US CPI release today: What to expect and market reactions

-

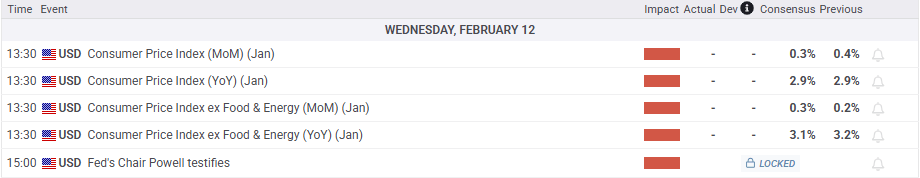

US CPI inflation data for February 2025 is being released today, and markets are closely watching due to recent increases in inflation expectations.

-

Economists expect headline inflation to rise by 0.3% for the month, keeping the yearly rate at 2.9%.

-

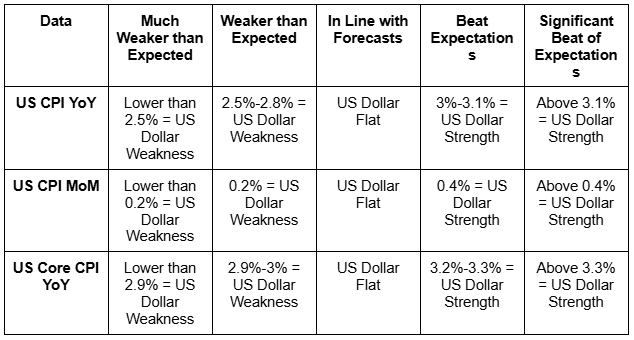

The article provides a table outlining potential market impacts based on different CPI scenarios on the US Dollar.

US CPI inflation data will be released today at 13h30 GMT time. Markets are paying close attention to today's release following a significant uptick in inflation expectations revealed in last week's Michigan Sentiment Index.

The incoming US administration of Donald Trump and his tariff and economic policies have made stoked inflation fears. I still think this inflation print will be too early to see any effects from President Trump's tariff policies.

Having said that, any significant uptick in inflation could definitely add to market concerns around the trajectory of inflation moving forward, especially when the impact of tariffs begin to have an effect.

What is the expected CPI print?

For all market-moving economic releases and events, see the FXStreet Economic Calendar.

Inflation continues to be a concern, even though the U.S. economy is still strong. In December 2024, prices went up by 0.4% compared to the previous month, leading to an annual inflation rate of 2.9%. Core inflation, which leaves out food and energy prices, increased by 0.2% in December and reached 3.2% over the year.

These numbers show how difficult it is to lower inflation to the Federal Reserve's target of 2%. Fed Chair Jerome Powell reiterated yesterday that there is no rush for further rate cuts as the Fed will wait and see the impacts of President Trump policies.

Economists predict that headline inflation for January will go up by 0.3% compared to the previous month, keeping the yearly rate at 2.9%. Core inflation, which leaves out food and energy, is also expected to rise by 0.3% for the month, with the yearly rate easing slightly to 3.1% from December's 3.2%.

This would show a continued gradual slowdown since inflation peaked in 2022.

The January inflation increase is expected to be driven by higher auto insurance rates and consistent rises in housing-related costs, which have been big drivers of core inflation. However, slightly lower energy prices, especially gasoline, may help balance out some of the increase. While housing expenses are still rising, they might start to show slower growth, following the broader pattern of easing price pressures in the rental market.

Potential market impact

Looking at the potential scenarios from today's CPI release, I have created a table that may help. Now this of course is no guarantee as to how the market may react but rather my take on the potential movements that could materialize.

Source: Table created by Zain Vawda, Data from LSEG, TradingEconomics

The above table provides an insight into what I expect will happen depending on the CPI prints released later in the day.

My personal expectations are that the data will land quite close to expectations which could lead to some short-term volatility and whipsaw price action before markets settle down.

