Durable Goods Soar

According to US Commerce Department figures, orders for goods meant to last for three years or more soared in the month of December by 4.6% - gaining for the fourth straight month. The advance beats estimates of a 2% gain in orders, with core figures showing a subsequent addition of 1.3%. Core figures strip more volatile transportation equipment from the headline number.

The better than expected figure is estimated to shed optimistic light on the US economy when the world’s largest economy releases advanced Gross Domestic Product figures this week. Advanced estimates are anticipated to the show a 1.1% annualized pace of growth, positive but still slower than the 3.1% seen earlier.

Counters Housing Decline

The positive durable goods figure overshadows relatively negative reports from the National Association of Realtors. According to the trade group, pending home sales declined in the month of December, the first time since the end of the summer. Overall, the index of sales declined by 4.3%, as both Western and Northeastern parts of the US were hit hard by slowing sales. West Coast pending sales decreased by 8.2% while Northeastern interest declined by 5.4%.

Although widely negative, as pending homes account for 90% of the market, the figure seems to be digested as normal pullback from the recent string of gains for the report. The notion places increasing emphasis on next month’s figures.

What Will the Fed Do

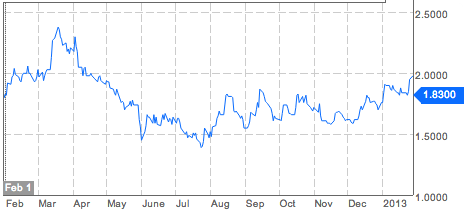

Given that baseline economic fundamentals remain well supported, through retail sales and manufacturing, speculation is growing that Fed policymakers may hint at an early exit from recently implemented monetary stimulus as the notion of a rebound continues to surface. With the Fed balance sheet growing to $3 trillion in the last month, the potential scenario has become more of reality now. And, any innuendos of a retraction of stimulus would be particularly bullish for bond yields, which could translate into US dollar strength in the medium term.

Source: Bloomberg

Source: Bloomberg

注释: 本网页上的所有信息随时可能更改. 使用本网站的浏览者必须接受我们的用户协议. 请仔细阅读我们的保密协议和合法声明. 撰稿者在Forex21.cn发表的观点仅是他本人观点, 并不代表Forex21.cn或他组织的观点. 风险披露声明: 外汇保证金交易隐含巨大风险, 它不适合所有投资者. 过高的杠杆作用可以使您获利, 当然也可能会使您蒙受亏损. 在决定进行外汇保证金交易之前, 您应该谨慎考虑您的投资目的, 经验等级和冒险欲望. 在外汇保证金交易中, 亏损的风险可能超過您最初的保证金资金, 因此, 如果您不能负担资金的损失, 最好不要投资外汇. 您应该明白与外汇交易相关联的所有风险, 如果您有任何外汇保证金交易方面的问题, 您应该咨询与自己无利益关系的金融顾问.

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.