US data Russia pulls back Tesla Apple RBA

US Inflation really is out of control

Producer Price Inflation has leapt higher yet again. Signalling pipeline pressures that have yet to hit already elevated consumer prices.

Russia is playing chess

The pieces being real world combat units.

NATO, as of time of writing, had not confirmed the extent of any return to barracks of Russian forces. Nevertheless, this is an encouraging sign. A true olive branch to the West or just a part of the overall game being played by Putin?

I am sure it is far too cynical to suggest it may be a good tactic to have your enemy relax when you are about to act.

All in all, a positive sign but by no means an end to the risk of conflict. Which is why market corrections on the hope of peace have been somewhat muted.

Tesla and Apple

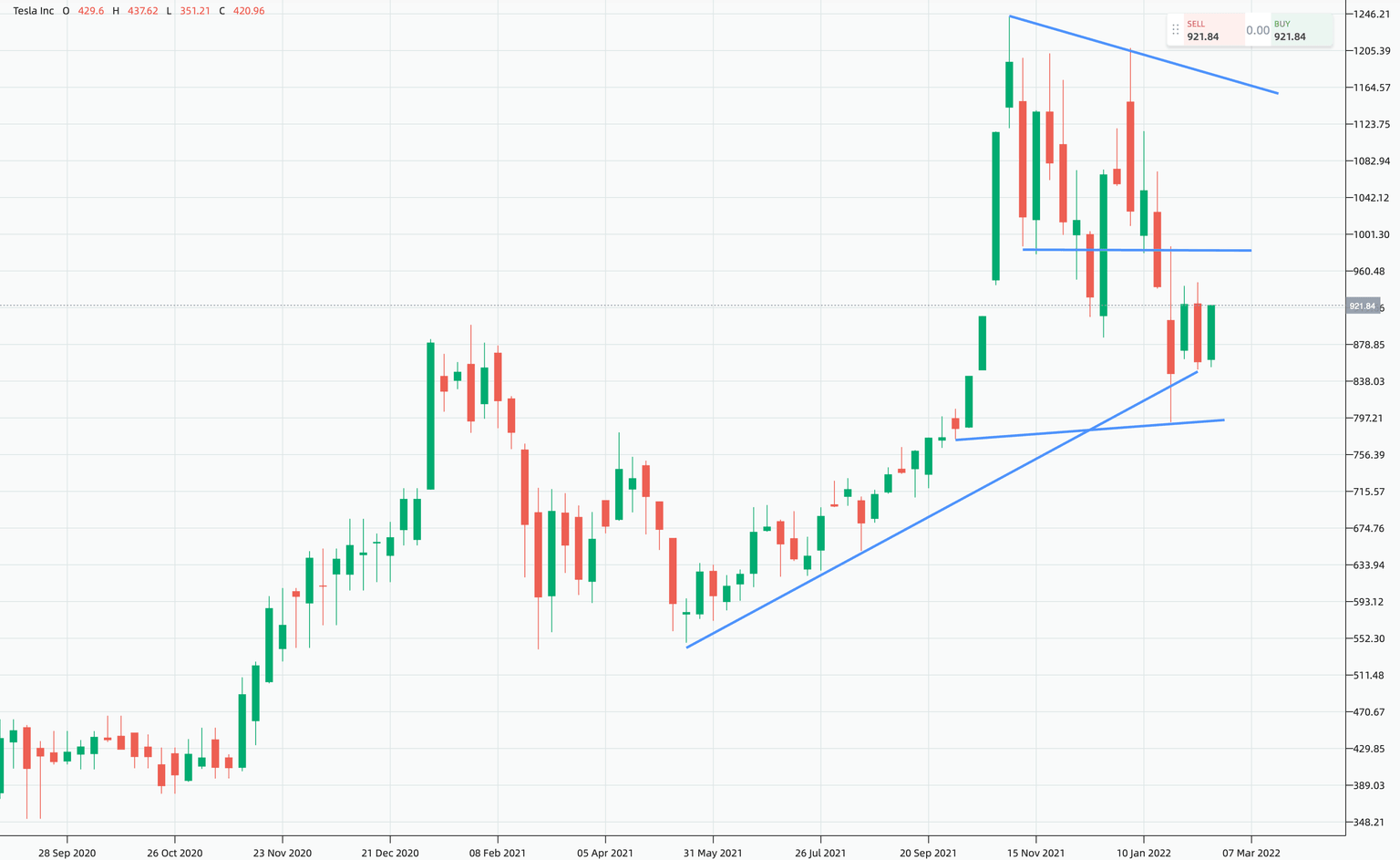

The equity market has been in trouble, as in struggling, for quite some time now. There is no doubting Tesla is one of the most inflated stocks for both real expectations and as a meme trade.

Apple on the other hand reminds me of the scene in "The Big Short" where the idea is hit upon, that no one else has thought of selling the "triple As". If the broad equity market is going to fall for reasons I have previously outlined and have again been highlighted by tragic consumer confidence and ever increasing inflation, then Apple may prove the ultimate canary in the mine.

No one thinks Apple is a sell. This creates a scenario where the stock most held and most leveraged long could well be Apple. In the near term, a break below $165 would be a warning that the entire market was set for a fresh significant decline phase.

Tesla has had the correction we were looking for, but it is too early to say of that correction is complete. Caution would seem appropriate. Especially, as other manufacturers with far more experience and nuance in the areas of suspension, chassis setup and interior design and comfort are now making smart electric vehicles too.

There are plenty of 'buy the dip' traders here, as there are throughout the equity market right now, and in this light it is important that support at $845 holds. Personally, I think there could be further downside to come. Tesla's true value may be more like $680.

For the bulls

If I were looking to buy a major global stock in the current environment of risk of war, impending rate hikes and a general economic slowing, the stock I would lean toward would be Apple. It has corrected and is firmly consolidating. Just keep an eye on that $165 level.

Tesla and Apple weekly charts

RBA forecast

As a fan of the RBA, a lot of people are asking for my view on the official cash rate this year and next?

2022, should see an RBA cash rate of 2.25%. That is the should. The more likely target for this year is probably just 1.00% to 1.25%. This is the world's slowest central bank after all. From the top down.

2023, if the Board has been sacked as it should be, we will see rates reach 3.00% to 3.50%. If somehow the RBA has not experienced revolution, then rates will likely be at just 2.25%.

Why would I prefer rates higher?

To contain inflation and be fully neutral in impact on the economy. Hope this helps. At least we can be sure of the direction.

Author

Clifford Bennett

Independent Analyst

With over 35 years of economic and market trading experience, Clifford Bennett (aka Big Call Bennett) is an internationally renowned predictor of the global financial markets, earning titles such as the “World’s most a