US jobs report been on gold’s valuation? In this article, we present results from a study in which we analyzed the XAUUSD pair's reaction to the previous 29 NFP prints*.

We present our findings as the US Bureau of Labor Statistics (BLS) gets ready to release the December jobs report on Friday, January 6. Expectations are for a 200,000 rise in Nonfarm Payrolls following the 263,000 increase in November.

*We omitted the NFP data for March 2021, which was published on the first Friday of April, due to lack of volatility amid Easter Friday.

Methodology

We plotted gold price’s reaction to the NFP release at 15 minutes, one hour and four hours intervals after the release. Then, we compared the gold price reaction to the deviation between the actual NFP release result and the expected result.

We used the FXStreet Economic Calendar for data on deviation as it assigns a deviation point to each macroeconomic data release to show how big the divergence was between the actual print and the market consensus. For instance, the August (2021) NFP data missed the market expectation of 750,000 by a wide margin and the deviation was -1.49. On the other hand, February’s (2021) NFP print of 536,000 against the market expectation of 182,000 was a positive surprise with the deviation posting 1.76 for that particular release. A better-than-expected NFP print is seen as a USD-positive development and vice versa.

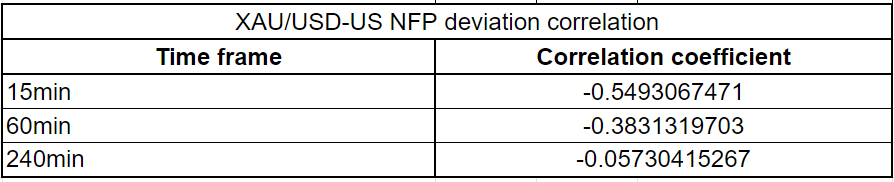

Finally, we calculated the correlation coefficient (r) to figure out at which time frame gold had the strongest correlation with an NFP surprise. When r approaches -1, it suggests there is a significant negative correlation, while a significant positive correlation is identified when r moves toward 1. Since gold is defined as XAU/USD, an upbeat NFP reading should cause it to edge lower and point to a negative correlation.

Results

There were 12 negative and 17 positive NFP surprises in the previous 29 releases, excluding data for March 2021. On average, the deviation was -0.86 on disappointing prints and 0.66 on strong figures. 15 minutes after the release, gold moved up by $3.97 on average if the NFP reading fell short of market consensus. On the flip side, gold declined by $3.37 on average on positive surprises. This finding suggests that investors’ immediate reaction is likely to be slightly more significant to a disappointing print.

However, the correlation coefficients we calculated for the different time frames mentioned above don’t even come close to being significant. The strongest negative correlation is seen 15 minutes after the releases with the r standing at -0.55. One hour after the release, the correlation weakens with the r rising to -0.38 and there is virtually no correlation to speak of four hours after the release with the r approaching 0.

Several factors could be coming into play to weaken gold’s correlation with NFP surprises. A few hours after the NFP release on Friday, investors could look to book their profits toward the London fix, causing gold to reverse its direction after the initial reaction.

It's also worth noting that markets could react to wage inflation component of the jobs report as Fed policymakers keep a close eye on wages when setting the monetary policy. A stronger-than-expected increase in the Average Hourly Earnings could help the US Dollar gather strength even if the headline NFP print falls short of the market expectation and vice versa.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD keeps the range bound trade near 1.1350

After bottoming near the 1.1300 level, EUR/USD has regained upward momentum, pushing toward the 1.1350 zone following the US Dollar’s vacillating price action. Meanwhile, market participants remain closely tuned to developments in the US-China trade war.

GBP/USD still well bid, still focused on 1.3200

The Greenback's current flattish stance lends extra support to GBP/USD, pushing the pair back to around the 1.3200 level as it reaches multi-day highs amid improved risk sentiment on Monday.

Gold trades with marked losses near $3,200

Gold seems to have met some daily contention around the $3,200 zone on Monday, coming under renewed downside pressure after hitting record highs near $3,250 earlier in the day, always amid alleviated trade concerns. Declining US yields, in the meantime, should keep the downside contained somehow.

Six Fundamentals for the Week: Tariffs, US Retail Sales and ECB stand out Premium

"Nobody is off the hook" – these words by US President Donald Trump keep markets focused on tariff policy. However, some hard data and the European Central Bank (ECB) decision will also keep things busy ahead of Good Friday.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.