Technical analysis

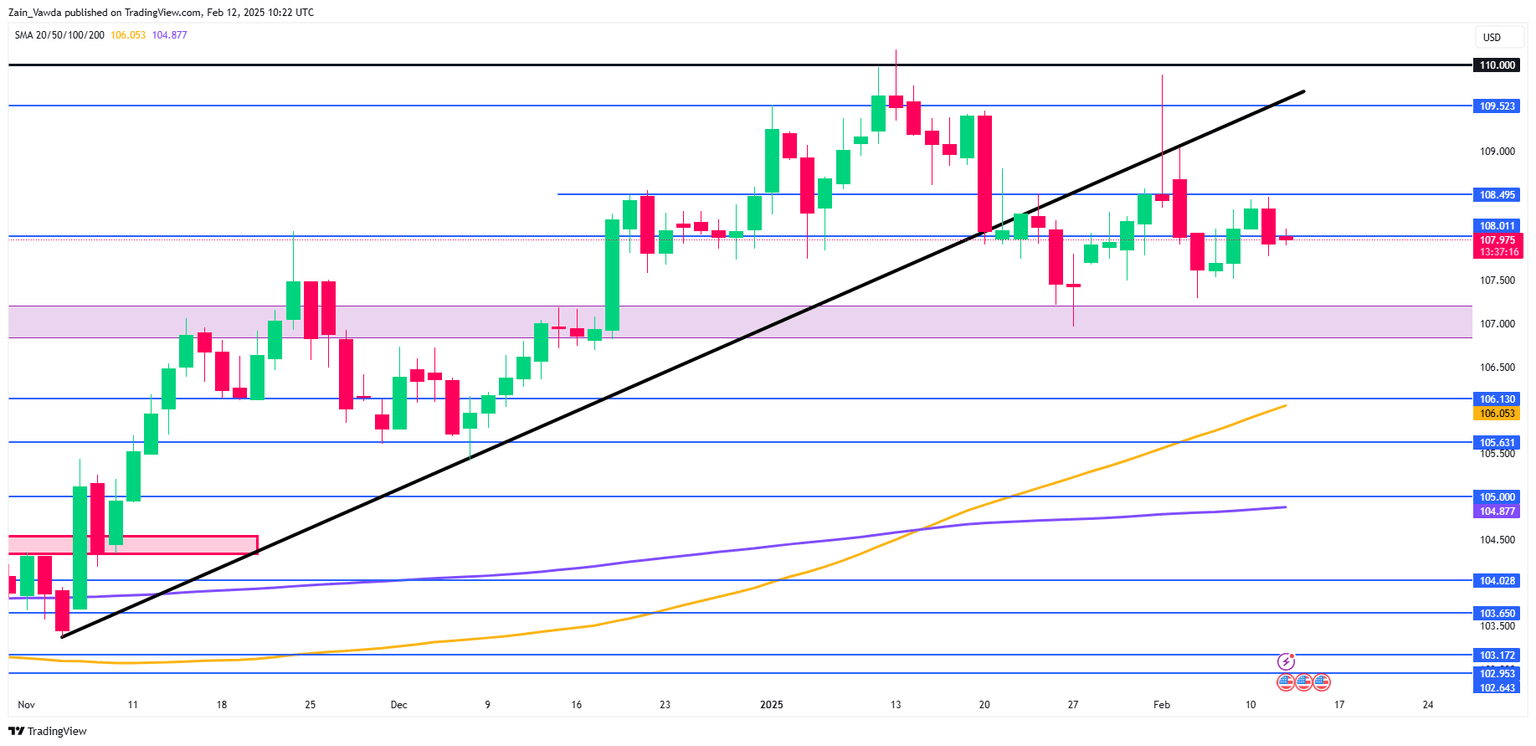

From a technical standpoint, the dollar has enjoyed a positive start to the week but struggled to continue its bullish momentum yesterday.

The 108.49 resistance level continues to hold firm for now and CPI is unlikely to change this unless we have a significant beat or miss of the forecasts.

Immediate support rests at 107.50 and 107.00. Resistance on the other hand rests at 108.49, 109.52 before the psychological 110.00 handle comes into focus.

I do not see today's data providing any impetus for a break of the recent trading range between the 107.00 and 108.49 handles.

US Dollar Index (DXY) Daily Chart, February 12, 2025.

Source: TradingView.com (click to enlarge)

Support

-

107.50.

-

107.00.

-

106.13.

Resistance

-

108.49.

-

109.52.

-

110.00.

Author

Zain Vawda

MarketPulse

Zain is a seasoned financial markets analyst and educator with expertise in retail forex, economics, and market analysis.