US debt ceiling crisis smoke and mirrors circus

It's definitely the time to bring out the clowns as MSM and much of the blogosfear are obsessed by the US debt ceiling smoke and mirrors circus that is being used as an excuse to explain potential market outcomes from a CRASH upwards, there is always a crash coming! And if the market soars then no problem it will soar because of debt ceiling positive developments, Whether UP or Down it will all be as a consequence of the DEBT CEILING! I have watched this circus take place every couple of years over the decades, it IS just a circus act for the Republicans and Democrats to prance around in front of the media, a smoke and mirrors TV show to remind the masses that they have all of the power and so if the chose to nuke the US economy.

Republican or Democrat, Trump or Biden makes very little actual difference, the US and all western nations are effectively one party states.

These are the facts

-

The US has never defaulted on it's debt.

-

Congress has already authorised the governments budget.

-

The circus tends to get resolved at the last minute with both sides claiming victory.

-

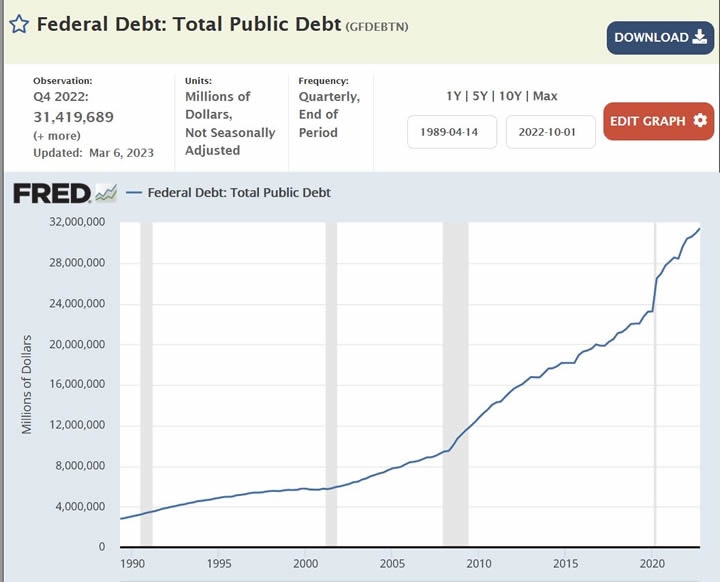

The inexorable mega-trend is for the US to continue PRINTING MONEY (Debt) to the MOON! Hence a primary driver of the Inflation Mega-trend and stock prices as the Dollar continuously loses value in response to rampant money printing.

Hang on a minute isn't the US debt limit supposed to be $31 trillion? So how come it's being reported as $31.4 trillion? Debt glass ceiling! Which illustrates that it really is just a circus for the politicians to gloat over and the MSM to obsess over, it's just a circus show folks. This is as deep as I want to go into the debt ceiling circus, it will be raised as it has some 100 times before hand!

On a side note the herd (MSM such as CNBC cartoon network) continues to obsess over short-term bonds (t-bills), the mantra goes why invest in risky stocks when one can collect 5.25% per annum in a T-Bill, to be blunt these fools are leading investors into a DEAD END. What happens when the bill matures? Say after 6 months You get your money back plus 2.625%, remember the rate the herd yap on about is the ANNUALISED rate. So now it's 6 months later and the 6 month T-Bill rate on offer is 4%? What now? Another 6 months? Rinse and repeat until it drops to 2% in 2 years time? You ve just wasted 2 years of a stocks bull market and end up with peanuts, even Long Treasury Bonds would have worked out a lot better due to capital appreciation as market interest rates fall bond prices go up - LESSON - Ignore what the herd proclaims one should do as it usually turns out to be WRONG..

AI will first kill us then save us

Humanity dancing to extinction as AI mega-trend goes parabolic

Musk says halt work on Large Language models, primarily so he can play and catch up to the runaway train sparked by the GPT Large Language Models that this video acts to chart where we are heading along on a Machine Intelligence curve that is now going parabolic as illustrated by the fact that even those who have been part of this trend for over a decade can no longer keep pace with the rate of change so what hope do ordinary folks have hence this video will act to shine a light much as my 2016 video did that laid the grounds for the Quantum AI Mega-trend so see this video as Part 2 of a 7 year arc.

Author

Nadeem Walayat

Marketoracle.co.uk

Editor of MarketOracle.co.uk, is its resident financial analyst, with over 20 years experience in trading and investing in the financial markets using both Technical and Fundamental Analysis.